3 Best Free Methods To Track Your Shopify Profit & Expenses

Tracking your profit & expenses on Shopify is an important skill you need to master to be successful with your eCommerce business. You will get a stronger grasp of how your store is operating and be able to pinpoint the most important areas for improvement.

Needless to say, measuring your profits and keeping track of your expenses efficiently is no easy feat as there are many aspects to keep an eye on.

Understanding your concerns, we have created this blog to give you the top 3 free methods of tracking your Shopify profit and expenses effectively and quickly.

Why Track Your Shopify Profit And Expenses?

If you are serious about running and scaling your Shopify store, you cannot do it without data. That’s why you must track all your incomes and expenses to:

- Evaluate your Shopify business’ performance

- Uncover spending issues

- Staying within budget limits

- Conduct easier tax filing

1. Evaluating your Shopify business’ performance

Tracking your Shopify profit and expenses makes calculating profitability so much simpler and quicker.

With data in hand, it is no longer a big deal to figure out if your business is making a profit or a loss. Some of you might argue that the higher my revenue is, the higher my profit is. What’s the point of tracking? But that’s not the case.

Assessing your store performance based only on your revenue will harm your business. Though revenue is a vital metric that reflects your sales & marketing efforts, it is just the tip of the iceberg, as most of the costs are excluded.

You need to scratch the surface and go deeper into your profit. There, you will find precious insights to make informed decisions about your products, business operation, and marketing plans.

Besides, you can see exactly how much profit your business is making and where the profit is coming from. For instance, tracking profits of products or the LTV of customer segments will let you know which products and customer groups are your most profitable.

After that, you can focus on them by allocating more resources to maintain or increase the profits they bring.

2. Uncovering spending issues

Identifying your spending hotspots is another advantage of tracking your expenses and profits on Shopify. You won’t be able to identify bad spending habits if you don’t know where your money is going.

By keeping track of your daily or monthly expenses, you may assess where your money goes. Then you can come up with plans to reduce wasteful spending. In the end, to ensure significant earnings for your business, you may quickly eliminate all of these needless costs.

For example, you can track the Return On Ad Spends (ROAS) of all the ad channels to find out which one is taking most of your money. If that channel isn’t working out, you can decide to cut the budget for it.

3. Staying within budget limits

Tracking the metrics like profit and expenses enables you to stay within budget limits. Knowing how much you spend on average each month or day can help you plan your finances more effectively, especially if your business has a fixed revenue stream.

You won’t know when to quit investing money in a certain activity if you don’t keep track of your expenses and profits. So, you should monitor and evaluate your expenses closely to compare your actual spending to your budgeted spending.

If you overspent, you can consider ways to cut spending on particular activities. However, if you spend too little on some initiatives and still see lots of potential, you may want to spend more to enhance your business operations.

For instance, monitoring your spending may show that you underspent on your social media marketing campaigns. In this situation, you may set aside more cash to create a more robust marketing campaign for your brand the next month.

4. Easier tax filing

If you track your profits and losses properly, when you have to prepare tax documents, it will be much simpler. Since all the necessary information is accessible in one location, this saves time during tax season.

In fact, many businesses are ill-prepared, so they dread tax season. While countless hours are wasted at the last minute looking for invoices and receipts, there will be chaos and mistakes.

How to Track Your Shopify Profits And Expenses for FREE?

There are a few methods you can use to track your profits and expenses on Shopify for free. Each of them has pros and cons that you need to be aware of.

Hence, you should be focusing as you go through each method to decide which one will be your best fit.

#Method 1: Use Shopify Reports

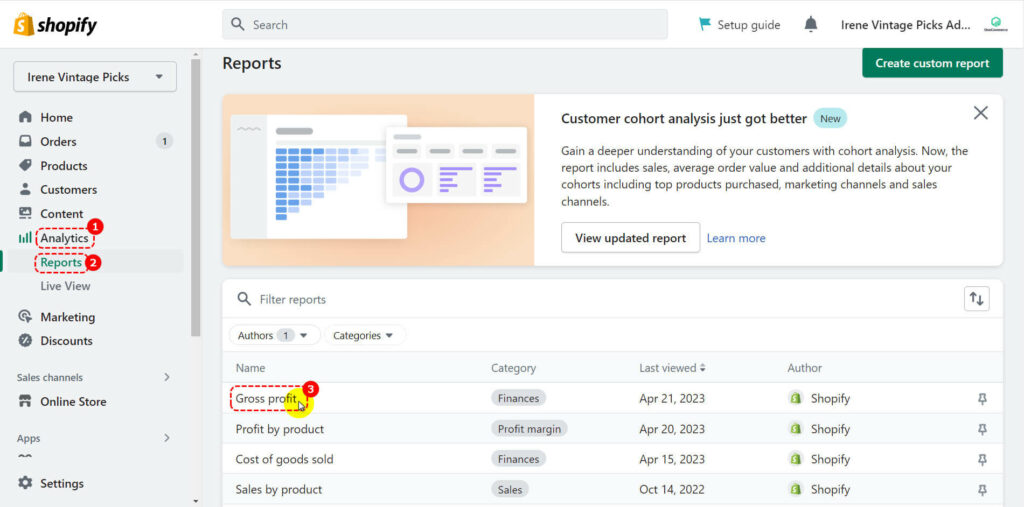

The first method of tracking expenses and profits on Shopify is to utilize the platform’s native feature – Shopify’s reporting tool.

This tool records performance metrics, analyzes current activity in your business, helps you discover who is visiting your online store, and does a whole lot more.

In the admin panel, select the “Analytics” tab to the left of your screen to see the dashboard. Additional reports can be found under the ‘Analytics’ tab.

There, you can view reports for certain channels (online store, social media, or items) as well as reports for various time frames (day, week, month, and year). The outcomes can be compared to earlier dates.

| Pros | Cons |

|

|

#Method 2: Use spreadsheets

A spreadsheet is a standardized template for keeping track of the expenses and profits of your business. Some of these spreadsheets record particular business costs and earnings, while others only give a quick, high-level overview.

Despite the variety of expense and profit tracking spreadsheets, these are the metrics that should be included in your spreadsheets:

- Gross Sales: Gross sales is a measure of your company’s overall sales that is not cost-adjusted for those sales’ production.

- Discounts: A discount is a lower price that your business offers on certain items or services.

- Refunds: Refunds typically relate to the process of paying back a customer for an item or service that they received, due to issues like product flaws or unsatisfactory work.

- Revenue: Revenue is the amount of money your business makes from a service or good it offers to a customer.

- Cost of Goods Sold (COGS): COGS relates to a product’s production and marketing costs. This comprises the expenditures for supplies, labor, shipping, packaging, and other unforeseen charges incurred during manufacturing.

- Shipping Cost: The direct costs involved in getting a product from a shelf in your store or warehouse to a customer’s door are known as shipping costs. The following expenses are only a few of them: box, packaging, tape, and sticker prices. the price of hiring a worker to pick, pack, and send out a package.

- Transaction Fees: Every time your company processes a customer’s payment, it must pay a transaction fee. Depending on the service chosen, the transaction charge will have a different price.

- Handling Fees: In addition to the subtotal of the order and the shipping costs, a customer may also be charged a handling fee. It pays for costs associated with fulfillment, including packing, shipping, and warehouse storage.

- Gross Profit: Gross profit is the amount of money your business has left after eliminating all of the expenses incurred in producing and offering your goods or services.

- Total Taxes: The total tax rate calculates the amount of taxes and mandated contributions that your business must pay after taking into account permissible deductions and exemptions as a percentage of business income.

- Ad Spends: Ad spends are the costs of attracting new customers via paid advertising channels.

- Net Profit: Net profit is the amount of money your company makes during a specific time period after subtracting all operational, interest, and tax costs.

- Net Margin: The amount of net income or profit generated as a percentage of revenue is referred to as the net profit margin, or net margin.

- Custom Spends: These are costs that are incurred in addition to COGS, Ad Spends, etc. For example, you have to pay to maintain your website periodically or to optimize your page speed.

We advise that you look for suitable spreadsheet templates to use in your tracking Shopify expenses and profits task. Then, customize it depending on which metrics you want to track, the tracking purpose, and the timeframe.

Here are our top three favorite ones that you should have a look at:

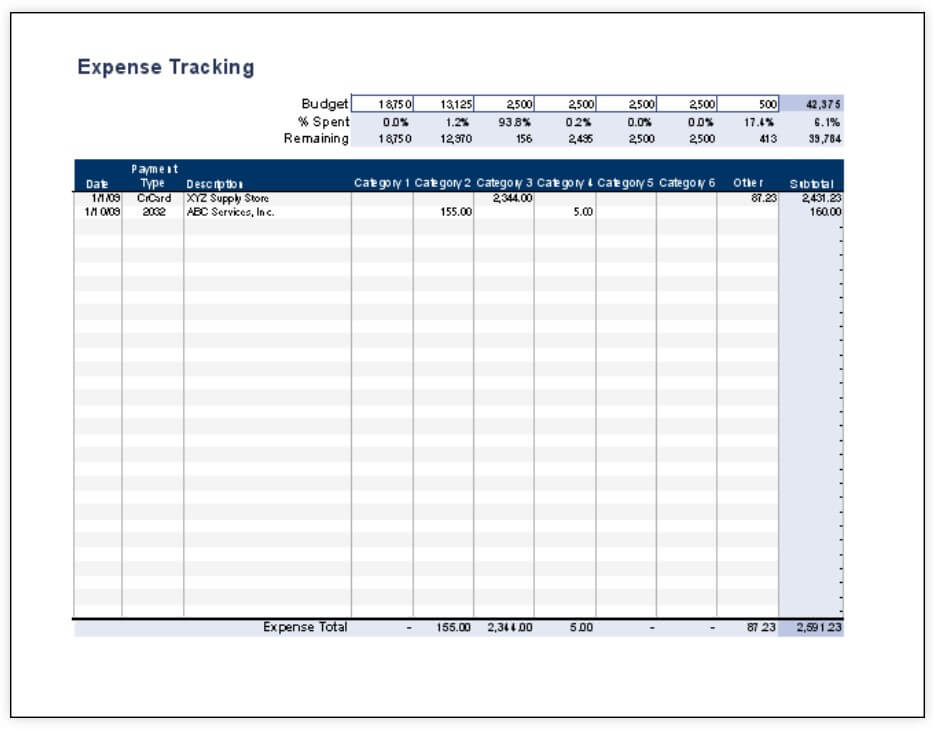

1. Basic business expenses spreadsheet

These spreadsheets are typically “barebones” tools that simply include basic information for recording expenses, such as the date of purchase, the mode of payment, a brief description, and the expense amount.

Download: Basic business expenses spreadsheet by Vertex42

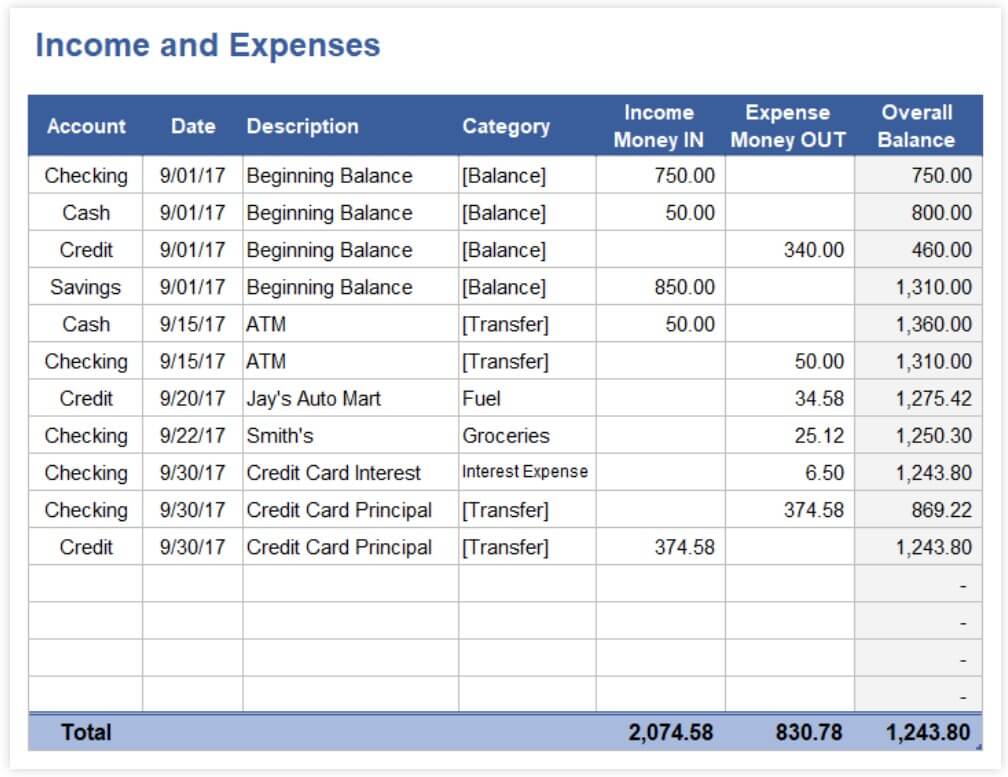

2. Income and expenses spreadsheet

An income and spending spreadsheet is yet another straightforward expense sheet in Excel. Based on the amount of income you generated and the amount you spent, this tool keeps track of the overall balance of your company.

It is wonderful to obtain a summary of all business-related finances and to identify broad spending trends.

Download: Income and expenses spreadsheet by Vertex42

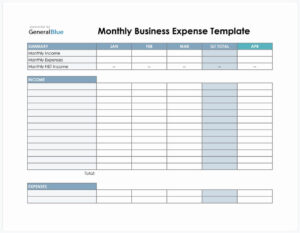

3. Monthly business expense spreadsheet

A monthly business costs spreadsheet, which compiles your monthly spending into a single report, is another well-liked Excel expense tracker.

These spreadsheets are useful for setting or modifying your monthly budget in addition to providing you with a high-level summary of your monthly spending.

You can determine how much you should budget for this month by looking at how much you spent the previous month.

Download: Monthly business expense spreadsheet by General Blue

| Pros | Cons |

|

|

#Method 3: Use a free Shopify profit tracking apps

The last method that you can use in order to save money is using a free Shopfiy profit tracking app.

A Shopify profit tracking app is superior to spreadsheets, manual input, or the Shopify native system as you can access all your information in one location, save time and effort from countless files and figures

Additionally, it enables you to understand your company’s overall picture, preventing any unneeded hassles and issues.

Running your business without such apps may quickly harm your business by inhibiting effective scaling. Therefore, you should find a profit tracking app to manage your Shopify store more efficiently.

This list below is our 3 favorite free apps that can help with tracking your Shopify expenses and profits. Note that we only focus on discussing anything within their free plans.

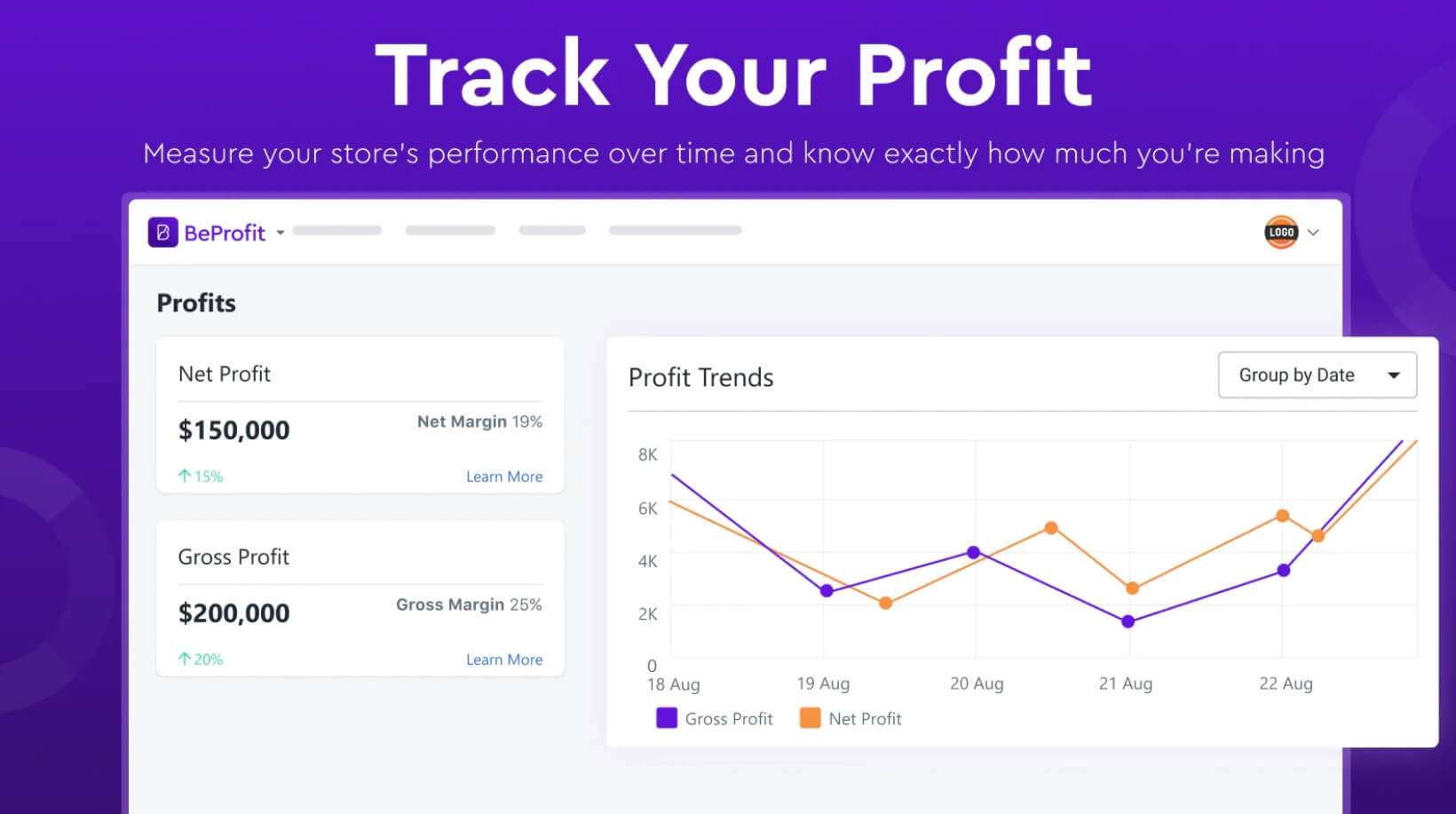

#1. BeProfit

- Rating: 4.9/5.0⭐

- Price: Free plan available | $25 – $150 per month | 14-day free trial

One of the top free Shopify profit tracking applications, BeProfit was created to maximize your company’s revenues and support the expansion of your online store. This app has the ideal solution for expense and profit tracking. A free account gives you access to an all-encompassing analytics dashboard.

You can easily monitor and analyze your gross or net profits and expenses, including manufacturing, shipping, ad spending, taxes, and fees. Additionally, the app features a comprehensive cohort analysis to determine the Customer Lifetime Value for you to find out your most profitable customers and gain precious insights into your marketing efforts.

However, the free plan that BeProfit offers only supports tracking for 5 orders per month. This is rather limited, so if you have more orders than that, you’d have to upgrade to their paid plans.

| Pros | Cons |

|

|

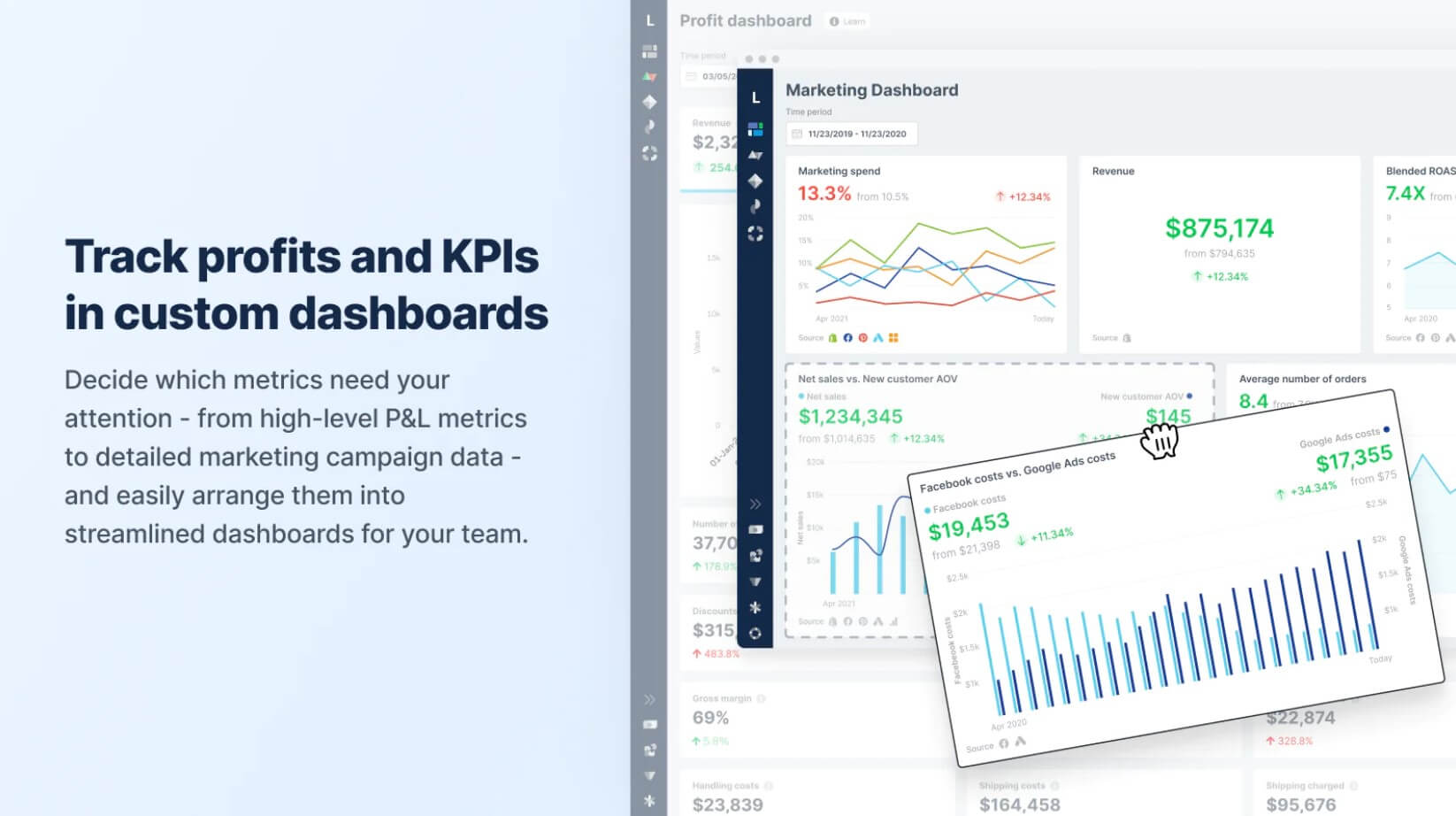

#2. Lifetimely

- Rating: 5.0/5.0⭐

- Price: Free plan available | $34 – $139 per month | 14-day free trial

Lifetimely is a Shopify app created by Lifetimely.io to assist you in tracking, calculating, analyzing, and reporting profits and expenses to optimize your Shopify business.

This profit tracking tool is designed with a dashboard that monitors your gross profit and net profit in real time as well as compares your store to your rivals based on parameters like gross margin, blended CAC, etc.

This app also analyzes your marketing spend, including Facebook costs vs Google ads costs, to determine how much you have spent on product promotion and customer acquisition.

| Pros | Cons |

|

|

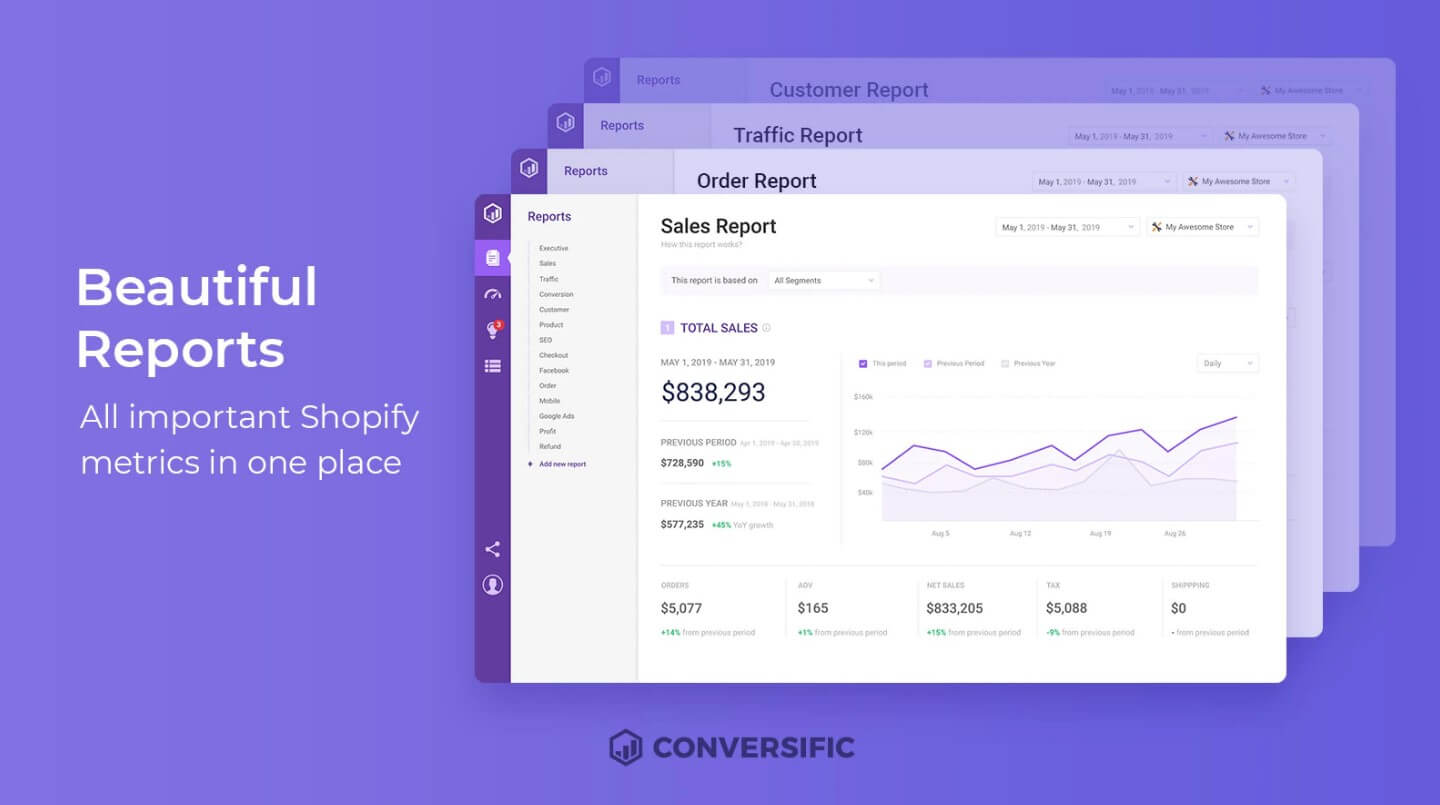

#3. Conversific

- Rating: 4.9/5.0 ⭐

- Price: Free plan available | $29 – $199 per month | 14-day free trial

Conversific is the last name of the top free Shopify profit tracking tools. With the use of this app, you will be able to adjust your tactics to achieve better results by knowing how profitable and expensive our store is with just a few clicks.

This app brings together data from Shopify, Google Analytics, Facebook, and all your marketing channels to provide you with detailed reports of your gross profit, net sales, gross margin, and ROI on every spend to find out which products or customers are your most profitable.

Besides, you can easily track various expenses such as Cost of Goods Sold, Taxes, and Shipping costs to help you stay within the budget.

| Pros | Cons |

|

|

Frequently Asked Questions

-

How do I track profit and loss on Shopify?

There are 3 ways to track your profit and loss on Shopify, as we have mentioned above. Select your favorite one, or you can try all 3 of them to find out the most suitable method for your business.

-

Can you track your expenses on Shopify?

Yes, you can. You can utilize our above-discussed methods to keep track of your Shopify expenses. They are all free and easy to conduct.

-

Is Shopify tracking app free?

Well, Shopify is neither a tracking app nor free to use to track data.

Wrapping Up!

In conclusion, we want to say that you get what you pay for. Though these free methods can help you track your expenses and profits on Shopify, they come with some drawbacks that could hinder the whole tracking process and final results.

Specifically, using spreadsheets is time-consuming and prone to human errors, while Shopify reports and free third-party apps are limited in terms of features, timeframe, etc. Therefore, you should think of paying a certain amount of money to acquire a better tool that can ensure an effective tracking process and accurate results.

For example, our TrueProfit profit tracking and analytics tool can help you do all the tasks of tracking different eCommerce metrics. What’s more, you only need to pay around ¢70 per day with our Basic plan to get all the things done on a real-time and daily basis.

[cta id=”3216″]

Discover what proper profit-tracking looks like at trueprofit.io

![Shopify Profit: How to Track It Properly [2023]](https://trueprofit.io/wp-content/uploads/2023/04/Shopify-Profit-TrueProfit-Thumbnail-Blog-768x572.png)