Operating Income Formula, Examples & Comparison With Other Metrics

Operating income is the remaining profit a business has after subtracting all costs associated with its core operations. The operating income formula takes into account different factors with different approaches.

Investors can benefit from operating income analysis since it excludes taxes and other special elements that could affect net income or profit.

Below are three different approaches to calculating operating income, along with an example and how it differs from other essential metrics.

Three Approaches to Operating Income Formula

There are three approaches on how to calculate operating income. The first approach is top-down, the second is bottom-up, and the last leverages cost accounting classifications.

You can collect data and calculate with operating income formula manually or by using a profit tracker app as your operating income calculator to determine the result.

Track all your Profits & Losses in real-time

With TrueProfit, you can automatically monitor all your store’s important metrics in one place.

Approach #1. Top-down

Based on the top-down method, the operating income formula is as follows:

| Operating Income = Gross profit – Operating expenses – Depreciation – Amortization |

Gross profit is calculated by deducting a company’s cost of goods sold (COGS) from its revenues.

Operating expenses do not include taxes or interest. They include the administrative, general, and selling costs required to run a business.

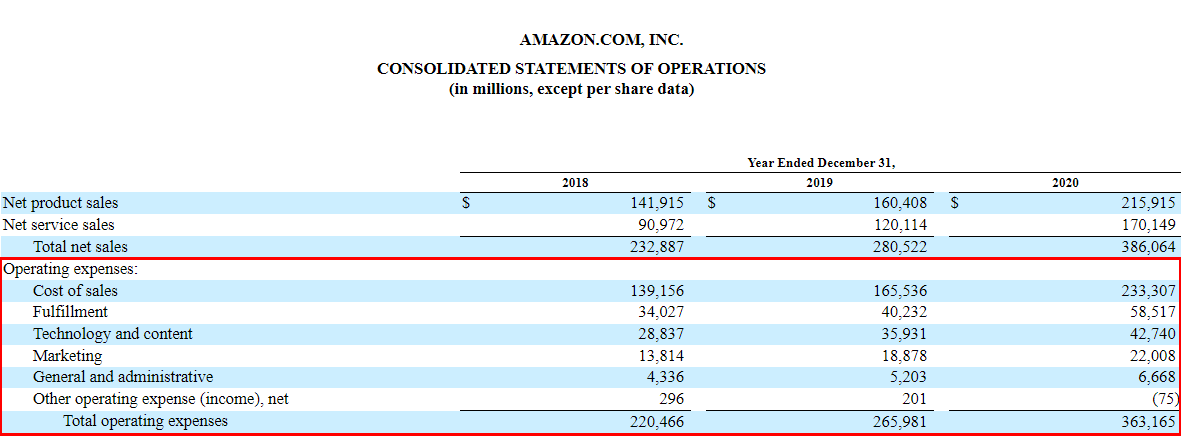

As you can see in the following example of Amazon’s consolidated statements of operations, the operating expenses include the cost of sales, fulfillment, technology and content, marketing, general and administrative, etc.

By spreading the cost of assets over several years, depreciation and amortization are accounting techniques that provide recurring expenses on the income statements of the business. They are also deducted because operating expenses do not include allocated costs.

Approach #2. Bottom-up

Another way to calculate operating income is, to begin with the net income at the bottom of the income statement and work your way up the earning “levels” by adding expenses back in.

As net income is computed by subtracting some items from operating income, you may add them back to figure out your operating income.

Using this technique, you can determine if your company’s core operations earn the net income or whether capital structure costs like interest, taxes, and other expenses or sources of income have distorted the number.

This is the operating income formula using the bottom-up approach:

| Operating Income = Net income + Interest expense + Tax expense |

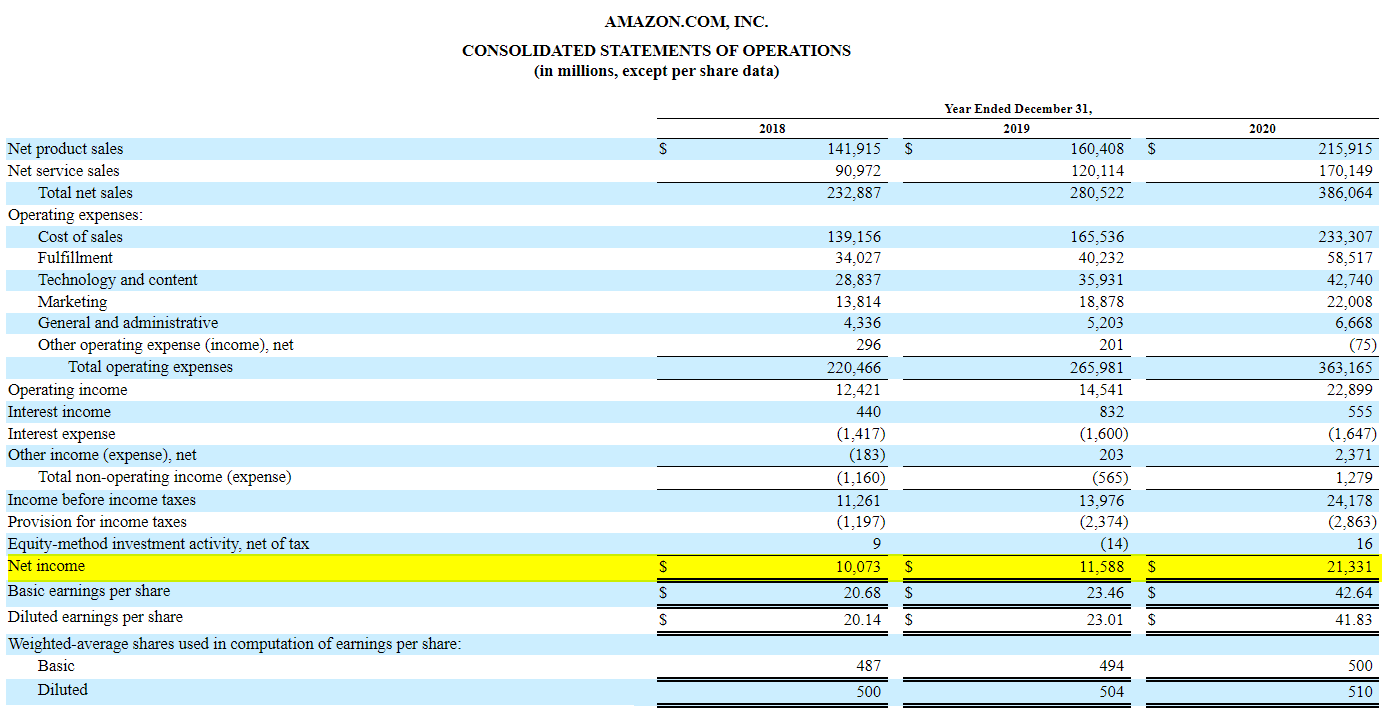

Since net income is the bottom and final element of the financial statements, you must have a fully computed income statement to use this approach. Take a look, and you can see the net income of Amazon at the bottom of its consolidated statements of operations.

Approach #3. Cost accounting

You can categorize your business’s costs and expenses into direct and indirect costs for internal usage, even if they are not frequently used in financial accounting. In this operating income formula, you can calculate your operating income by deducting such costs from the revenue.

This is the operating income formula using the third approach:

| Operating Income = Total revenue – Direct costs – Indirect costs |

Total revenue, also known as net sales, refers to the money made by selling products and services to your customers, excluding any product returns and allowances or discounts given to the customers. This can be accomplished through credit or cash sales.

Direct costs are expenses incurred and linked to the production, acquisition, or provision of goods or services.

The expenses, explicitly connected to the cost of producing goods or services, are sometimes recognized as the cost of goods sold (for companies selling tangible products) or the cost of revenues/ sales (for service companies).

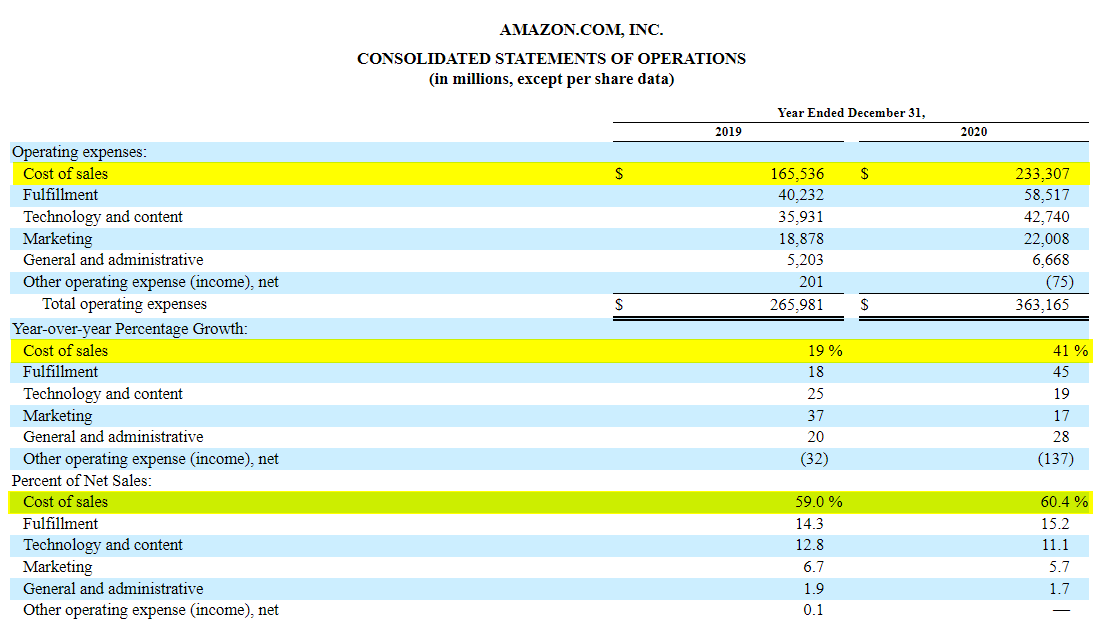

As in the following example, Amazon is a service company, so you can see the company listed cost of sales rather than cost of goods sold.

These costs can be either constant or variable in this operating income formula, depending on the quantity of products or services produced and sold.

Examples of direct costs:

- Direct materials and supplies such as parts, raw materials, and manufacturing supplies

- Direct labor such as machine operators, factory workers, assembly line operators, and painters

- Power and water consumption attributed to the production

- Cost of merchandise

- Commissions or professional fees such as costs for insurance, real estate, consultancy, and law firms

Indirect costs, known as operating expenses, are not directly connected to the production or acquisition of items for resale. These costs are usually added together as a fixed or overhead expense and distributed among different operational activities.

Examples of indirect costs:

- Salaries and related benefits of production managers and quality assurance staff

- Office and factory facility rent

- Office supplies

- Utilities such as electricity, water, telephone lines, or those that are not directly involved in creating or purchasing goods

- Maintenance costs and depreciation of office building, equipment, furniture, and fixtures or of factory equipment.

- Insurance and amortizations

- Marketing and advertising costs

- Travel expenses

💡 No matter which method you choose, waiting for the income statement at the accounting year’s end to calculate your operating income doesn’t help. Instead, you must closely monitor operating income to evaluate your business’s efficiency trend over time to make timely adjustments.

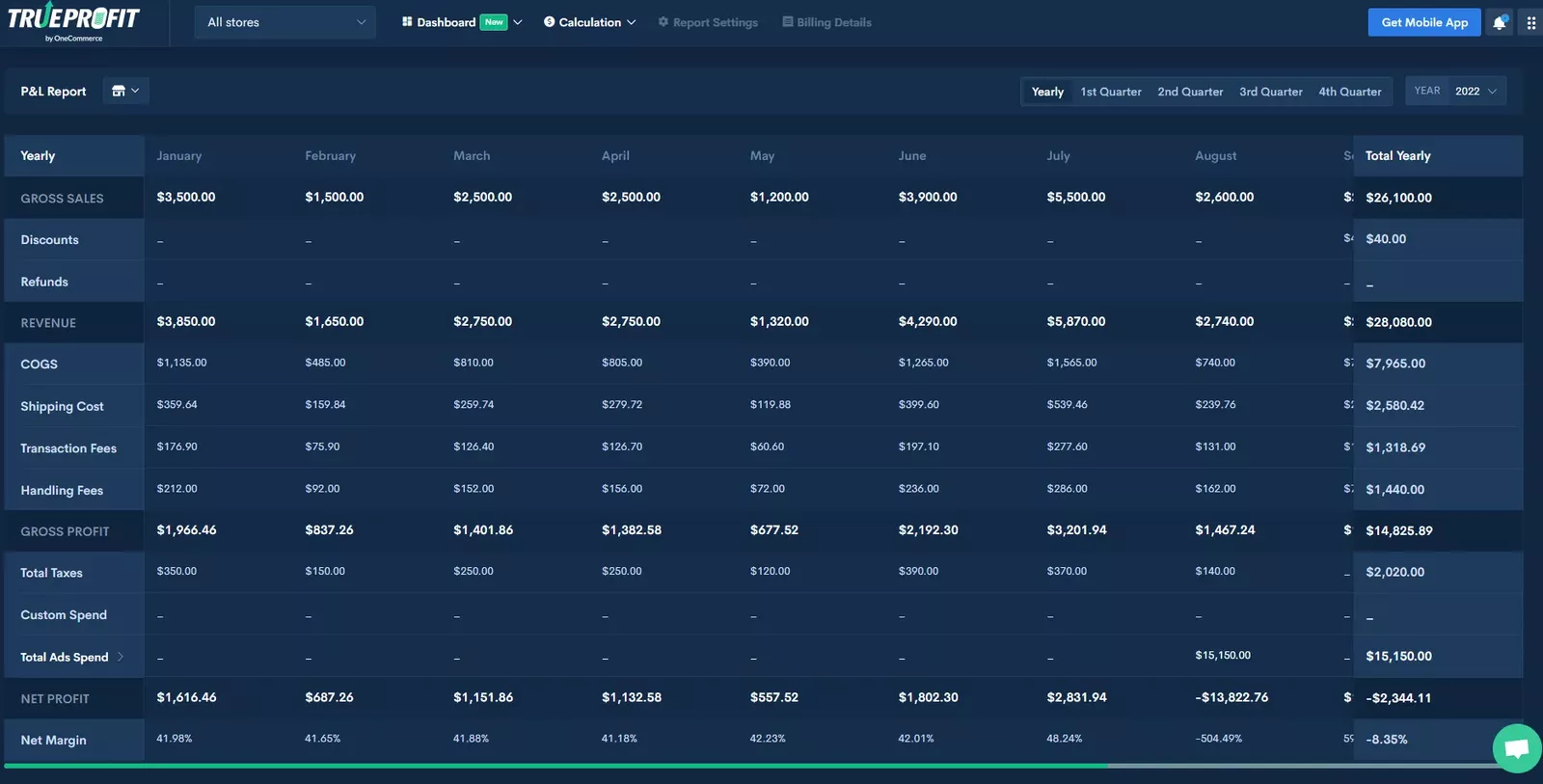

If you are a Shopify merchant, install TrueProfit > Go to ‘Profit & Loss Report‘ to check your store’s profits and losses. You can see the trends and fluctuations for all your metrics by day, week, month, or year!

A Real-life Example Of Operating Income

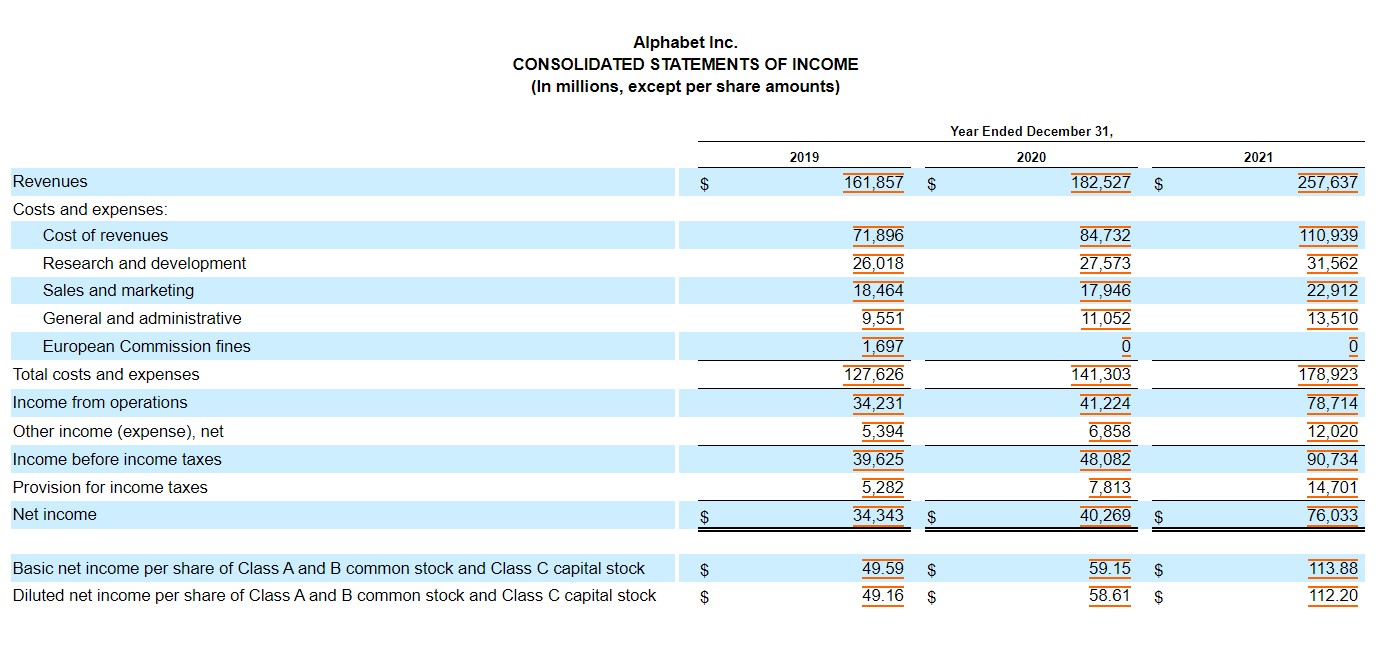

Here is an example from Alphabet (Google) Inc.’s annual report for 2021 to show how operating income is calculated. The fiscal year runs from January to December, and the financials are shown in millions of US dollars.

The operating income (or Income from operations in this statement) in 2019, 2020, and 2021 is $34,231, $41,224, and $78,714, respectively.

By subtracting all of the costs and expenses, including Costs of revenue (as Alphabet is a service company), Research and development, Sales and marketing, General and administrative, and European Commission fines from net revenue, they have the operating income for each year.

On its income statement, Alphabet reported that the company’s expenses increased quickly, jumping by over 21% to $178,923 because it spent a lot of money developing and promoting new services to increase its market share.

Yet, the company’s operating income still increased from $41,244 to $78,714, thanks to the drastic year-on-year rise in total revenue. Overall, the company was on the right track by implementing the right strategies that yielded higher profitability for them.

Operating Income vs. Other Metrics

Besides operating income, there are other metrics that can assist you in measuring your company’s profitability. Of all these metrics, EBIT, EBITDA, and Net Income are three figures people usually confuse with operating income.

Below is the table that summarizes the key differences among them:

#1. Operating Income vs. EBIT

There is a significant distinction between operating income and EBIT (earnings before interest and taxes), though the two terms are sometimes used interchangeably. EBIT is net income before taxes and interest.

Yet, EBIT can include revenue and costs from non-operating sources. It is only the same as operating income if a business has no revenue or costs from those sources.

Moreover, EBIT and operating income differ if a business generates non-operating income through investments or the sale of a subsidiary or pays non-operating costs like a write-off.

The last yet crucial difference is that operating income is a GAAP-approved accounting metric, but EBIT isn’t.

#2. Operating Income vs. EBITDA

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is another often-used measure of profitability. You add net income by interest, taxes, depreciation, and amortization to arrive at EBITDA.

Operating income differs from EBITDA because the former excludes revenue and costs from non-operating sources. Besides, EBITDA doesn’t include depreciation and amortization – the expenses considered when calculating operating income.

Depreciation costs for businesses with expensive machinery or large assets can be high. So some prefer EBITDA over operating or net income as it gives a better view of their companies’ ongoing operating profit and cash flow since such depreciation costs don’t really represent cash outflows.

Lastly, similar to EBIT, EBITDA is not GAAP-approved.

#3. Operating Income vs. Net Income

Both operating income and net income are significant indicators of how profitable a business is. However, net income includes all profits and losses, while operating income only factors in the profit left over after subtracting COGS and operating expenses from revenue.

In addition to non-operating expenses, net income also includes non-operating revenue from investments and the sale of assets.

Frequently Asked Questions

-

What is operating income, and how do you calculate it?

Operating income, also known as income from operations, is an accounting metric that assesses the profit generated by a company’s operations following the deduction of operating expenses.

As we explained above, there are three distinct formulas for operating income that can be used to calculate this metric.

-

What is total operating income?

The total operating income is the same as the operating income and has the same operating income formula to compute.

-

Is operating income the same as EBIT?

It is a typical misperception that operating income and EBIT are the same. They are quite similar yet still have some differences.

The primary distinction is that EBIT includes non-operating factors, frequently shown as “other income/loss” on the income statement and distinct from interest and taxes.

For many businesses, operating income and EBIT are the same, but the differences might be obvious for those with significant gains or losses from the “other” category.

-

What is an example of operating income?

Here is a hypothetical example of calculating operating income:

- Your business generated $500,000 in sales revenue this year.

- The items sold for the period were $80,000

- The rent fee was $10,000

- Maintenance costs were $1,500

- Insurance was $4,000

- Net employee compensation was $60,000

Using the operating income formula, your business has a total operating income of $344,500. For better understanding, scroll up to see real-life examples of operating income.

Final Thoughts

In brief, operating income can help you evaluate how well your business creates profits from its main business operations before considering the capital structure, taxes, and other income and expenses from non-core businesses.

And we hope after reading this article, you can better grasp the operating income formula, its purposes, and how it differs from similar profitability metrics.

Discover what proper profit-tracking looks like at trueprofit.io