Exposed: 5 Silent Killers of Your Shopify Net Profit

The crime scene? Your net profit margin, thinner than your customers’ patience.

The suspects? Hidden, devious costs.

A few extra cents here and there may seem insignificant. But over time, they snowball into thousands lost. Left unchecked, these silent killers can turn a thriving business into a crippling one.

But here’s the twist—you can actually catch them before they do more damage.

What you're about to read comes from 2 powerful sources: the hard-earned wisdom of eCommerce veterans and our own observations across thousands of Shopify stores.

The 5 silent killers of net profit

Killer #1: Chargebacks

At first glance, a chargeback seems like just a lost sale, but the real damage runs much deeper.

Each dispute triggers a cascade of hidden costs that silently eat away at your profits. If you lose the dispute, here’s what you’re really losing:

- The original purchase amount.

- Chargeback fees – anywhere from $15 to $100 per incident.

- Processing fees.

- Shipping costs.

- Lost inventory – If the item was already shipped and isn’t returned, that’s a total loss.

- Customer service time.

Killer #2: Returns

Just like chargebacks, product returns cost more than you think.

That $50 refund? It’s likely costing you closer to $100 when factoring in all costs:

- Original shipping cost.

- Return shipping cost.

- Processing fees (both ways).

- Repackaging/restocking costs.

- Additional shipping supplies.

- Customer service time.

The average return rate for eCommerce stores hovers around 16%, depending on your industry. Fashion and accessories often see higher return rates (20-30%), while in categories like supplements and consumables, even a 1% return rate can hit margins hard, since many returned items can’t be resold.

Killer #3: Platform fees

Okay, let’s talk about platform fees. We all know Shopify bills you for the monthly subscription—starting at $39/month for the basic plan – but here’s where things get interesting. It’s not just Shopify’s subscription fee that eats away at your profits. It’s the whole tech stack that quietly adds up.

Here’s how the fees break down:

- Shopify subscription fee.

- Transaction fees – Shopify charges you a percentage per online transaction depending on your pricing plan.

- App subscription fees – Apps in and outside of Shopify can cost anywhere from $5 to $100/month, depending on the features.

Killer #4: Inventory chaos

Here’s a scary truth: Most eCommerce brands don’t actually know their true COGS (except for the ones that use TrueProfit instead of stupid Excel spreadsheets).

Sure, they might have a number written down somewhere in their sheets, but that's not the full story.

Why? Because COGS isn't a static number – it's constantly changing. The cost to get your product to a customer in California is different from New York. Ordering 1,000 units vs 10,000 units? You guessed it, different costs again.

And here’s the kicker: One small miscalculation in COGS cascaded into:

- Inventory values significantly off target.

- Profit margins that looked better than reality.

- Forecasting that missed seasonal impacts.

- Cash flow surprises at the worst times.

Killer #5: Sales tax

Wanna hear a horror story? There are over 13,000 sales tax jurisdictions in the US alone. And because of “economic nexus laws”, you might be required to collect sales tax in far more places than you realize.

What that means is if your business makes a certain amount of sales or has a certain number of transactions in a state—usually $100,000 in sales or 200 transactions—you’re required to collect sales tax in that state, even if you don’t have a physical location there.

The real challenge is it’s not just about collecting sales tax; it’s about knowing where you need to collect it. This is because every state has different rules about what's taxable & when you need to file.

To catch the killers

Now that we’ve highlighted some of the silent profit killers lurking in the background, it’s time to talk about how to catch them—and more importantly, how to trim them down. While it’s impossible to eliminate all these costs, there are always areas where you can save.

In this section, we’ll show you how to track these costs and make smart decisions to keep your cash flow healthy.

Ready? Let’s dive in.

The golden rule: Use the right cost-tracking tool

If you think we’re about to mention TrueProfit—our own app, you’re absolutely right. And we have no shame in that 😀

Tracking every cost in your Shopify business is a life-or-death matter. It’s the only way to understand where your money is going and make sure no hidden expenses slip through the cracks.

Running your store without clear cost insights means you’re accepting the reality of making sales but seeing zero net profit (aka what you can actually take home)—or even worse, finding yourself in debt.

So that means, having the right tool to track these costs is extremely important. And that’s exactly what we provide.

Think of TrueProfit as an X-ray machine. Our app monitors all the costs mentioned, plus any other expenses your Shopify business incurs, both in real-time and over different periods of time.

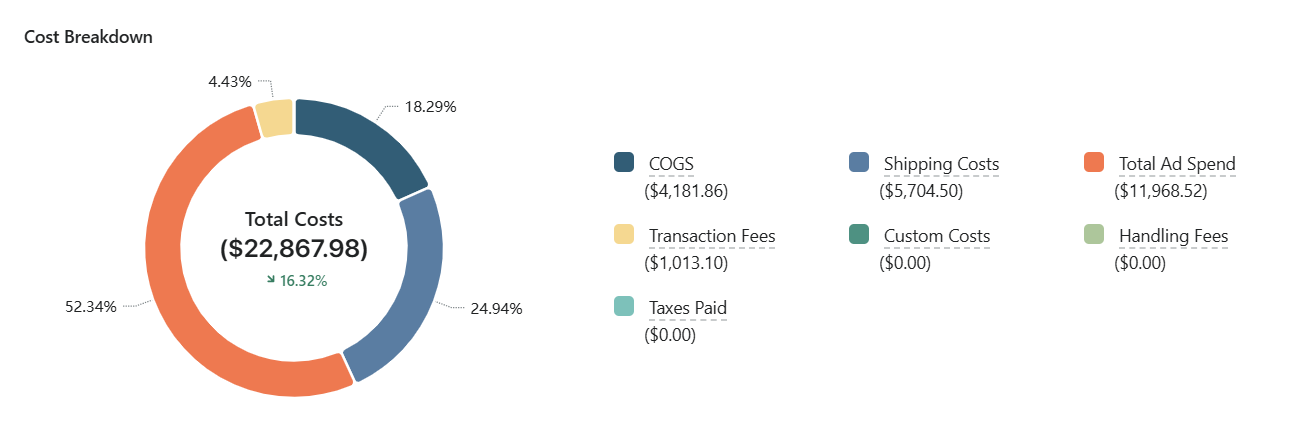

On top of that, we also provide a detailed cost breakdown chart, giving you a clear view of all the costs eating into your net profit, so you can optimize your net margins with confidence. Try for free

Now that you've got the right tool in your arsenal, let's dive into how you can actually tackle the 5 silent profit killers we’ve discussed.

Catching killer #1: Chargebacks

Here’s your battle plan if chargebacks are hitting your store hard:

- Track common chargeback reasons: Understanding why chargebacks happen (fraud, fulfillment issues, or disputes) helps you address root causes and reduce future losses.

- Document all shipping/delivery carefully: Always read what documentation your payment processors require, and keep records of tracking numbers, proof of delivery, and customer communications to back up your claims in disputes.

- Fight the ones you can win: Not all chargebacks are worth contesting, but with strong evidence, you can overturn wrongful disputes and recover lost revenue.

- Look for patterns in high-risk orders: Frequent chargebacks from certain regions, products, or customer profiles could signal fraud or weak policies that need fixing.

- Consider chargeback protection services: Tools like Chargeflow or Midigator can help you reduce manual effort and improve your win rate by automating the dispute process & detecting frauds.

Catching killer #2: Returns

More than just unavoidable expense, you can use product returns as valuable data points to improve your business.

Tag each return with:

- Reason code – Identify why customers are returning items (sizing issues, defects, wrong expectations, etc.) to spot recurring problems.

- Customer cohort – Track which customer segments have higher return rates to refine targeting and expectations.

- Time since purchase – Analyze whether returns happen quickly (indicating buyer’s remorse) or after extended use (potential quality issues).

- Product category – See which types of products are most frequently returned and adjust descriptions, images, or quality control accordingly.

Catching killer #3: Platform fees

Many Shopify merchants try to cut costs by avoiding apps altogether or using free tools only—but that often backfires.

The right tools drive growth, automate tasks, and save you more money in the long run. Instead of sacrificing efficiency, take a smarter approach: audit your platform fees and trim the fat.

A thorough review can reveal costs that quietly eat into your profits. Start by reviewing:

- Apps you haven’t used in ages—If it’s been months since you last touched it, you probably don’t need it (unless it’s a one-time setup tool that still does its job).

- Duplicate tools with overlapping features—You might be paying twice for the same functionality.

- Unnecessary premium plans—Downgrade if you no longer need advanced features.

- Unused user seats—If your team has changed, you might be overpaying for extra accounts.

And don’t stop at Shopify—hidden fees add up across platforms:

- Payment processor fees—Rates vary by card type, and you might be losing more than you realize. If you're processing a high volume of sales, consider upgrading your Shopify plan to secure lower rates.

- Marketing platform overages—Extra ad spend or email contacts can push you into higher pricing tiers without notice.

Catching killer #4: Inventory chaos

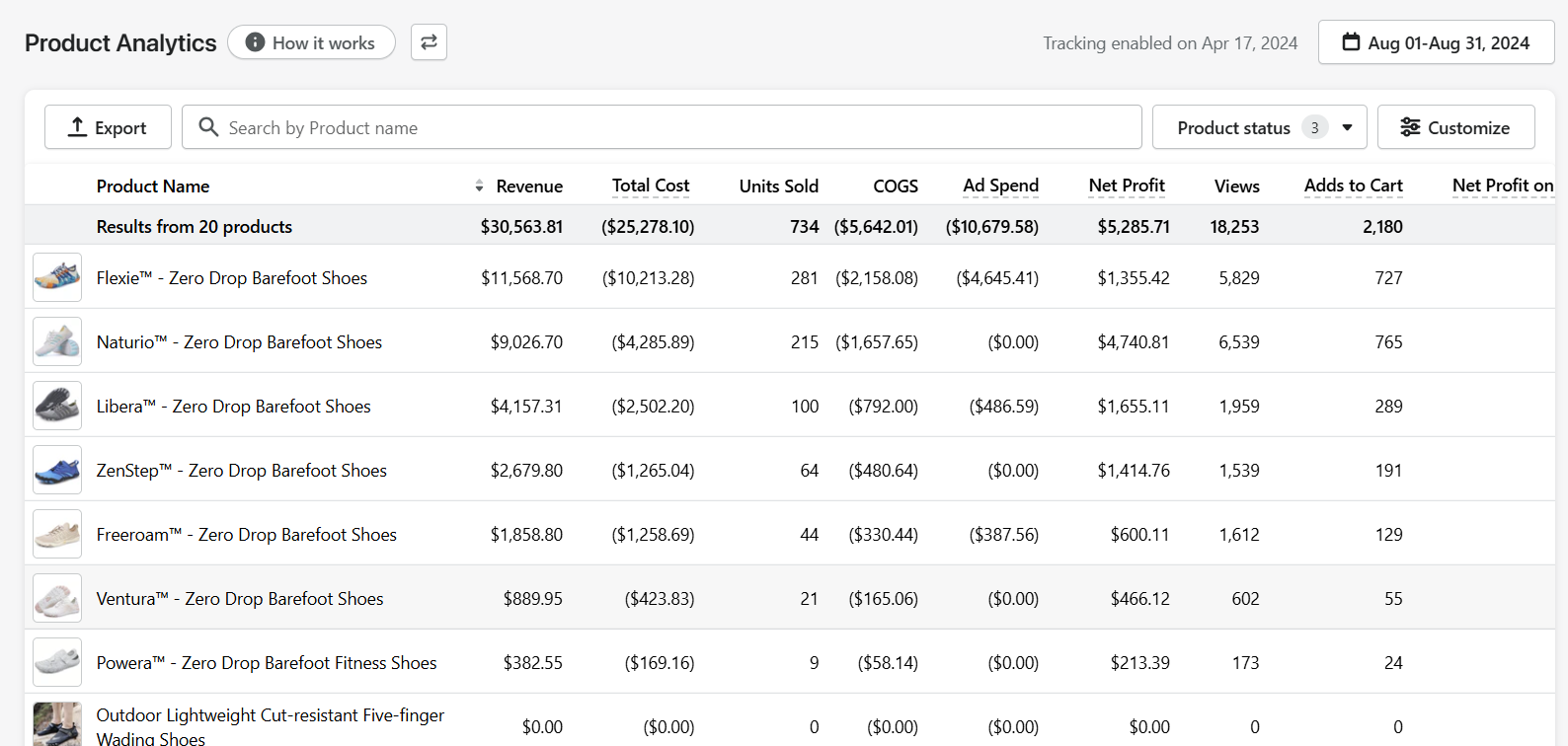

Fixing inventory chaos is actually simpler than you might think. The key is tracking your COGS both in real-time and over different periods of time—and that’s exactly where TrueProfit has to offer.

We ensure your COGS stays as accurate as possible by offering advanced settings that let you customize COGS for each product. This is especially useful if your costs vary by quantity or region.

Catching killer #5: Sales tax

The best approach is to stay ahead of the game before sales tax becomes a serious issue.

Here's what you need:

- Track every sale by state

- Understand your nexus obligations

- Get the right tools or tax experts on your side—Sure, it'll cost you some money upfront. But trust us – it's pocket change compared to dealing with an audit or back taxes.

Final thoughts

If there’s one thing to take away from this, it’s this: never underestimate silent profit killers. They may not be obvious at first, but over time, they can quietly drain your net profit.

We know keeping track of every cost isn’t easy—but that’s exactly why TrueProfit exists. We help you monitor every expense in real-time, so you can make smarter decisions to protect your net profit.

In the end, profit isn’t about how much you sell—it’s about how much you keep.

Founder of TrueProfit & eCommerce Profitability Expert

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.