All About Amazon Costs of Goods Sold: Definition & Methods

In today's rapidly changing selling environment on Amazon, monitoring your finances and understanding how certain factors impact your overall profitability is increasingly important. Understanding Amazon Cost of Goods Sold (COGS) is crucial for maximizing profits and staying ahead in this competitive market.

In this post, we will dive deep into the definition of COGS, its formula, and best practices for optimizing your COGS when selling on Amazon.

In this blog:

What is the Amazon Cost of Goods Sold?

Amazon Cost of Goods Sold refers to the costs of producing and selling a product on Amazon. This includes materials, labor costs, shipping fees, packaging expenses, and other variable costs incurred during production.

As an Amazon seller, monitoring your COGS can help you identify which products generate the most profit and which may hurt your bottom line. Particularly, Amazon costs of goods sold include both direct and indirect costs:

Direct Costs:

- Manufacturing/Procurement costs: The raw materials and labor used to produce your products. If you’re a retailer, this would be the price your supplier quoted.

- Packaging costs: The cost of packaging materials.

Indirect Costs:

- Shipping costs: Any shipping or freight charges.

- Storage & fulfillment costs: The cost of your inventory and getting your products to your Amazon customers.

- Advertising costs: The money you spend to advertise your products. Either on Amazon ads or off-platform ads.

- Amazon fees: Any fees Amazon charges. Some basic fees are selling plans and Amazon referral fees. And if you choose Amazon FBA instead of Amazon FBM, you will have to factor in the Amazon FBA fees (fulfillment, storage, returns processing, removal order, etc.)

- Taxes and duties: The taxes and duties to the government for each of your sales.

However, you should note that Amazon Cost of Goods Sold does not include operating expenses (OPEX). This means you should exclude costs such as utilities, office rent, or accounting fees.

Why Keeping Track Of Your Amazon COGS Is Important?

Knowing your Amazon Cost Of Goods Sold is very critical for running a successful business. By understanding your COGS, you can:

- Determine your gross profit: Subtracting your COGS from your total sales revenue gives you your gross profit. Gross profit tells you how much profit you make on each sale and can help you optimize your business strategy.

- Monitor your profitability: Regularly tracking your COGS allows you to monitor your business's profitability over time. If your COGS is increasing or your gross profit is decreasing, it may be time to adjust your business strategy. You can start thinking about changing suppliers or removing some excess labor/packaging materials to reduce costs.

- Make informed business decisions: Since COGS is a crucial metric for Amazon finance, knowing your COGS can help you make informed decisions about your Amazon business's product offerings, pricing, and other aspects. For example, if a particular product has a high COGS and low gross profit, consider discontinuing it or adjusting its price.

- Report to tax: Accurate Amazon Cost of Goods Sold calculations are required for tax purposes. You'll need to report your COGS on your tax returns, so keeping accurate records and ensuring your correct calculations is important.

And remember this, understanding your cost of goods sold (COGS) is essential, but it’s just one piece of the puzzle. To see the full picture of your profitability, try our Profit Margin Calculator. It helps you quickly determine your profit margin, net profit, and other key metrics—giving you clear insights into your business performance.

How to Calculate Amazon Cost Of Goods Sold?

Now let’s refresh our memory on the formula of Amazon COGS:

In which:

- Beginning inventory: The value of your inventory at the beginning of the period

- Purchases during the period: Any purchases made during the period

- Ending inventory: Your remaining inventory at the end of the period

In other words, to calculate your Amazon COGS, you take the total value of your inventory at the beginning of a period. Then, add any purchases you made during that period, and subtract the value of your remaining inventory at the end.

The tricky part of this formula would be identifying the 2 factors: Beginning Inventory and Ending Inventory. How would you define which is your beginning stock, and what should be your ending?

There are four commonly used methods to determine these: First-In, First-Out (FIFO), Last-In, First-Out (LIFO), Average Cost Method, and Specific identification. Let's look at each method and its pros and cons:

Method #1. First-In, First-Out (FIFO)

FIFO is a method where the first units of inventory purchased are sold. This method assumes that the oldest inventory is sold first and the newest inventory is still on hand. FIFO is widely used because it is straightforward and closely mirrors the order in which inventory is purchased.

For example, let's say you purchase 100 units of Product A for $5 each and then purchase 200 more units of the same product for $7 each. Later on, you sell 150 units of Product A. Using the FIFO method, you would assume that the first 100 units sold were the ones you bought for $5 each and the remaining 50 were the ones you bought for $7 each.

Therefore, in this case your COGS would be (100 x $5) + (50 x $7) = $650.

Method #2. Last-In, First-Out (LIFO)

LIFO is a method where the last units of inventory purchased are the first ones sold.

The Amazon COGS is calculated by multiplying the cost of the most recent inventory by the number of units sold. LIFO is less commonly used than FIFO, but it can be beneficial when inventory costs rise over time.

For example, let's say you purchase 100 units of Product B for $5 each and then purchase 200 more units of the same product for $7 each. Later on, you sell 150 units of Product B.

Using the LIFO method, you would assume that the last 150 units sold were the ones you bought for $7 each, and your COGS would be (150 x $7) = $1050.

Method #3. Average Cost Method

The Average Cost Method calculates the average cost of all units in inventory. That average cost is used as the COGS for each unit sold.

For example, let's say you purchase 100 units of Product C for $5 each and then purchase 200 more units of the same product for $7 each. The total inventory cost is ($5 x 100) + ($7 x 200) = $1600.

Using the average cost method, the cost per unit is $1600 / 300 units = $5.33. Later, you sell 150 units of Product C, and your COGS would be (150 x $5.33) = $800.

Method #4. Specific Identification

The Specific Identification method is a way of tracking inventory that involves identifying and tracking each item individually. This means you need to keep track of the cost of each item in your inventory separately.

For example, say you own a coffee shop and sell various coffee drinks and pastries. You begin the month with $5,000 worth of inventory and purchase $3,000 worth of new inventory throughout the month.

At the end of the month, you determine the specific costs associated with your inventory (cost of beans, cost of milk, cost of pastries, etc.), which equals $2,000.

Using specific identification, use the following COGS calculation:

New purchases ($3,000) + beginning inventory ($5,000) - associated costs ($2,000) = COGS ($6,000).

Subtract $6,000 from your revenue, and you have an ending inventory valuation, which becomes your beginning inventory for the next month.

Understanding Amazon cost of goods sold is essential to successful eCommerce operations. We hope this post has helped you better understand COGS and how to calculate it.

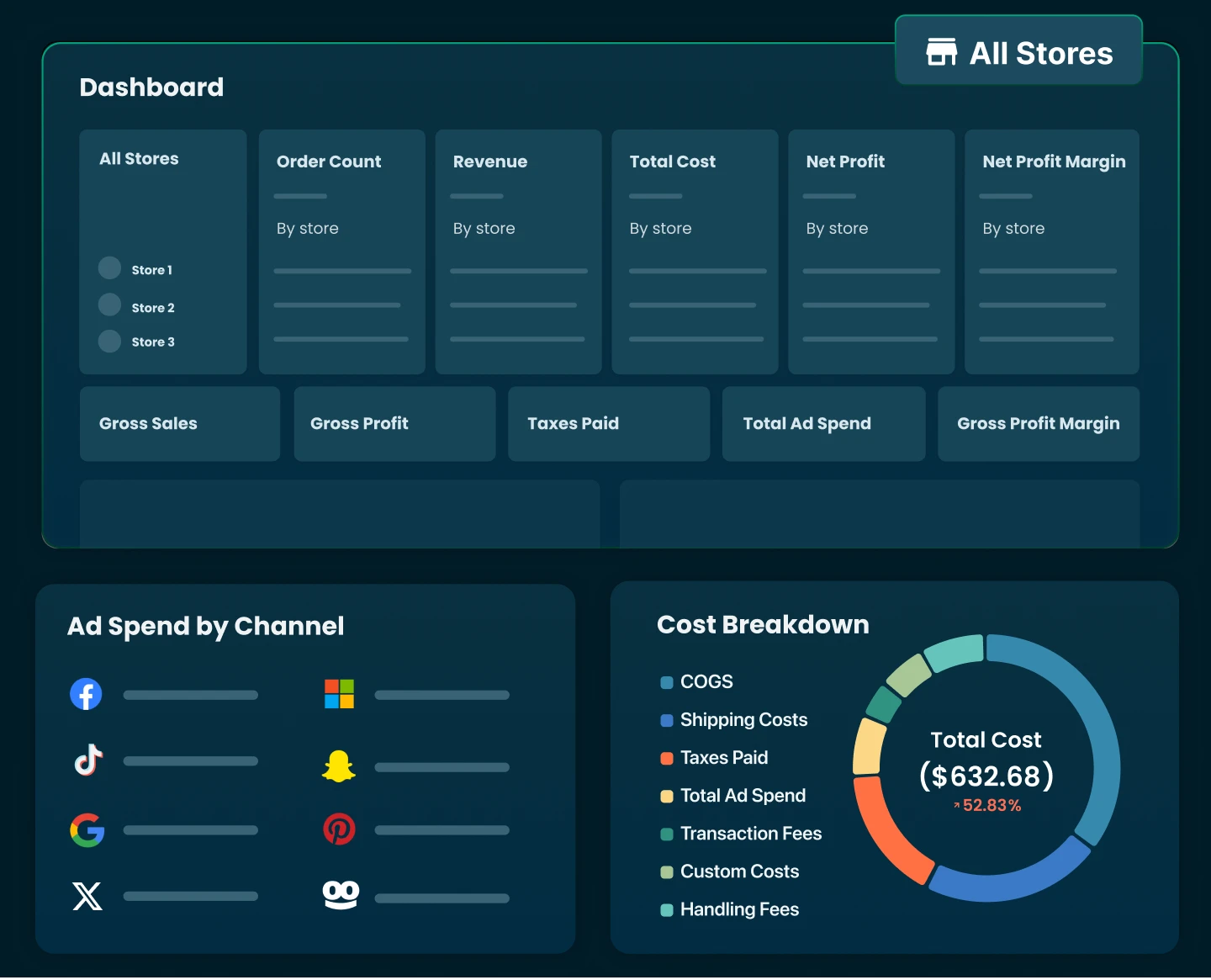

To make your life easier, take advantage of analytics tools like TrueProfit to easily calculate your COGS. Best of luck as you continue growing your online business! Thanks for reading, and happy selling!

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits