The Profitable Facebook Ads Strategy for 2026 (Post-Andromeda)

Optimize your pricing strategy with our double discount calculator. Test different discount combinations to find the perfect balance between competitiveness and profitability.

Pricing can get messy when discounts stack up, but this calculator takes the guesswork out of it. Here’s how you can use it:

First, enter your Product Cost — the amount you pay your supplier or spend to manufacture the product yourself. This is also known as Cost of Goods or Cost of Goods Sold (COGS).

Next, set your Target Profit Margin. This is the percentage of profit you want to make on top of your cost.

Let’s say your product costs $60 and you want a $10 profit—that’s about a 16.6% margin.

Now, add in your discounts. If you’re planning a First Discount (like 10%) and maybe a Second Discount (like another 10%), type those in. The calculator knows these stack, so it’ll do the compounding math for you.

Once you’ve filled it all out, the results appear instantly:

Please take notes: two 10% discounts don’t equal 20% off—it’s slightly less because the second discount applies to a reduced price. That’s why this tool is so handy—it keeps your margins safe without you having to crunch the numbers.

A double discount strategy is a pricing and promotion technique where two separate discounts are applied one after the other — instead of giving customers just one flat markdown.

Here’s what that means in practice:

Because the discounts are applied sequentially, the total reduction isn’t simply added together. For example, 20% off + 10% off isn’t 30% — it’s actually 28% off overall (since the second discount applies to the reduced price).

Running promotions is exciting, but the tricky part is figuring out how much discount you can give without eating into your profits. That’s exactly where the double discount calculator comes in handy.

Here’s the idea:

1. Start with your target profit margin. This ensures that no matter what discounts you apply, you’re still covering costs and making money.

2. Use the Selling Price as your anchor. The calculator works backward from the profit margin you want. It figures out the lowest price you can sell at (after all discounts) without going below your target profit.

3. Adjust your discounts. Play around with the first and second discount fields to see how they impact your List Price and Profit per Sale.

Find the sweet spot. The “optimal” double discount rate is the one where your final selling price looks attractive to customers, but you still walk away with the profit you aimed for.

For example:

If your product costs $60 and you want to make $10 profit, the calculator shows you need a selling price of $86.33. From there, you can test discounts (say 10% + 10%) and instantly see how much list price you need to keep that profit safe.

For ecommerce sellers, a double discount strategy can be a smart way to drive sales, increase order value, and move inventory — but only when used in the right situations. Instead of offering one flat discount, stackable discounts (for example, 20% off + an extra 10% at checkout) feel more exciting to customers and often convert better.

Here are the best times to use double discounts in ecommerce:

1. Seasonal promotions and holiday sales:

During events like Black Friday, Cyber Monday, or year-end clearance, shoppers expect deep savings. Offering stackable discounts creates urgency and helps your brand stand out.

2. Boosting average order value:

Apply a first discount on individual products, then add a second discount at checkout for larger purchases. This encourages customers to spend more while protecting your profit margins.

3. Rewarding loyal or VIP customers:

Run a public discount everyone sees, and then give your email subscribers or loyalty program members an additional discount code. It makes customers feel valued while keeping your pricing strategy consistent.

4. Clearing old or slow-moving stock:

A double discount can help liquidate products that aren’t selling fast, all while ensuring you don’t dip below your target profit margin when you calculate the right prices.

Running a double discount strategy can be a game-changer for ecommerce sellers, but the real win comes when those discounts actually convert into sales. Shoppers love the thrill of “stackable savings,” but if you don’t plan it right, you risk giving away too much and hurting your margins. Here’s how to find the balance:

First, think about the psychology. A flat 30% discount doesn’t feel as exciting as “20% off + an extra 10% at checkout.” That second step feels like a bonus, and customers are more likely to complete the purchase because they believe they’re getting something extra.

Second, make the savings crystal clear. Don’t leave customers to guess what they’ll pay after both discounts. Show the original price, the first discount, and the final discounted price. The easier it is to see the deal, the higher your conversion rates will climb.

Third, build urgency and exclusivity. A simple line like “extra 10% today only” or “exclusive double discount for email subscribers” can push hesitant shoppers to act right away.

And of course, protect your profit margins. That’s where a double discount calculator comes in. Instead of guessing, you can play with different discount scenarios, check the final selling price, and make sure every sale still brings in profit.

Finally, keep testing. Sometimes flipping the structure — for example, a smaller first discount and a bigger second one — converts better, even if the math ends up nearly the same.

In short, optimizing double discount conversion rates is less about slashing prices and more about how you frame the offer. Make it feel rewarding, keep it simple, and always double-check the numbers before launching your promo.

Securing your store’s bottom line after running a double discount can be tricky, because two successive discounts reduce the selling price more than most sellers realize. For example, a 20% discount followed by another 20% isn’t the same as one 40% discount—it actually brings the price down further, which can eat into your margins if you’re not careful.

The first step to protecting your profit is to calculate the true final selling price after the discounts, then compare it against your cost of goods, shipping, transaction fees, and ad spend. If the margin is too thin, you may need to adjust your base price, set discount limits, or bundle products to maintain value without cutting too deeply into profits.

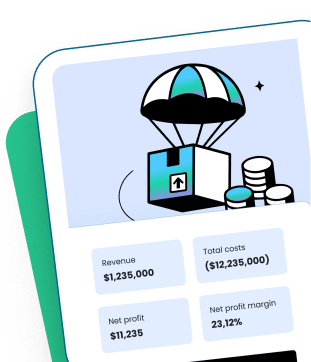

But beyond manual calculations, the smartest solution for Shopify sellers is to track everything automatically with a tool like TrueProfit. Unlike spreadsheets, TrueProfit pulls real-time data from your store, ad platforms, and expenses to show your actual net profit after discounts, fees, and hidden costs.

With this level of clarity, you can run promotions confidently, knowing exactly how they affect your bottom line. Instead of guessing whether your discounts are helping or hurting your business, you’ll have precise insights that let you optimize your offers, scale winning campaigns, and keep your store profitable in the long run.

Discover other handy tools designed to save time, optimize pricing, and increase profits.

Handle complex discounting with ease—calculate three-level reductions accurately and protect your revenue.

Set the right price, secure your profit, and grow your print on demand businesses confidently.

Quickly estimate your margins, set profitable prices, and ensure every sale boosts your bottom line.

Measure your ad spend efficiency, calculate returns, and maximize your marketing performance with precision.

A double discount happens when two discounts are applied one after the other, not added together. For example, a 20% discount followed by another 10% discount doesn’t equal 30% off — it equals 28% off, since the second discount applies to the already reduced price.

To calculate successive discounts, you apply each discount step by step. Start with the original price, subtract the first discount, then apply the second discount to the reduced price. Our double discount calculator makes this easier by showing the exact final price you should list to protect your margins.

A stacking discount (or stackable discount) means customers can combine multiple discount offers in one purchase. For example, “20% off site-wide + extra 10% off at checkout.” Shoppers love stackable discounts because they feel like extra savings, but sellers need to calculate carefully to avoid hurting profits.

Two successive discounts mean the price is reduced twice in sequence. For example, a $100 product with 20% off becomes $80. If you then apply a 10% discount, the new price is $72. This method is different from simply taking 30% off the original price.

If you know the original price and the discounted price, you can calculate the discount percentage by dividing the difference by the original price. For example: if the original price is $100 and the final price is $72, the total discount is 28%.

To reverse calculate a discount, start with the discounted price and work backward to find the original. For example, if an item costs $72 after a 10% discount, divide $72 by 0.9 to get the original price of $80.

In ecommerce, a “good” discount usually ranges from 10% to 30%, depending on your profit margins and product type. Smaller discounts (10–15%) work well for everyday promotions, while bigger double discounts (20% + 10%) are effective during seasonal campaigns like Black Friday or Cyber Monday.

The most common mistakes include:

A 50/10 discount means two successive discounts: first 50% off, then 10% off the reduced price. For example, a $200 product becomes $100 after the 50% discount, and then $90 after the additional 10% discount.

The trick is to remember that successive discounts are multiplicative, not additive. Instead of adding the percentages, you apply each one in order. For example:

Your next wise move starts with seeing your True Net Profit now.

Get instant net profit insights into your numbers to make every choice count— with TrueProfit!