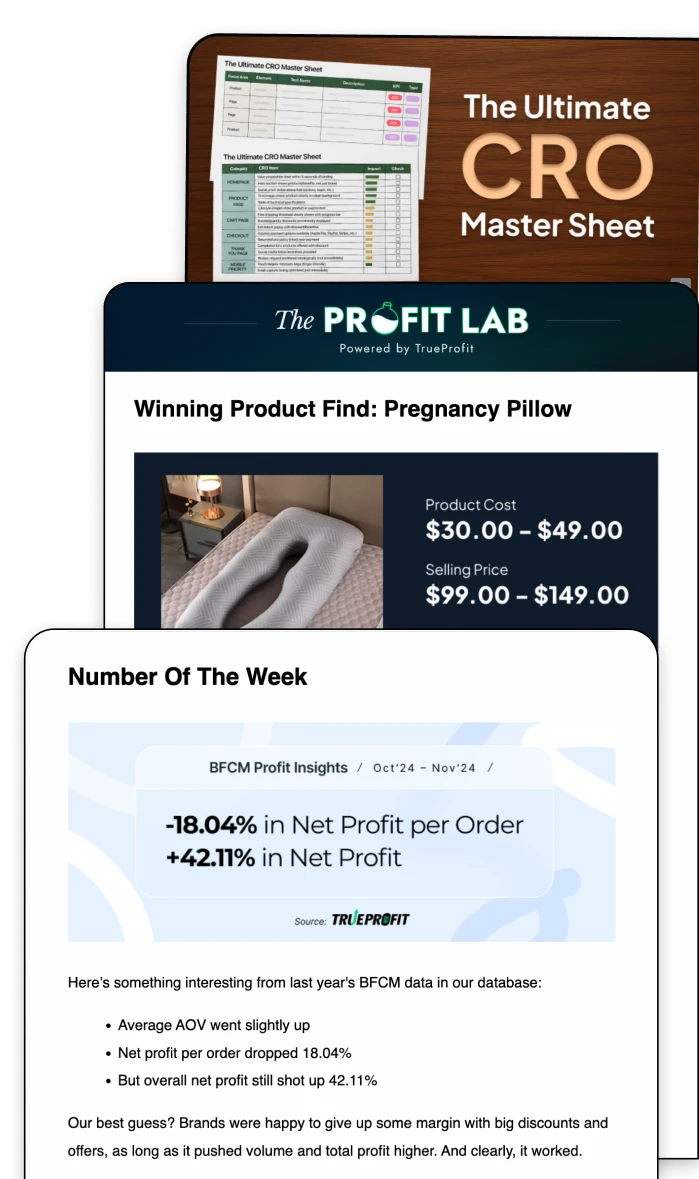

Gross Profit vs Net Income: Key Differences and Why They Matter

Gross profit and net income are both important ecommerce metrics that measure profitability, but they reveal different parts of a company’s financial story.

Gross profit shows how much a business earns after covering the direct costs of making its products (COGS), while net income reflects what’s left after subtracting all expenses, including operating costs, taxes, and interest.

If you're making decisions based on one and ignoring the other, you're missing half the picture. Let’s break it down.

In this blog:

Gross Profit vs Net Income: A Clear Comparison

Aspect | Gross Profit | Net Income |

|---|---|---|

Scope of Expenses | Deducts only direct production costs (COGS) | Deducts all expenses including operating costs, taxes, interest, etc. |

Purpose | Measures efficiency in production and pricing | Shows overall profitability after all expenses |

Position on Income Statement | Near the top, right after revenue and COGS | At the bottom, known as the “bottom line” |

Usage | Analyzes product lines and cost control | Assesses financial health, investment value, and returns to shareholders |

What is Gross Profit?

Gross profit is the amount a business earns after subtracting the direct costs of producing its goods or services. These direct costs—often referred to as cost of goods sold (COGS)—typically include raw materials, labor, and manufacturing expenses tied to production.

To better understand a company’s profitability, the gross profit margin is often used. It expresses gross profit as a percentage of total revenue, helping compare efficiency across businesses of different sizes.

Which Expenses Are Part of Gross Profit?

Gross profit is calculated by subtracting Cost of Goods Sold (COGS) from revenue. COGS includes:

- Raw materials or inventory costs

- Manufacturing or production costs

- Direct labor (e.g., wages for workers involved in making or delivering the product)

- Packaging and shipping (if directly tied to sales)

It does not include indirect costs like rent, utilities, marketing, admin salaries, or software subscriptions. Those are counted later when calculating net income.

So, if you're wondering whether wages are included: only the wages directly tied to making or delivering your product count toward gross profit—everything else comes afterward.

What is Net Income?

Net income is the profit a company keeps after covering all its expenses. It’s often called “the bottom line” because it appears at the end of the income statement and shows what’s left after operating costs, taxes, interest, and other expenses are deducted from total revenue.

Net income is often expressed as the net profit margin, which shows net income as a percentage of total revenue. This metric helps assess a company’s overall profitability and operational efficiency.

Which Expenses Are Part of Net Income?

Net income accounts for all business expenses, not just production costs. It includes:

- Cost of Goods Sold (COGS): Direct production costs

- Operating Expenses: Salaries, rent, utilities, software, insurance

- Marketing and Advertising Costs

- Depreciation and Amortization

- Interest on Debt or Loans

- Taxes (Local, State, Federal)

- Other Business Expenses: Legal fees, consulting, equipment maintenance

- Less: Other Income (if applicable): e.g., interest income or one-time asset sales

Net profit gives the most complete view of a company’s profitability after every cost is factored in. It’s what the business ultimately keeps.

To better understand your net income relative to revenue, using a net profit margin calculator is helpful. TrueProfit offers a free, easy-to-use calculator that lets you quickly see how much profit you keep after all expenses. Try TrueProfit’s net profit margin calculator now.

Gross Profit vs Net Income: Which Matters More?

Gross profit highlights operational efficiency, while net income shows complete profitability. Both are important, but net income gives the fuller picture.

Gross profit shows how well a company controls direct production costs like materials and labor. It helps with pricing and efficiency but ignores other expenses.

Net income accounts for all costs—including overhead, interest, and taxes—revealing the company’s true profit. It’s essential for assessing overall financial health, sustainability, and investment value.

In short, it all depends on your goals.

Where To Find Gross Profit and Net Income

You can find both gross profit and net income on a company’s income statement.

Gross profit appears near the top, calculated by subtracting the cost of goods sold (COGS) from total revenue. It’s often listed under terms like gross income, sales profit, or gross margin.

Net income appears at the bottom of the income statement after all other expenses and additional income are accounted for. It may also be called net profit, net earnings, or profit after tax.

Together, these figures provide a snapshot of a company’s profitability at different stages of its operations.

Understanding gross profit vs net income is essential for anyone managing or evaluating a business. Gross profit shows how well a company controls production costs, while net income reveals the true profitability after all expenses. Both give important insights but serve different purposes.

Use this knowledge to make smarter decisions and keep growing your business steadily.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits