What is a Good Net Profit Margin? The 2026 Benchmarks

Net profit margin is one of the few metrics that tells the truth about a business.

Revenue can be inflated.

Gross margin can look healthy.

Cash flow can hide timing issues.

But net profit margin answers a single, unavoidable question:

After everything is paid, how much money do you actually keep?

This guide breaks down what net profit margin is, what “good” looks like by industry and ecommerce model, what actually affects it, and how to improve and track it in a practical way.

In this blog:

What Is Net Profit Margin?

Net profit margin is a profitability metric that measures how much of a business’s revenue remains as profit after all expenses are deducted.

It is calculated by dividing net profit by total revenue and multiplying by 100.

Net profit margin includes every cost involved in running a business, such as cost of goods sold, marketing and advertising expenses, operating costs, payment processing fees, refunds, taxes, and overhead.

Because it reflects the final amount of money a business actually keeps, net profit margin is widely used to evaluate overall financial performance and compare profitability across industries.

For instance, if you make $100,000 in revenue and keep $15,000 after all costs, your net profit margin is 15%.

That’s it.

What Is a Good Net Profit Margin?

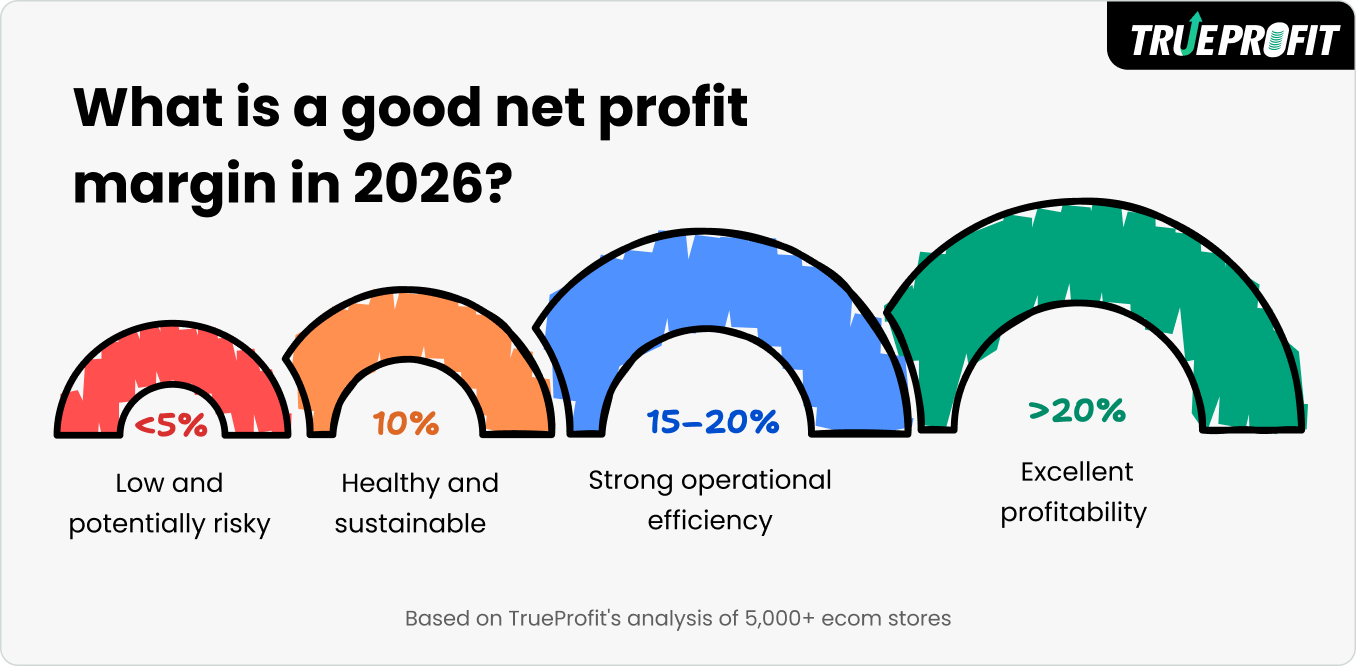

As a general benchmark across most businesses, a good net profit margin depends on your industry, cost structure, and business model rather than a single universal number. In practice, net profit margins typically fall in the range as below:

- Below 5% → Low and potentially risky

- Around 10% → Healthy and sustainable

- 15–20% → Strong operational efficiency

- 20% or higher → Excellent profitability

These benchmarks provide useful guidance, but they are only meaningful when compared against the right industry standards and business model.

1. Good Net Profit Margin by Industry

The table below shows typical gross and net profit margin ranges by industry, based on aggregated industry data, ecommerce-focused analysis, and benchmarks from TrueProfit’s internal data and the NYU report.

Industry | Avg. Gross Margin | Avg. Net Profit Margin | Notes |

|---|---|---|---|

Ecommerce | 60–70% | 15–25% | Depends heavily on ads & ops |

Software & Internet (SaaS, Platforms) | 70–85% | 20–30% | Asset-light, scales extremely well |

Advertising & Digital Services | 60–75% | 15–25% | High margins, SG&A sensitive |

Financial Services (Banking, Insurance, Asset Mgmt) | 55–70% | 15–25% | Low COGS, stable profits |

Healthcare (Pharma, Biotech, MedTech) | 55–75% | 10–20% | R&D eats into net margin |

Business Services (Non-capital-intensive) | 45–60% | 8–15% | Stable, moderate scale |

Retail (General & Specialty) | 30–45% | 2–6% | High volume, thin margins |

Apparel & Footwear (incl. ecommerce) | 45–55% | 3–8% | Ads + returns are margin killers |

Consumer Goods / FMCG | 35–50% | 5–10% | Brand power matters |

Manufacturing & Industrial | 20–40% | 4–8% | Capital-heavy |

Automotive | 15–25% | 3–6% | Scale ≠ profit |

Energy (Oil, Gas, Utilities) | 25–45% | 5–10% | Strong cycles |

Transportation & Logistics | 20–35% | 2–5% | Extremely cost-sensitive |

Key insights:

- Asset-light industries consistently achieve higher net profit margins, while capital- and logistics-heavy businesses (retail, manufacturing, transportation) operate on structurally thinner margins.

- Ecommerce margins are highly execution-dependent, with net profit largely determined by advertising efficiency, fulfillment costs, and operational discipline rather than revenue size.

- Brand strength plays a major role in net profitability, as industries with strong pricing power and repeat demand convert a larger share of revenue into profit.

2. Good Net Profit Margin in Ecommerce

Ecommerce deserves its own breakdown because how you make money matters more than how much revenue you generate. Two stores can earn the same revenue and end up with completely different profit outcomes simply because they operate under different ecommerce models.

Based on TrueProfit’s internal analysis of thousands of ecommerce stores, the table below shows realistic net profit margin benchmarks across common ecommerce business models.

Ecommerce Models | Good Net Profit Margin |

|---|---|

Ecommerce (overall) | |

Dropshipping | |

Self-produced / Private label | 13–33% |

Print on Demand (POD) |

Key insights:

- Dropshipping tends to sit in the middle due to higher ongoing ad and fulfillment costs, while self-produced and private-label brands can achieve higher margins through better control over pricing and production.

- Print-on-demand often shows the highest margins because it minimizes inventory risk and supports premium pricing through branding and content.

Factors That Affect Net Profit Margin

Net profit margin is rarely affected by one big decision. In most businesses, it’s shaped by a series of small, compounding factors across pricing, costs, and execution.

1. Pricing Power Matters More Than Volume

Net profit margin improves when a business can charge prices that reflect the value it delivers, not just the cost of staying competitive. Businesses with weak pricing power often rely on volume to grow, but higher volume usually comes with higher costs and thinner margins.

In contrast, even a small increase in price can dramatically improve net profit when costs stay relatively stable. This is why many profitable businesses focus on pricing strategy long before chasing scale.

2. Costs That Grow Every Time You Make a Sale

Some costs increase automatically with each transaction, project, or customer served. When these costs rise faster than revenue, net profit margin shrinks even though sales look healthy.

This is a common reason businesses feel busier but less profitable as they grow. Sustainable margins depend on making sure each additional sale contributes more profit, not less.

3. Fixed Expenses Quietly Set Your Profit Ceiling

Expenses like salaries, rent, and long-term software subscriptions don’t change daily, but they define how much profit a business can realistically keep.

When fixed costs expand faster than revenue, net profit margin becomes permanently constrained. Many businesses only realize this after growth slows and those costs are already locked in.

4. Small Percentage Costs Add Up Faster Than You Think

Minor costs often feel harmless because they appear as small percentages. Over time, they compound and eat directly into net profit.

A few percentage points lost across multiple cost categories can turn an apparently profitable business into one that struggles to retain cash, even with strong revenue.

5. Taxes and Financing Shape the Final Profit Number

Net profit margin reflects what remains after everything is paid including taxes and interest. Financing decisions, loan structures, and tax obligations can significantly change net profit without affecting daily operations. This is why two businesses with similar revenue and expenses can end up with very different profit margins.

How to Improve Net Profit Margin

Increasing net profit margin is about making smarter decisions with the revenue you already have, not just pushing harder to grow sales.

Here are the tips:

1. Fix Pricing Before Chasing Growth

The fastest way to improve net profit margin is often adjusting pricing, not increasing sales volume. When prices are too low, every new sale adds work without adding enough profit. Even small pricing changes can significantly improve margins, especially when most costs stay relatively stable.

2. Increase Profit per Sale, Not Just Revenue

Revenue growth only helps net profit when each sale contributes more than it costs to deliver. Businesses improve margins by focusing on contribution per sale whether that means better cost control, higher-value customers, or more efficient delivery instead of celebrating top-line growth alone.

3. Reduce Cost Leakage and Operational Friction

Net profit margin is often lost through small, repeated inefficiencies rather than one big mistake. Unnecessary fees, manual work, process complexity, and minor waste add up over time. Removing friction usually improves margins without harming customer experience or growth.

4. Make Decisions Based on Net Profit Visibility

Sustainable margin improvement requires clear visibility into what the business actually keeps after all costs. Revenue can rise while profit disappears. Businesses that consistently increase net profit margin use profit data to guide pricing, spending, and growth decisions — not revenue signals.

Keeping Track of Net Profit Margin is Non-negotiable

In short, net profit margin is one of the most honest indicators of a business’s financial health. It shows not just how much money comes in, but how much actually stays after all costs are paid. As this guide has shown, net profit margin is shaped by pricing decisions, cost structure, operational efficiency, and financial visibility and improving it usually comes from clarity and discipline, not shortcuts or aggressive scaling.

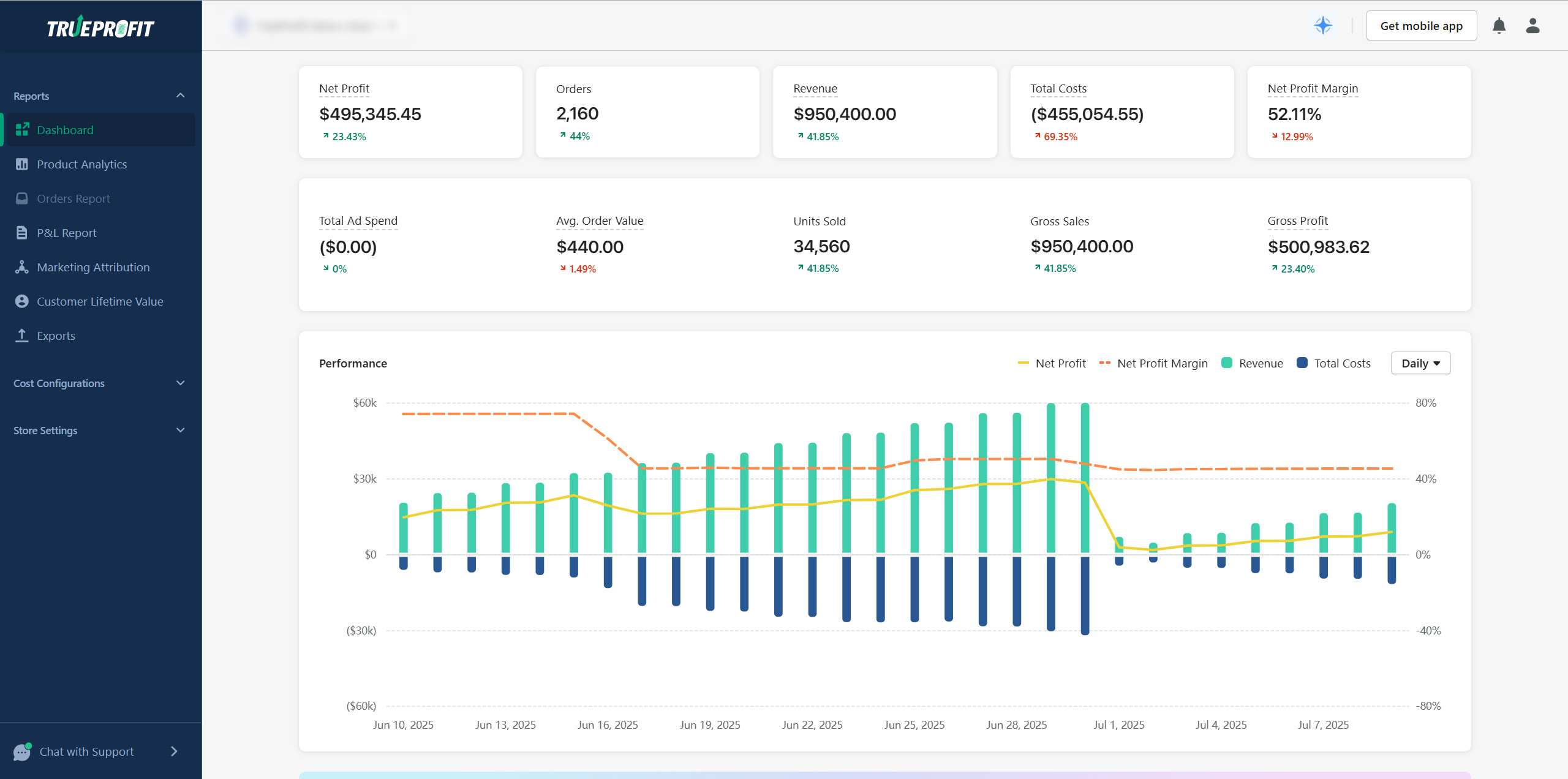

The challenge for many ecommerce sellers isn’t understanding that profit matters, it’s tracking it accurately as the business grows. When costs are spread across ads, payment fees, apps, refunds, and fulfillment, relying on spreadsheets or surface-level metrics makes it easy to miss where profit is leaking.

That’s where TrueProfit fits naturally into the picture. TrueProfit gives ecommerce sellers real-time visibility into net profit by automatically tracking revenue and all associated costs in one place. Instead of guessing whether growth is healthy, sellers can see exactly how each product, campaign, or day impacts their bottom line and make decisions with confidence.

In the end, growing a sustainable ecommerce business isn’t about chasing revenue numbers. It’s about understanding your net profit margin — and having the right tools to protect and improve it as you scale.

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.

Shopify profits

Shopify profits