How to Create a Profit and Loss Statement 2026: Step-by-Step Guide

A Profit and Loss (P&L) Statement helps you understand whether your business is making money or losing it. This guide will walk you through how to make a simple profit and loss statement, especially if you're an e-commerce merchant looking for an actionable approach.

In this blog:

What Is a Profit and Loss Statement?

A Profit and Loss Statement (also called an Income Statement) is a financial report that summarizes your revenues, costs, and expenses over a specific time period - usually monthly, quarterly, or annually.

It shows:

- Revenue: How much money your business made

- COGS (Cost of Goods Sold): The direct costs to produce and ship products

- Operating Expenses: Ongoing business costs like marketing, tools, salaries

- Net Profit or Loss: What’s left after all expenses

For e-commerce businesses, a P&L gives you a clear picture of your financial health and helps with budgeting, pricing, and growth planning.

What You Need Before You Start

Before creating a P&L statement, gather the following:

- Sales revenue: From your Shopify dashboard or other platforms

- COGS: Product costs, shipping, packaging

- Marketing spend: Facebook, TikTok, Google Ads, influencer payouts

- Operating expenses: Subscriptions (Shopify apps, tools), salaries, freelancers

- Other income or expenses: Refunds, chargebacks, or interest earned

How to Make a Profit and Loss Statement

Step 1: Calculate Your Net Revenue

Start by identifying your gross revenue. This is the total amount of money generated from product sales, before deductions. This figure reflects your actual income from sales and sets the foundation for your profitability analysis. Next, subtract:

- Product returns and refunds

- Payment gateway fees (Shopify, PayPal, Stripe, etc.)

- Canceled orders or chargebacks

Step 2: Calculate Your Gross Profit (by Subtracting COGS)

Gross profit shows how much you're making after covering product-related costs, but before operating expenses. To get that number, you need to know your cost of goods sold (COGS) - including all direct costs involved in delivering your products to customers. For e-commerce, this typically covers:

- Product sourcing or wholesale cost

- Fulfillment and shipping expenses

- Packaging materials (branded boxes, fillers, inserts)

- Any customs duties or import taxes

Step 3: Calculate Your Operating Profit (by Subtracting Operating Expenses)

This gives you a clear picture of your business health after day-to-day costs are covered. To get this number, you need your operating expenses to be the recurring costs needed to keep your business running. Be as specific as possible here:

- Advertising spend (Meta, TikTok, Google Ads, influencers)

- Shopify and third-party app subscriptions

- Staff costs (VAs, freelancers, customer service teams)

- Email marketing tools, CRM, analytics software

- Office supplies, phone bills, or any home-office allocations

Step 4: Include Other Income and Expenses

Not all income and costs are part of your core operations, but they still affect your bottom line. You may need to factor in:

- Bank interest or income from side services

- Business loan repayments or interest charges

- Currency conversion losses/gains

- Government grants or tax credits

Including these gives a more complete view of your financial performance.

Step 5: Determine Your Net Profit or Loss

Once you’ve factored in everything above, calculate your final net profit. This is the most critical number for any business. It tells you whether your business is financially healthy - not just generating sales, but actually keeping profit after all costs are paid.

Profit and Loss Statement Example for E-Commerce

Category | Amount |

Revenue | $50,000 |

COGS | $20,000 |

Gross Profit | $30,000 |

Marketing Spend | $8,000 |

App Subscriptions | $500 |

Freelancer Costs | $1,000 |

Operating Expenses | $9,500 |

Operating Profit | $20,500 |

Other Expenses | $500 |

Net Profit | $20,000 |

Common Mistakes to Avoid When Setting Up Your PnL

Forgetting to subtract refunds and returns

Your revenue should reflect what you actually keep, not just what you sell. Neglecting to remove returns can inflate your profitability and give a false sense of success.

Overlooking hidden platform fees

Payment processors (like PayPal or Stripe) and e-commerce platforms (like Shopify) charge fees that eat into your profits. These can add up fast — make sure they’re always accounted for in your expenses.

Mixing personal and business expenses

If you're buying ads, subscriptions, or supplies on a personal card, you're risking inaccurate reporting. Keep your finances clean by using dedicated business accounts.

Not updating your COGS regularly

Prices change — especially if you're running promos, changing suppliers, receiving new tariffs or testing new product variants. Outdated COGS data can lead to incorrect gross profit and bad decision-making.

Ignoring your marketing spend

Ad spend is often your biggest variable cost in e-commerce. Whether you’re running Facebook Ads, TikToks, or influencer campaigns, these need to be tracked consistently to understand what’s truly working.

Skipping smaller recurring costs

Subscriptions to apps, tools, or SaaS services may seem minor individually, but they add up. Forgetting to include them can lead to underestimating your operating costs.

Focusing only on revenue, not profitability

Many merchants obsess over sales numbers but don’t track margins. A high-revenue store that’s not profitable is just burning cash. Always prioritize net profit tracking.

Best Tool to Automate Your P&L

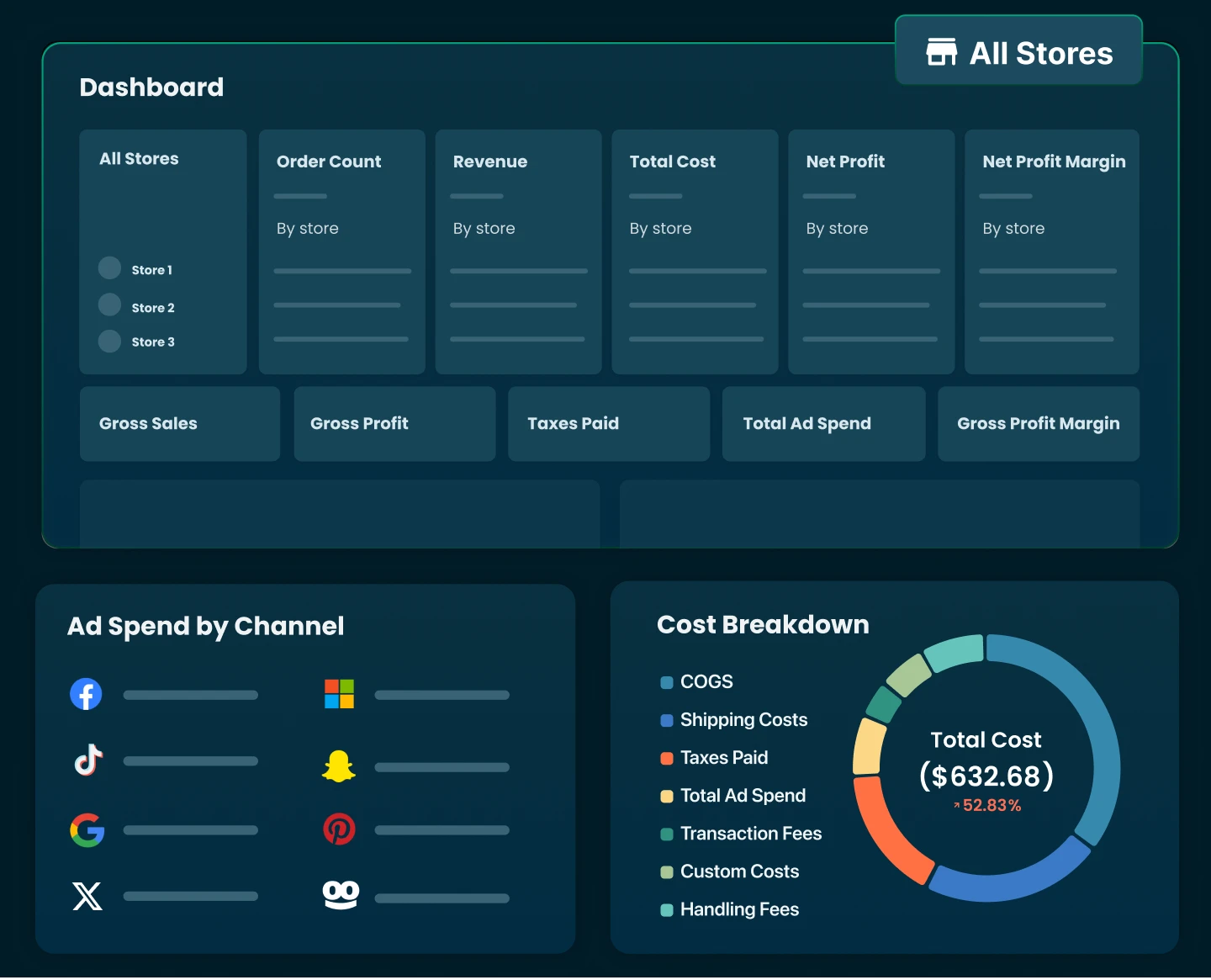

Creating a P&L manually is time-consuming and easy to mess up. Keeping your P&L updated, accurate, and actionable is where many e-commerce merchants struggle. That’s where TrueProfit comes in.

As a Net Profit Analytics platform built for Shopify merchants, TrueProfit delivers real-time, accurate, automated, profit-focused insights that go beyond vanity metrics. Instead of juggling spreadsheets, you get a clear view of your true profits - so you can track what matters and make decisions with confidence.

Tracy is a senior content executive at TrueProfit – specializing in helping eCommerce businesses scale profitably through content. She has over 4 years of experience in eCommerce and digital marketing editorial writing. She develops high-impact content that helps thousands of Shopify merchants make data-driven, profit-focused decisions.

Shopify profits

Shopify profits