Profit vs. Cash Flow: Key Differences Explained (With Examples)

Profit and cash flow are two key financial metrics, but they measure different things. Profit shows how much money a business makes after expenses, while cash flow tracks the actual movement of money in and out of the business.

Understanding both is crucial for business success. Profit tells you if your business is making money, but cash flow reveals if you have enough money to cover daily expenses.

In short: Profit is about earnings, and cash flow is about liquidity. Both matter, but they play different roles in keeping your business running smoothly.

In this blog:

Profit vs. Cash Flow: Key Differences

What is Profit?

Profit is the money left over after a business pays for all its expenses.

Profit shows the overall financial health of a company over a period, usually a quarter or year.

There are different types of profit that businesses track to understand their financial health:

- Gross Profit: This is the revenue minus the cost of goods sold (COGS). It shows how much money is made after covering the direct costs of producing or purchasing goods.

- Operating Profit: Also known as EBIT (Earnings Before Interest and Taxes), this shows the profit after covering both direct and indirect costs but before paying interest and taxes.

- Net Profit: The final profit after all expenses, including operating costs, interest, taxes, and any other costs, have been deducted from revenue.

For example, if a business earns $100,000 in revenue and has $70,000 in expenses, its profit is $30,000.

What is Cash Flow?

Cash flow is the movement of cash in and out of a business over time.

Cash flow focuses on liquidity, meaning whether there’s enough cash available to pay bills and run daily operations.

For instance, a company might report a profit of $50,000, but if it hasn’t received payment from customers yet, its cash flow could be negative.

Key Differences Between Profit and Cash Flow

Profit and cash flow are both important, but they measure different things.

Aspect | Profit | Cash Flow |

|---|---|---|

Definition | Surplus after expenses | Movement of cash in/out |

Focus | Long-term profitability | Short-term liquidity |

Calculation | Revenue - Expenses | Cash in - Cash out |

Impact | Reflects overall financial health | Reflects business’s operations health |

Timing | Reported at the end of a financial period (like monthly or quarterly PnL) | Happens continuously. |

For example, a business might report a profit of $50,000 but struggle with cash flow if customers are slow to pay. This delay can affect the company’s ability to pay suppliers or employees on time.

Why Both Profit and Cash Flow Matter for Your Business

Both profit and cash flow are critical for business success.

Profit is needed for long-term growth. It shows your business can make more money than it spends.

Cash flow is needed for day-to-day operations. It ensures you can pay bills, employees, and suppliers on time.

Imagine this, a company might show a profit on paper but struggle to pay suppliers if customers are slow to pay. Without enough cash flow, operations can stall even if the business is technically profitable.

Profit vs cash flow — both matter, but in different ways. Profit shows you’re making money on paper. Cash flow shows whether you can actually pay your bills. The biggest key learning? A business can be profitable and still run out of cash. That’s why tracking both is non-negotiable.

If this made you rethink how you’re watching your numbers, good. That’s a solid start. Keep going. Look at your numbers closely. Make decisions based on both profit and cash flow. You’ll stay sharper, steadier — and more in control.

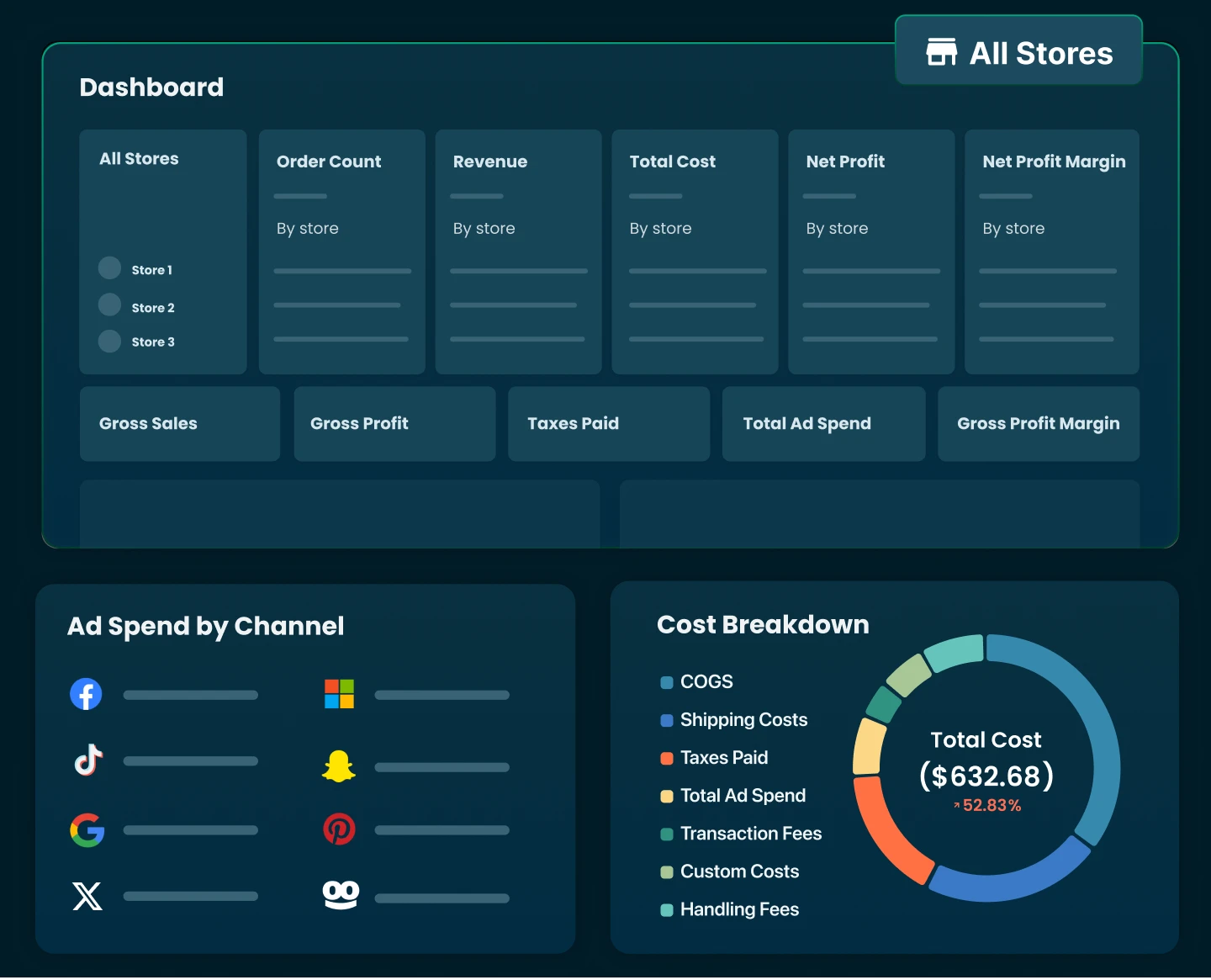

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits