P&L vs Income Statement: Differences Explained in 2 Minutes

A P&L (Profit and Loss) statement is the same thing as an income statement. These two terms are used interchangeably and refer to the same financial report that shows your business’s revenues, expenses, and profits over time.

Now that we’ve cleared that up, here’s where it gets more valuable: knowing what a P&L shows, how to read it, and how it compares to other financial statements like the balance sheet or cash flow report can help you make smarter, more confident business decisions.

In this blog:

What Does a P&L (or Income Statement) Show?

The P&L (or income statement) shows your bottom-line profitability. It helps answer one simple question: Am I making or losing money?

Nevertheless, here’s what a PnL report typically included:

- Revenue (all your sales income)

- Cost of Goods Sold (COGS) – what it costs to produce or purchase the products you sell

- Operating Expenses – ads, software, salaries, rent, shipping, fulfillment, etc.

- Net Profit (or Loss) – what’s left after expenses.

This report gives you a clear view of your financial performance over time whether it’s for a week, a month, or a full year.

Without it, you may feel like you’re doing well because revenue is up but your profit could be vanishing due to rising costs or hidden fees. To learn more, check out our article on p&l meaning and its impacts on e-commerce businesses.

Key Differences Between P&L vs. Other Financial Statements

While the P&L (income statement) is essential, it’s just one piece of your financial puzzle. Here’s how it compares to other major financial reports:

1. P&L vs. Income Statement

As mentioned earlier, a P&L (Profit & Loss) statement is the same as an income statement. However, the key isn't what you call it, but how you use it.

Example

Your income statement/P&L shows your revenue, costs, and net profit or loss over a specific period; typically monthly, quarterly, or annually. For example, if your Shopify store brought in $30,000 in March but had $20,000 in expenses, your P&L would show a $10,000 profit for the month.

Why do you need a P&L (Income Statement)?

For eCommerce businesses, your profit and loss statement is like a health check-up for your store. Reviewing it monthly isn’t just good practice, it’s your early warning system.

If your revenue is growing but your profit margins are shrinking, a regular P&L review helps you spot this before it becomes a bigger issue. Maybe your ad spend on Meta or TikTok is eating into your profits, or a top-selling product suddenly has higher fulfillment costs. Without a monthly check-in, those hidden leaks go unnoticed until you’re operating at a loss.

Your P&L also reveals the real impact of promotions, discounts, influencer collaborations, and shipping upgrades - all things that feel like good ideas but can quietly drag down your profitability. In short, this report turns your gut feeling into data-backed decisions.

For deeper analysis of company finances and investment potential, professionals like an equity research analyst often rely on P&L data to evaluate profitability trends and make informed recommendation

2. P&L vs. Balance Sheet

While the P&L shows performance over time, the balance sheet shows your financial position at a single moment.

Example:

Let’s say it’s April 30. Your balance sheet might show:

- Assets: $50,000 in inventory and cash

- Liabilities: $20,000 in outstanding payments

- Equity: $30,000

This is your business’s net worth on that day. Meanwhile, your P&L shows whether your business earned or lost money during April.

Why do you need both a P&L and a Balance Sheet?

Your P&L may show a profit, but your balance sheet reveals whether that profit is supporting your business’s financial health.

Here’s a common scenario for eCommerce merchants: You’ve had a great quarter in sales, your P&L shows a strong profit, but your balance sheet shows you’re cash-poor. Why? Maybe thousands of dollars are stuck in unpaid invoices from B2B buyers or wholesale clients. Or your liabilities (e.g. loans, inventory financing, or deferred vendor payments) are outpacing your assets.

Your balance sheet helps you zoom out and ask: "Am I building something sustainable, or am I one cash crunch away from a problem?"

Together, the P&L and balance sheet give you both perspective and precision. One shows how well you’re running the store. The other shows whether your store can keep running.

3. P&L vs. Cash Flow Statement

Here’s where confusion often happens: your P&L might show you made money, but your bank account says otherwise. That’s because the P&L is based on accrual accounting — it records income when it's earned, not necessarily when cash is received. The cash flow statement, on the other hand, tracks actual money moving in and out.

Example:

- You sell $10,000 worth of goods in April (recorded as income in your P&L).

- But your customer pays in May.

- Your cash flow statement for April shows no incoming cash.

Why do you need both P&L and Cash Flow Statement?

Many merchants make the mistake of thinking profit equals financial stability. But if you’ve ever had to front-load inventory costs, spend thousands on ads before seeing a return, or wait weeks to get paid by payment processors - you know that cash is king.

The P&L might show your business is thriving on paper, but a cash flow statement reveals if you’re actually able to cover your expenses right now. This is especially critical for dropshippers, subscription brands, and stores with pre-orders or net payment terms.

Using both reports helps you avoid sleepless nights, missed vendor payments, and last-minute cash scrambles. It allows you to plan ahead, protect your operations, and reinvest with confidence.

To sum up, understanding your P&L, balance sheet, and cash flow statement isn't just for accountants — it's essential for making smarter, faster business decisions. When used together, these reports reveal not just where your profits come from, but whether your store is financially sustainable.

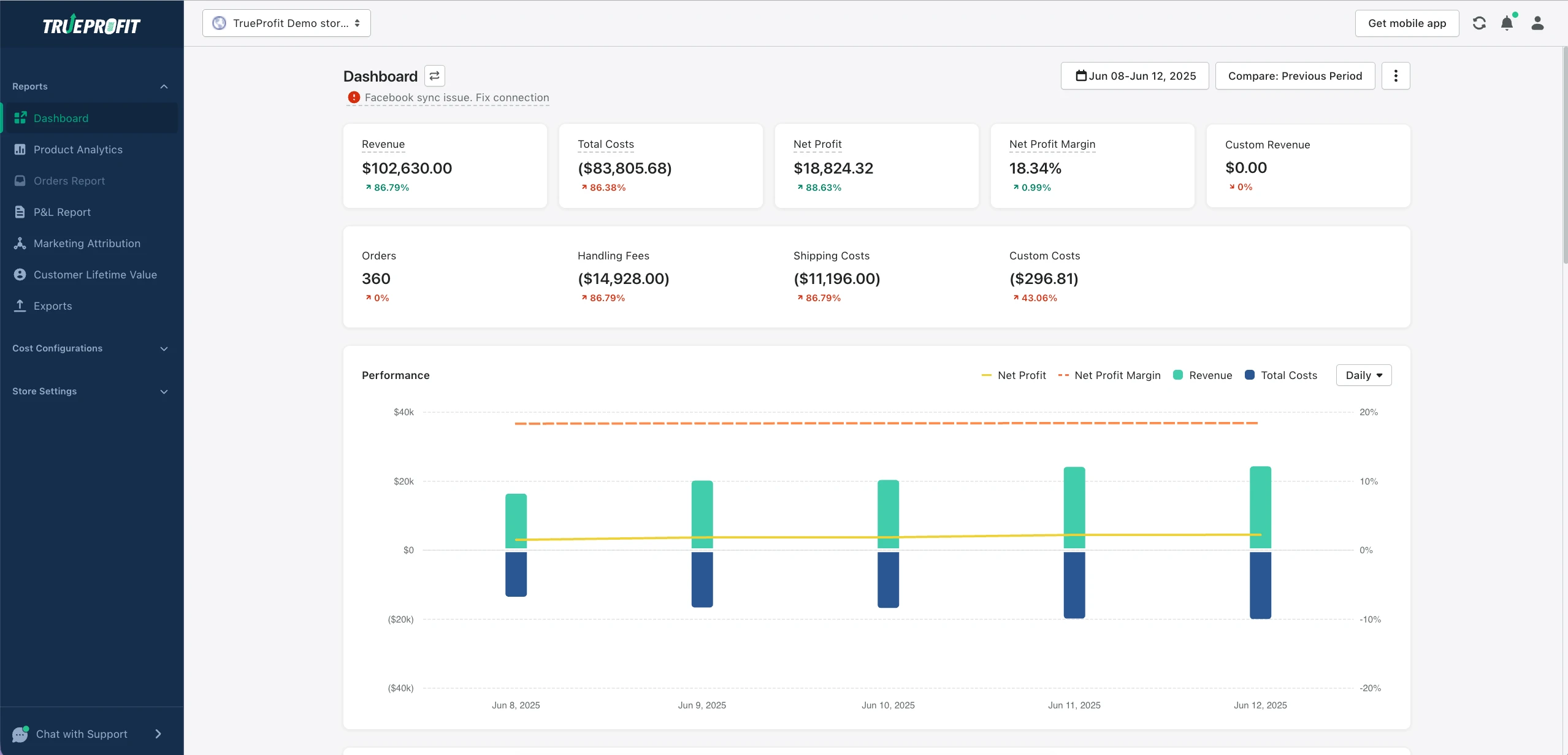

If you’re tired of spreadsheets and guesswork, profit tracker apps like TrueProfit to automate everything from real-time revenue tracking to cost breakdowns so you can focus on growing, not calculating.

Tracy is a senior content executive at TrueProfit – specializing in helping eCommerce businesses scale profitably through content. She has over 4 years of experience in eCommerce and digital marketing editorial writing. She develops high-impact content that helps thousands of Shopify merchants make data-driven, profit-focused decisions.

Shopify profits

Shopify profits