What Is a Good Profit Margin for Retail in 2026? Benchmarks & Insights

Profit margin tells you how much money your retail business actually keeps, not just how much it sells.

In 2026, with rising costs and tighter competition, knowing what a good retail profit margin looks like is more important than ever.

This guide breaks down the benchmarks and what they mean for your business.

In this blog:

What is Profit Margin for Retail?

Profit margin is a financial metric that shows how much profit a retail business keeps from each dollar of sales after covering costs such as inventory, operating expenses, fees, and taxes.

It’s usually expressed as a percentage and helps retailers understand whether their store is truly profitable or simply generating revenue.

Because retail businesses often operate on thin margins and high sales volume, tracking profit margin is essential for pricing products correctly, controlling costs, and making sustainable growth decisions.

The Different Types of Profit Margins Retailers Track

Retail businesses typically track three main types of profit margin. Each one answers a different question about your business, from product pricing to overall profitability.

1. Gross Profit Margin

Gross profit margin shows how much revenue remains after subtracting the cost of goods sold (COGS). For retail businesses, COGS usually includes product sourcing or manufacturing costs, wholesale prices, and sometimes includes shipping.

This margin focuses purely on product-level profitability, before any operating expenses are considered.

Retailers usually use gross profit margin to evaluate pricing strategy, compare products, and decide which items are worth stocking or scaling. A healthy gross margin means your products are priced high enough to cover operating costs and still leave room for profit.

The formula of gross profit margin is as follows:

If you sell a product for $100 and the product costs you $60 to source:

Then gross profit = $40

And gross profit margin = ($40 ÷ $100) × 100 = 40%

2. Operating Profit Margin

Operating profit margin shows how much profit remains after subtracting operating expenses from gross profit. For retail businesses, operating expenses typically include rent, salaries, utilities, marketing, software, and other day-to-day costs required to run the store.

This margin reflects how efficiently your retail business operates, before accounting for taxes and interest.

Retailers use operating profit margin to assess whether their business model is sustainable and to identify inefficiencies in overhead, staffing, or marketing spend.

The formula of operating profit margin is:

If your store generates $100,000 in revenue, has $60,000 in COGS, and $30,000 in operating expenses:

- Operating profit = $10,000

- Operating profit margin = ($10,000 ÷ $100,000) × 100 = 10%

3. Net Profit Margin (Bottom Line)

Net profit margin is the bottom line. It shows how much profit remains after all expenses are deducted, including COGS, operating costs, transaction fees, taxes, interest, and other non-operating expenses.

This margin represents the true profitability of a retail business.

Retailers use net profit margin to evaluate overall business performance, long-term sustainability, and whether the business is actually making money, not just generating sales.

The formula is as follows:

If your retail business earns $100,000 in revenue and ends with $5,000 in net profit after all expenses:

Then Net profit margin = ($5,000 ÷ $100,000) × 100 = 5%

What a Healthy Retail Profit Margin Looks Like in 2026

In 2026, a healthy retail profit margin isn’t defined by a single number, it’s shaped by industry economics and business model structure.

While gross margins often sit in the 30–50% range and net margins typically fall between 2–10%, these averages can vary widely depending on what you sell and how you sell it.

Looking across retail industries, some sectors consistently retain more profit because their gross margin survives operating costs, while others see margins compressed by price competition and high overhead.

The same pattern holds across business models: ecommerce, brick-and-mortar, and omnichannel retailers all operate with very different cost dynamics, which directly impacts how much revenue ultimately turns into net profit.

1. Profit Margin Benchmarks Across Retail Industries

According to NYU Stern with data as of January 2026, combined with TrueProfit’s analysis, the average profit margin benchmarks for retail industries are as follows:

Retail sector | Gross profit margin | Operating profit margin | Net profit margin |

|---|---|---|---|

Retail Grocery & Food | ~25.1% | ~3.1% | ~1.9% |

Retail Building Supply | ~34.9% | ~10.2% | ~7.8% |

Retail Online | ~42.0% | ~8.5% | ~6.0% |

Retail Specialty | ~38.5% | ~9.1% | ~6.6% |

Retail Automotive | ~21.2% | ~4.6% | ~3.0% |

Retail Ecommerce | ~65% | ~32% | ~15% |

Key insights:

- Retail Ecommerce, Building Supply, Specialty, and Online retail show the strongest net margins because more of their gross profit survives operating costs (higher average order value, better product mix, and less price-led competition).

- Grocery & Food retail operates on extremely thin net margins, as intense price competition and high labor, logistics, and shrink costs consume most of the gross margin.

- Automotive retail generates large ticket sales but retains relatively low net margins due to heavy discounting, inventory carrying costs, and operating expenses below the gross margin line.

2. How Profit Margins Differ Across Retail Business Models

Retail profit margins vary widely depending on the business model, mainly because each model carries a very different cost structure. Rent, labor, inventory risk, marketing spend, and fulfillment costs all compound differently across channels, directly shaping gross, operating, and net margins.

Business model | Avg. gross margin | Avg. operating margin | Avg. net margin |

|---|---|---|---|

Brick-and-mortar retail | ~50% | ~10% | ~3% |

Ecommerce retail | ~65% | ~30% | ~15% |

Omnichannel retail | ~55% | ~10% | ~8% |

What these benchmarks reveal:

- Brick-and-mortar retailers often achieve solid gross margins, but high fixed costs (rent, in-store staff, utilities) significantly compress operating and net profit.

- Ecommerce retailers typically enjoy higher gross margins due to direct-to-consumer pricing and fewer physical overheads, allowing more room to absorb marketing and fulfillment costs while still maintaining stronger net margins.

- Omnichannel retailers sit in the middle—benefiting from diversified revenue streams, but carrying both physical and digital cost structures, which limits operating leverage compared to pure ecommerce.

What Factor Really Affects Retail Profit Margins?

Retail profit margins aren’t determined by pricing alone. They’re the result of several structural and strategic factors working together, many of which are harder to change than most retailers realize.

1. Industry economics set your margin ceiling

Every retail industry operates within a margin range shaped by supply chains, competition, and customer expectations. For example, beverage retailers often sustain high gross margins (60%+), while grocery stores run on thin margins due to commoditized products, price-sensitive customers, and intense competition. Understanding your industry’s baseline helps set realistic profit targets.

2. Your business model determines cost flexibility

What you sell and how you sell it matters as much as price. Niche, branded, or premium products typically support higher margins because they’re harder to compare directly. Mass-market or undifferentiated products face constant price pressure, leaving little room for margin expansion.

3. Pricing strategy shapes margin durability

Premium pricing can increase margins, but only when backed by perceived value (brand, quality, experience). Competing primarily on price may drive volume, but it often compresses margins and increases dependency on scale to stay profitable.

4. Cost control defines how much profit you keep

Margins are won or lost on the cost side. Inventory inefficiencies, supplier terms, fulfillment costs, and operational overhead quietly erode profits over time. Retailers with tight cost controls can outperform competitors even at similar price points.

5. Market saturation limits pricing power

Location and competitive density directly affect how much you can charge. In crowded or highly competitive markets, retailers often sacrifice margin to maintain volume, making differentiation and cost discipline even more critical.

How Successful Retailers Protect and Grow Their Profit Margins

Improving your retail profit margin doesn’t require drastic changes, just smart adjustments. These strategies can help:

1. Pricing Strategies: Optimize your pricing to maximize margins. Consider premium pricing for unique products or dynamic pricing to adjust for demand.

2. Negotiate with Suppliers: Better deals with suppliers can lower your COGS. Focus on bulk discounts or long-term contracts to reduce costs.

3. Efficient Inventory Management: Avoid overstock or stockouts. Keep inventory levels balanced to reduce waste and maintain cash flow.

4. Cost Cutting: Identify operational inefficiencies. Cut back on unnecessary overheads and supply chain costs to improve margins.

5. Increase Sales Volume: Enhance customer experience and marketing. More sales lead to better overall profitability, even with lower margins.

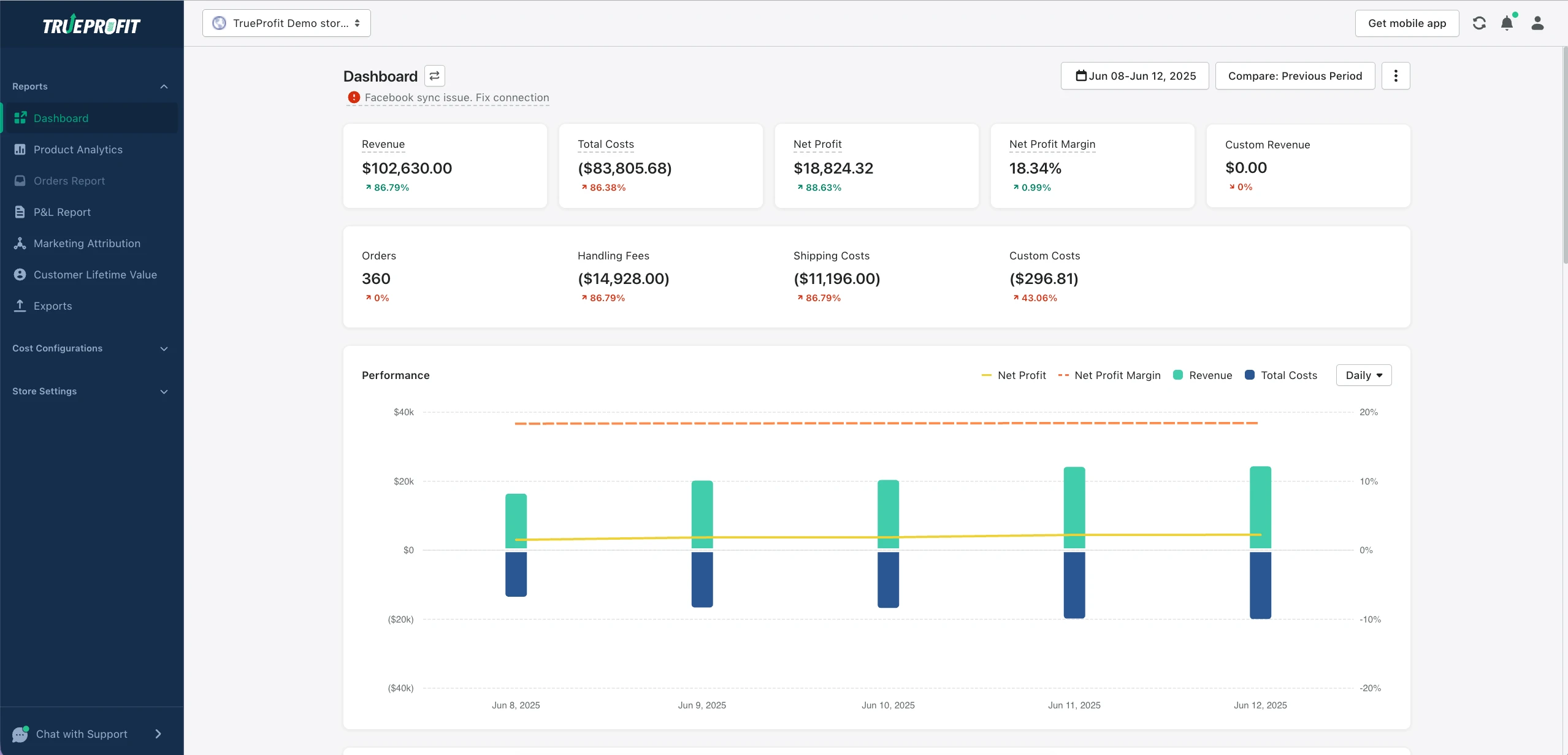

How to Track True Profitability of Your Retail Business

Retail profit margin isn’t about chasing a single “good” number, it’s about understanding how gross, operating, and net margins work together, and how your industry, business model, pricing strategy, and cost structure shape what’s realistically achievable.

As this guide shows, most retail businesses don’t struggle because margins are low by default, but because they lack visibility into where profit is created or quietly lost across products, channels, and expenses.

That’s why consistent, accurate profit tracking matters. For ecommerce businesses, especially Shopify stores. TrueProfit helps turn margin theory into real decisions by showing your true profit in real time, not just revenue.

Instead of telling you how much you sold, TrueProfit shows you how much you actually keep, in real time. Every cost from COGS, ad spend, fees, shipping, and overhead is reflected directly in your bottom line, so you always know whether you’re making or losing money.

That clarity turns margin theory into real decisions, helping Shopify businesses protect profitability, scale with discipline, and grow with confidence.

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.

Shopify profits

Shopify profits