2026 Ecommerce Profit Margins: Key Benchmarks Across Niches

Profit margins vary widely across ecommerce industries, and knowing the benchmarks can help you make smarter business decisions.

In this guide, we’ll break down profit margin by industry, showing how margins differ by niche and business model.

You’ll learn what “healthy” profitability looks like, how your store compares, and practical ways to increase profit margins in ecommerce without relying on revenue alone.

Let’s dive in!

In this blog:

What Is Profit Margin in Ecommerce? Gross vs Net Explained

In ecommerce, profit margin shows how efficiently your store turns revenue into profit. But this metric isn’t one-size-fits-all. To understand real profitability, business owners rely on two core profit metrics: gross profit margin and net profit margin each serving a different purpose.

1. Gross Profit Margin (Product-Level Profitability)

Gross profit margin measures how much profit you make after subtracting direct product costs from revenue.

For ecommerce business owners, this metric is crucial because it answers one key question:

Is this product worth selling at all?

Gross profit margin helps you:

- Identify products that can absorb ad costs and discounts

- Compare product pricing and supplier efficiency

- Filter out low-margin products before scaling traffic

However, gross profit margin does not include operating costs like advertising, payment processing fees, apps, refunds, or platform fees which means it can make a store look healthier than it really is.

2. Net Profit Margin (Business-Level Reality)

Net profit margin measures how much money your business actually keeps after all expenses are deducted, including ads, transaction fees, software tools, taxes, and overhead.

For ecommerce owners, this is the metric that reflects true business performance. It answers the most important question: Is my store actually making money?

Net profit margin helps you:

- Understand real profitability across the entire store

- Evaluate whether scaling will increase profit or just increase workload

- Make long-term decisions about growth, hiring, and reinvestment

While gross profit margin helps you evaluate products, net profit margin determines survival.

Many ecommerce stores scale quickly with strong gross margins, only to discover later that high ad costs and hidden fees have erased their profits.

That’s why experienced ecommerce sellers prioritize net profit margin since it captures the full financial picture and prevents revenue-driven but profit-poor growth.

Average Ecommerce Profit Margins in 2026

Ecommerce profit margin typically falls between 15% and 30% net profit, depending on your business model, niche, and operating costs.

Based on TrueProfit’s analysis of 5,000+ ecommerce stores from Jan 2025 to Jan 2026, most ecommerce businesses today maintain:

- Gross profit margins between 55% and 70%

- Net profit margins between 18% and 26%

However, profit margins vary significantly by ecommerce model and industry niche. That’s why comparing your store to the right benchmarks matters more than chasing a universal “ideal” margin.

1. Average Ecommerce Profit Margins by Business Type

This data reflects average net and gross profit margins across ecommerce business types, based on our analysis of 5,000 stores from January 2025 to January 2026.

Ecommerce Models | Average Net Profit Margin | Average Gross Profit Margin |

|---|---|---|

Ecommerce (overall) | 21.7% | 64.2% |

Dropshipping | 18.3% | 67.4% |

Self-produced / Private label | 23.9% | 62.8% |

Print on Demand (POD) | 26.6% | 65.1% |

From the table, we can see:

- Dropshipping stores show high gross margins, but net profit is lower due to rising advertising costs and limited control over fulfillment.

- Private label ecommerce businesses achieve higher net margins thanks to better pricing control and brand equity.

- Print-on-demand businesses have the highest average net profit margin, driven by low inventory risk and predictable costs.

2. Average Ecommerce Profit Margin by Niche

Using data from TrueProfit’s analysis (Jan 2025 - Jan 2026), we break down average net and gross profit margins of ecommerce stores by niche.

Niche | Average Net profit margin | Average Gross profit margin |

|---|---|---|

Animal & Pet supplies | 14.1% | 63.88% |

Apparel & Accessories | 20.2% | 62.78% |

Arts & Entertainment | 23.14% | 62.09% |

Baby Products | 16.21% | 62.81% |

Electronics | 19.15% | 58.93% |

Food & Beverages | 26.10% | 57.16% |

Furniture | 29.13% | 61.75% |

Health & Beauty | 22.45% | 69.27% |

Home & Garden | 22.57% | 62.55% |

Sports | 25.37% | 58.22% |

Toys & Games | 20.28% | 63.71% |

Vehicles | 24.12% | 56.85% |

While these numbers provide a helpful benchmark for understanding average ecommerce profit margins by niche, they do not define how profitable an individual business will be.

Differences in pricing, customer acquisition costs, fulfillment strategy, and overall operations can lead to significantly different outcomes, even within the same industry.

What Factors Affect Ecommerce Profit Margins?

Ecommerce profit margins are shaped by multiple moving parts, not just how much a product sells for. While gross profit margin reflects product-level profitability, net profit margin shows how efficiently the entire business operates.

In 2026, rising advertising costs, fulfillment expenses, and platform fees make margin management more critical than ever.

1. Product Costs and Cost of Goods Sold (COGS)

Product costs form the foundation of ecommerce profitability. This includes manufacturing or supplier costs, packaging, and inbound shipping. Businesses with private-label or self-produced items typically maintain healthier margins because they control sourcing and pricing more effectively. Even small increases in COGS can significantly impact net profit once sales volume scales.

2. Pricing Strategy and Average Order Value (AOV)

Pricing strategy directly affects how much profit is retained per order. Ecommerce businesses that compete solely on price often face shrinking margins, while brands that build perceived value through branding, bundling, or differentiation can sustain higher profit margins. Increasing average order value through upsells, cross-sells, or subscriptions often improves net profit more reliably than increasing traffic.

3. Advertising and Customer Acquisition Costs

Advertising is one of the largest expenses for ecommerce businesses in 2026. Rising CPMs on platforms like Facebook, Google, and TikTok have made customer acquisition more expensive, particularly for competitive niches. Stores that rely heavily on paid traffic without optimizing conversion rates or customer lifetime value often see net profit margins decline despite growing revenue.

4. Fulfillment, Shipping, and Return Costs

Fulfillment and logistics costs play a major role in determining ecommerce profitability. Shipping fees, third-party logistics services, customs duties, and return processing can quietly erode margins, especially for low-AOV or high-return products such as apparel. Businesses with efficient fulfillment systems and lower return rates tend to maintain stronger net margins.

5. Platform Fees and Software Expenses

Ecommerce platforms and software tools introduce recurring costs that directly impact net profit. These include payment processing fees, platform subscription fees, transaction fees, and third-party app costs. While each fee may seem minor on its own, combined they can take a significant percentage of revenue if not tracked and optimized regularly

6. Operational Efficiency and Cost Control

Operational efficiency determines how well an ecommerce business converts revenue into profit as it scales. Poor inventory planning, inefficient customer support workflows, and lack of expense visibility often lead to margin leakage over time. Businesses that closely monitor costs and make data-driven decisions are better positioned to protect profit margins in the long run.

How to Improve Your Ecommerce Profit Margins (+Examples)

Improving your profit margins isn’t about one big change, it’s about making small, smart moves across multiple areas of your business.

Here are the most impactful strategies to increase ecommerce profit margins in 2026:

1. Lower Your COGS

In eCommerce, COGS includes manufacturing, packaging, shipping from supplier to warehouse, and any import taxes or duties. It matters because your product cost can directly eat into every order’s margin.

Especially, for dropshippers and POD stores, supplier costs vary widely, negotiation or switching can unlock better deals. Here’s some lowering COGS tactics you can try:

- Negotiate with fulfillment partners: If you use 3PLs or dropshipping platforms like CJdropshipping or Zendrop, negotiate per-unit or volume shipping discounts.

- Use supplier marketplaces (Alibaba, 1688) to source alternate options.

- Redesign packaging to be lighter or smaller, which reduces shipping costs and returns from damaged goods.

Example: A skincare brand lowered their glass jar thickness slightly and saved 15% on international shipping.

2. Increase AOV (Average Order Value)

This is one of the fastest ways to grow your profit margins without spending more on ads. Your CAC is fixed per customer, so the more they spend, the higher your ROI per order. Hence, increasing AOV offsets fulfillment and transaction fees. Here are increasing AOV tactics that work:

- Pre-purchase upsells: Add “Complete the look” or “You might also like” sections on your product pages.

- In-cart offers: Free shipping thresholds ("Spend $50 more for free shipping") drive upsell behavior.

- Post-purchase upsells: Offer add-ons after the first purchase using one-click upsell apps like Zipify or ReConvert.

Example: A fashion brand introduced product bundles (top + bottom + accessory) and increased AOV by 22%.

3. Optimize Ad Spend

Ad costs are a profit killer - especially if you’re scaling aggressively without tracking true profitability. Platforms like Meta and TikTok charge you upfront. But you may not see profit until the second or third order. Moreover, many eCom stores are unprofitable at the first purchase. To optimize for ad spend, here’s what we would recommend:

- Track CAC vs. LTV in real time: Tools like TrueProfit help you know when you're scaling profitably.

- Use product-level ROAS: Instead of average ROAS, break it down by SKU so you know which products are eating margin.

- Retarget smarter: Set up segmented campaigns (e.g. loyal customers, abandoners, recent viewers) to improve ROAS and reduce CAC.

Example: A tech accessories store turned off campaigns for break-even SKUs and reallocated budget to their top 20% profit drivers, net margin increased 12% in 30 days.

4. Reduce Operational Waste

Every tool, integration, or manual workflow adds hidden costs - and most eComm brands are bloated with them. This matters because monthly app subscriptions and slow ops eat into profit quietly. Also, manual work often means higher payroll or lost time for your team. Here are where to look for operational waste:

- Subscription audits: Do you really need 3 different reporting tools? Cut overlaps.

- Streamline fulfillment: Use rules in apps like ShipStation or use Smart Order Routing in Shopify to reduce errors.

- Automate workflows: Automate review requests, abandoned cart emails, reporting, or P&L tracking to save time and reduce manual errors.

Example: An electronics DTC brand cut 5 tools, switched to a centralized ERP system, and saved $650/month plus 20+ hours/month in team time.

Insight: The most profitable brands aren’t necessarily the biggest, they’re the leanest. Ecommerce is won on margins, not just revenue.

Final Thoughts: Profitability Comes Down to Clarity

Ecommerce profit margins in 2026 vary widely by niche and business model, but the takeaway is simple: profitable stores are built on clear, accurate net profit data, not revenue alone. While gross margin helps validate products, net profit margin is what determines whether your business can scale sustainably after ads, fees, shipping, and operating costs.

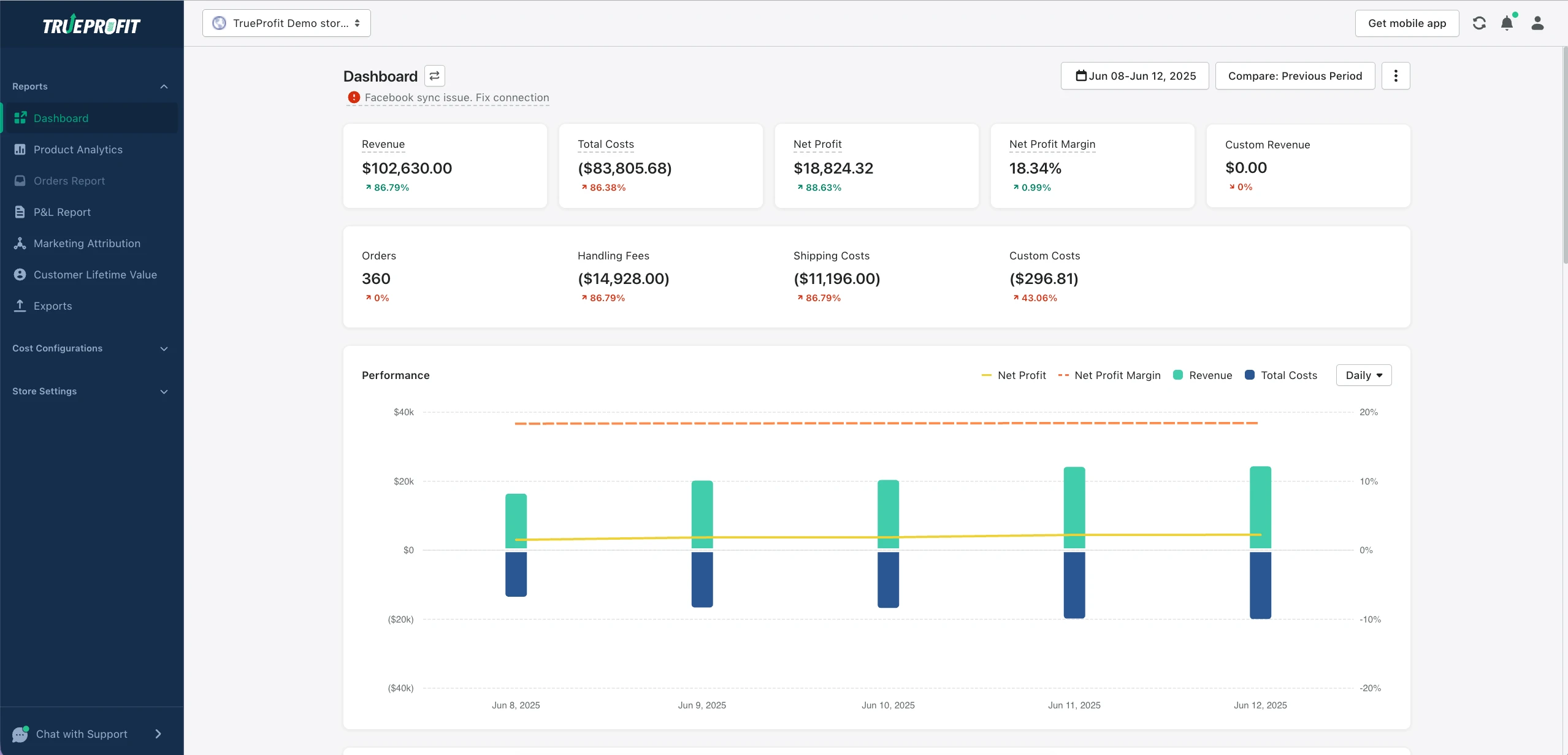

This is where TrueProfit fits naturally into a modern ecommerce stack. As a net profit analytics platform built for Shopify merchants, TrueProfit consolidates revenue, costs, products, and marketing performance into one unified dashboard showing real net profit storewide, by product, and by ad channel.

With real-time profit dashboards, automated cost tracking, product-level profitability insights, and full P&L reporting, sellers can finally see what’s truly driving (or draining) their margins.

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.

Shopify profits

Shopify profits