How COGS vs Operating Expenses Differ? (2026)

Cost of Goods Sold (COGS) refers to the direct costs incurred in producing or purchasing the products that a business sells during a specific period.

Operating expenses are the ongoing costs required to run the daily operations of a business. This cost is not directly tied to the production or purchase of goods sold.

Many store owners mix these up without realizing it, and that confusion can quietly chip away at your profit.

This guide will walk you through the 4 key differences between COGS and operating expenses, so you can see where your money is going and track your profit with confidence.

In this blog:

COGS vs Operating Expenses: Key Differences Breakdown

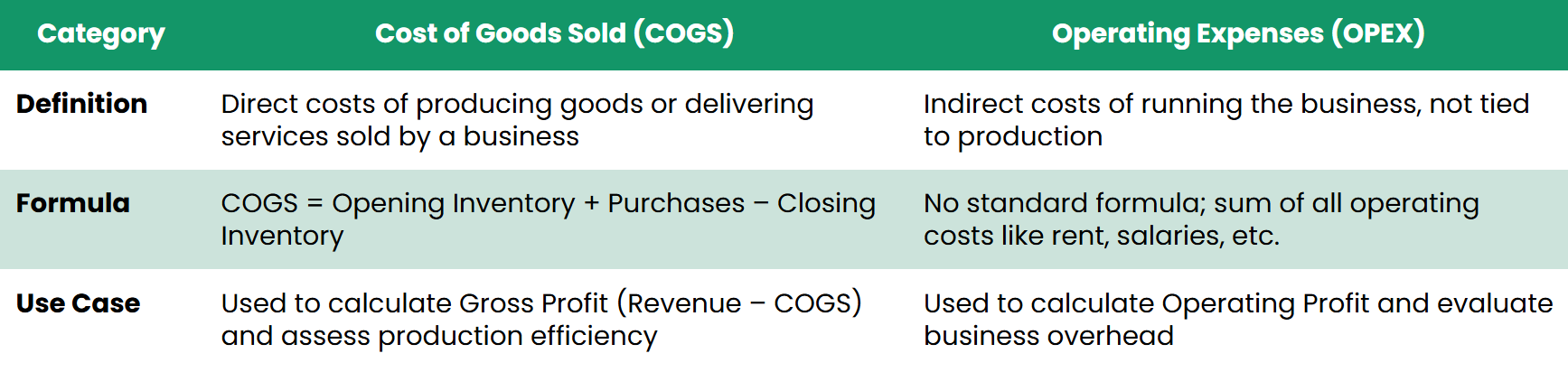

1. Defintion

Cost of Goods Sold (COGS) refers to all direct costs needed to manufacture products or acquire goods for resale. It measures the cost directly attributable to the goods that generate sales revenue during a period.

Operating Expenses are the ongoing indirect expenses required to operate a business, excluding the direct costs of producing or purchasing goods. They cover administrative, selling, and general business costs.

Simply put, COGS tracks direct product-related costs, while operating expenses track business operation costs not tied to production.

2. What Cost Included

Cost of Goods Sold (COGS) typically includes:

- Raw Materials and Inventory: The cost of materials used to create products, including any inventory purchased for resale.

- Direct Labor: Wages paid to employees who directly manufacture products or provide services. This includes factory workers, assembly line staff, and service technicians.

- Manufacturing Overhead: Factory-related expenses such as equipment depreciation, factory utilities, and production facility rent.

- Freight and Shipping Costs: Transportation costs to bring raw materials to your facility or finished goods to customers.

Operating Expenses include indirect, recurring costs such as:

- Selling Expenses: Costs related to marketing, advertising, sales commissions, and promotional activities.

- Administrative Expenses: Office rent, executive salaries, accounting fees, legal expenses, and general office supplies.

- General Business Expenses: Insurance, utilities for non-production facilities, professional services, and technology costs.

3. Example

Let’s see how COGS and operating expenses show up in examples.

Calculating Gross Profit

If your revenue is $50,000 and your cost of goods sold (COGS) is $20,000, you calculate:

Gross Profit = $50,000 - $20,000 = $30,000

This shows how much you keep after covering the direct costs of producing or sourcing your products.

Calculating Operating Profit

Now, let’s say your operating expenses (like rent, salaries, utilities) are $10,000. You calculate:

Operating Profit = Gross Profit - Operating Expenses

Operating Profit = $30,000 - $10,000 = $20,000

This shows what’s left after paying for the day-to-day costs of running your business.

4. Purpose

Cost of Goods Sold (COGS) is subtracted from revenue first to calculate gross profit. This shows how efficiently a business produces or acquires the goods it sells, providing insight into product-level profitability before considering other business expenses.

Operating Expenses are subtracted from gross profit to calculate operating profit. This reflects how efficiently a business manages its day-to-day operations, including selling, administrative, and general expenses needed to support the business.

By seeing how COGS and operating expenses differ, you can better tell the difference between gross profit vs operating profit.

Why Tracking COGS and Operating Expenses Is Important?

It’s because clear, accurate cost tracking means clear, accurate profit tracking.

When you know exactly what you’re spending on COGS and operating expenses, you know exactly what you’re earning, too.

This helps you track your gross profit, operating profit, and net profit with confidence, so you can spot where money leaks, see which products drive real profit, and know how much you can safely reinvest without hurting your cash flow.

How to Track COGS and Operating Expenses?

You can start tracking your COGS and operating expenses with a simple spreadsheet. You can set up columns for your product costs, shipping fees, software subscriptions, and marketing expenses, updating them weekly or monthly to stay on top of your cash flow.

But as your store grows, manual tracking can get messy and time-consuming. This is where tools like TrueProfit come in.

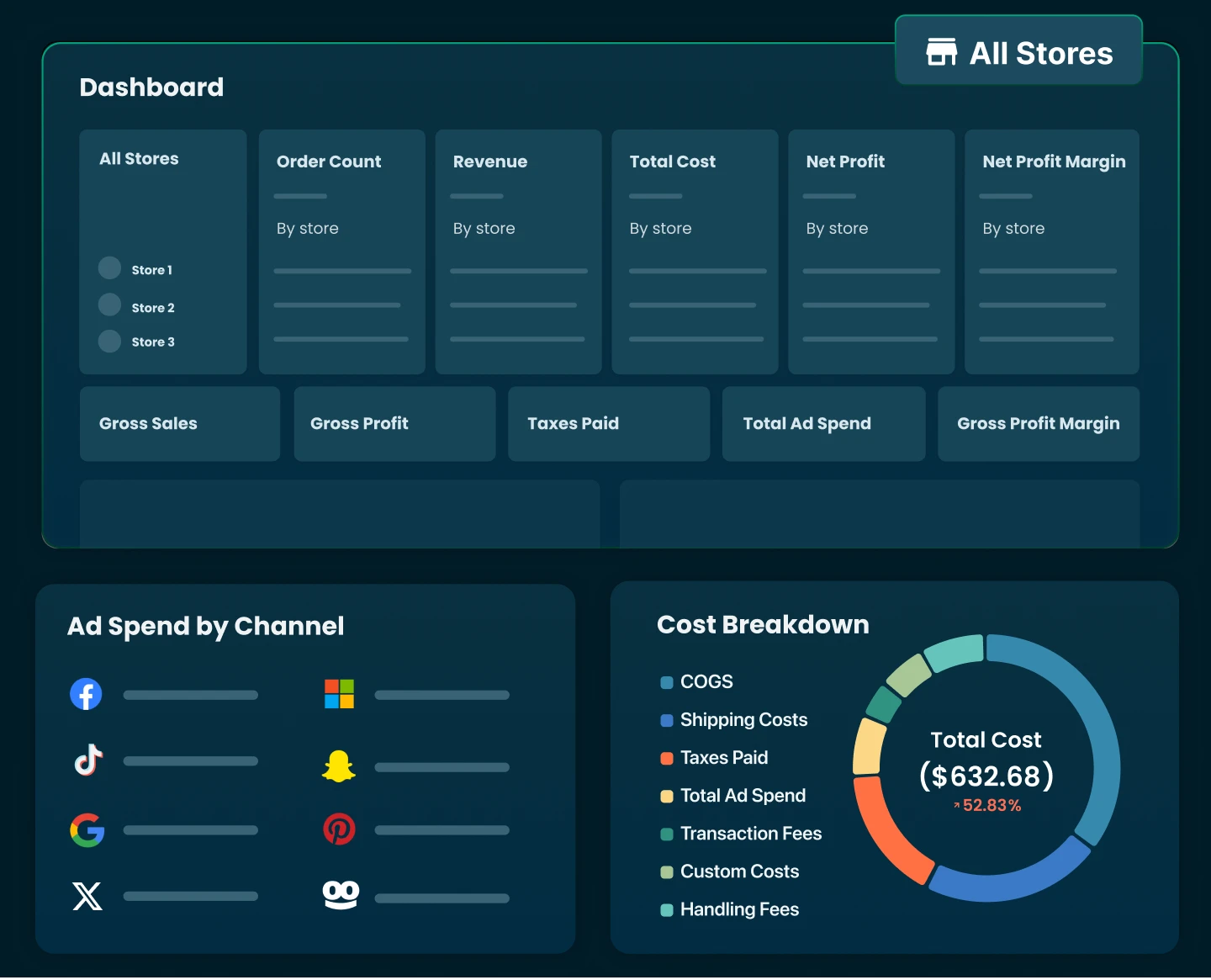

TrueProfit is a profit analytics tool built specifically for Shopify and eCommerce sellers. It gives you an accurate view of gross, operating, and net profit by automatically tracking your COGS, operating expense, and even more.

Unlike spreadsheet, TrueProfit is built for tracking profit in real time - this app updates your profit as your cost happens, anywhere, anytime.

Wrapping it all up, COGS goes up and down with your sales, while operating expenses keep ticking along each month, no matter what. When you track these costs clearly, you get a real picture of gross profit and operating profit.

They are both costs you can’t avoid, but there’re always proven tips to reduce them for better margin. Check out 6 strategies to improve profit margin in 2026.

COGS vs Operating Expense FAQs

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits