Net Profit Margin vs Gross Profit Margin: What To Track?

Not sure how net profit margin vs gross profit margin differ? Gross profit margin shows how much you keep after covering production costs, while net profit margin reveals your true profit after all expenses.

In this post, you’ll quickly learn the difference and why both matter for your business’s bottom line.

In this blog:

Net Profit Margin vs Gross Profit Margin: A Quick Comparison

Here’s a quick side-by-side comparison:

Aspect | Gross Profit Margin | Net Profit Margin |

|---|---|---|

What it measures | Profit after cost of goods sold (COGS) | Profit after all expenses (COGS, operating, taxes, etc.) |

Formula | (Revenue – COGS) ÷ Revenue | Net Profit ÷ Revenue |

Focus | Production efficiency | Overall business profitability |

Includes | Only COGS | COGS + Operating Expenses + Interest + Taxes |

Tell you... | How much you make from the product itself | How much you keep after everything is paid |

Best used for | Pricing, supplier costs, product margin strategy | Growth strategy, sustainability, investor reporting |

Example usage | "Is this product profitable to sell?" | "Is my business financially healthy overall?" |

What is Gross Profit Margin?

Gross profit margin — often just called gross margin — shows how much money your business keeps after covering the cost of producing your goods or services. It’s one of the clearest indicators of whether your current pricing and production setup is profitable.

Gross profit margin usually appears as a percentage on your profit and loss (P&L) statement. If your gross margin is 25%, it means you’re keeping 25¢ of every $1 you earn in revenue — before paying for other costs like marketing, software, or salaries.

Why Gross Profit Margin Matters?

Gross margin helps answer a critical question: Can you make money with the way you’re pricing and producing your product right now?

It reflects your ability to cover production costs, adjust to changing labor or material prices, and stay profitable as your business grows.

A shrinking margin often signals rising costs or ineffective pricing. On the flip side, a healthy gross margin gives you breathing room to invest in marketing, hire a team, or expand operations. To see how your profit margin compares, check out What is a Good Profit Margin for Retail in 2025? for the latest benchmarks and insights.l

The Gross Profit Margin Formula

To calculate it, use this formula:

Where:

- Total Revenue is what you earned (after returns or discounts)

- Cost of Goods Sold (COGS) includes all direct production costs — like materials, packaging, and labor

Both figures are listed on your PnL statement for a specific period.

A Quick Example of Gross Profit Margin

Let’s say a boutique jewelry brand made $32,000 in sales last quarter, and it cost $14,000 to produce those goods. Here’s how that looks:

Metric | Amount |

|---|---|

Total Revenue | $32,000 |

Cost of Goods Sold | $14,000 |

Gross Profit | $18,000 |

Gross Profit Margin | 56% |

Using the formula:

[($32,000 – $14,000) / $32,000] × 100 = 56% gross margin

This means the business kept $0.56 from every $1 in sales to cover overhead, pay staff, invest in growth, or turn a profit.

What Is Net Profit Margin?

Net profit margin, also known as net margin, measures how much profit your business keeps after covering all expenses in a given period. This includes the cost of goods sold (COGS) plus operating costs like rent, salaries, administrative expenses, taxes, depreciation, and sometimes one-time or non-operating costs or income.

Net profit margin is expressed as a percentage. For example, if your net margin is 15%, it means your business retains 15¢ from every dollar of revenue after paying all costs.

Why Net Profit Margin Matters?

Net profit margin gives a complete picture of your business’s profitability and financial health. It shows whether your business model can generate true profit once all expenses are accounted for. Since it includes more costs than gross margin, net margin is usually lower but more revealing for long-term viability. To learn how to improve this metric, explore our guide on Profit Optimization for practical strategies.

The Net Profit Margin Formula

You can calculate net profit margin with this formula:

Where:

- Total Revenue is your sales after returns or discounts.

- Total Costs include COGS and all other business expenses like rent, wages, taxes, and depreciation.

A Quick Example of Net Profit Margin

Description | Amount |

|---|---|

Total Revenue | $32,000 |

Cost of Goods Sold | $14,000 |

Operating Expenses | $8,000 |

Taxes & Other Costs | $3,000 |

Total Costs | $25,000 |

=> 32,000−25,000×100 = 21.9%

This means the business keeps about 22% profit from every dollar of sales after all expenses.

Net Profit Margin vs Gross Profit Margin: What To Track?

Net profit margin vs gross profit margin are both important ecommerce metrics to track. However, depending on what you want to learn about your business, one may be more useful than the other.

This table helps you decide which metric to focus on based on your current needs.

When to Use | Gross Profit Margin | Net Profit Margin |

|---|---|---|

Focus | Understand product or service profitability | Understand overall business profitability |

Best for | Analyzing production efficiency and direct costs | Assessing complete financial health after all expenses |

Use if you want to | Evaluate pricing, cost of goods sold, and production costs | Measure true profit after operating expenses, taxes, and interest |

How To Track Shopify Gross Margin vs Net Margin Easily in 2025?

1. Use Shopify’s Built-In Analytics

Shopify’s built-in analytics give you a basic view of your gross profit margin through its Profit Margin reports. Just log into your admin panel, head to Analytics, and review the available metrics. However, it’s worth noting that Shopify doesn’t show your net profit margin directly—you’ll need to factor in additional costs like marketing, shipping, and apps separately to get the full picture.

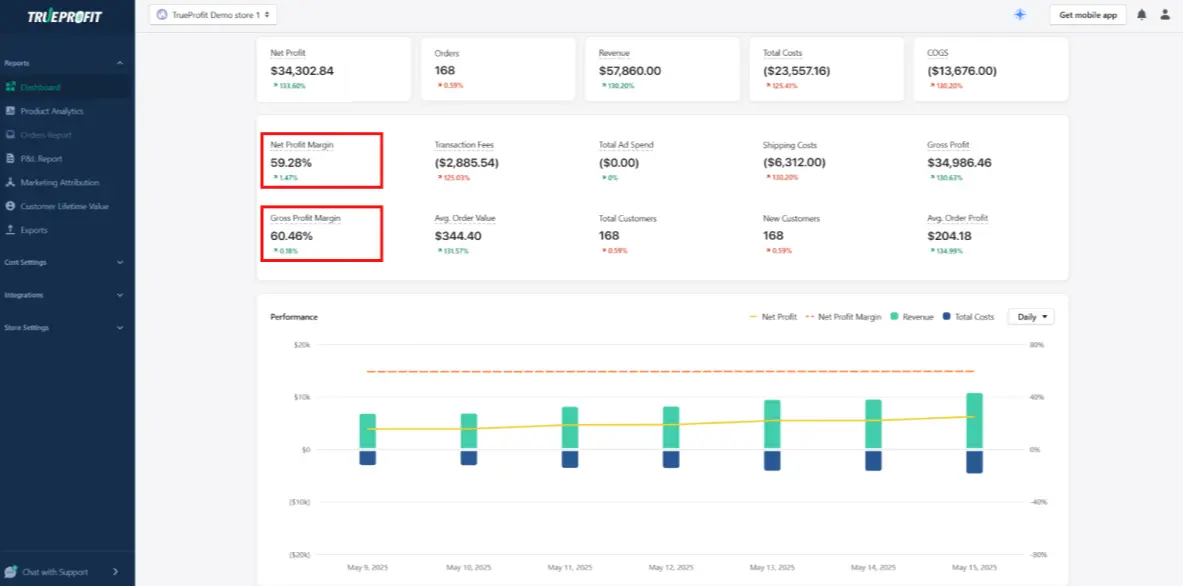

2. Try Real-Time Profit Tracking Apps

For more detailed and automated tracking, third-party profit tracker apps like TrueProfit can help. These apps connect to your store, calculate margins in real time, and provide easy-to-understand dashboards. They save time and offer deeper insights than Shopify’s native reports.

Use Free Online Calculators for Quick Checks

If you want a quick check without logging in anywhere, free profit margin calculators can be handy. They let you input your revenue and costs to get instant margin estimates.

In short, when comparing Net Profit Margin vs Gross Profit Margin, the key difference is what costs each margin includes.

Gross profit margin focuses on production costs, while net profit margin accounts for all expenses.

Understanding key metrics is critical to your store’s success. But calculating and tracking them manually? That’s time-consuming and prone to errors.

With TrueProfit, you can instantly access all your essential metrics in one place - no spreadsheets, no stress. Join thousands of Shopify merchants who have unlocked a clearer view of their net profit with our real-time profit tracking solution.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits