Operating Profit vs Gross Profit: 4 Key Differences Explained

Profit metrics are essential for evaluating the financial health of an eCommerce business. Two commonly used metrics, operating profit vs gross profit, are often confused but serve different goals.

Gross profit represents the profit remaining after subtracting the cost of goods sold (COGS) from total sales.

Operating profit is the profit remaining after deducting operating expenses from gross profit, but before interest and taxes.

While both measure your ability to generate profit, they capture different profitability levels. Understanding their differences helps you make better decisions on pricing, expenses, and scalability.

In this blog:

Operating Profit vs Gross Profit: Key Differences Explained

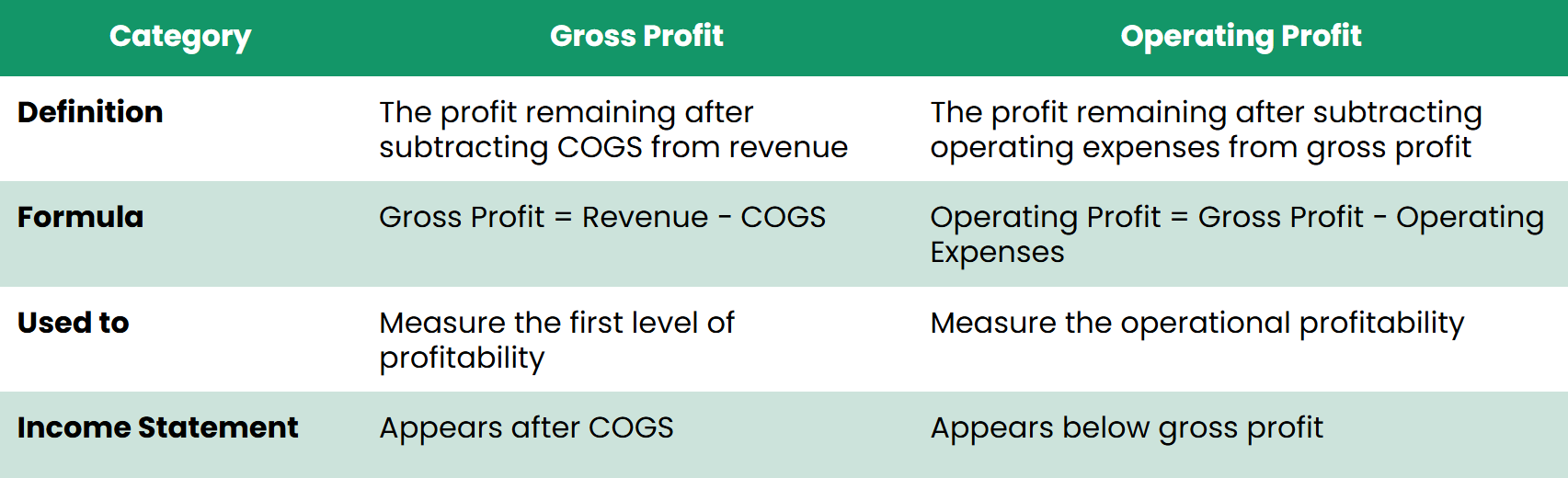

1. Defintion

Gross profit is the profit a business earns after subtracting the cost of goods sold (COGS) from total revenue. It includes only direct costs related to producing or purchasing the goods sold, such as raw materials and direct labor.

Gross profit does not include operating expenses like rent, utilities, salaries of administrative staff, marketing expenses, interest, or taxes.

Operating profit is the profit a business earns after subtracting operating expenses from gross profit. It includes costs such as rent, utilities, salaries for administrative staff, and marketing expenses.

Operating profit does not include non-operating items like interest expenses and taxes. It reflects the profit generated from the business’s core operations before accounting for interest and taxes.

2. Formula

Gross profit is calculated as:

Meanwhile, calculate operating profit using:

Let’s say your revenue is $50,000, and your COGS is $20,000.

You would calculate:

Gross Profit = $50,000 - $20,000 = $30,000

Now, if your operating expenses are $10,000, you can find your operating profit:

Operating Profit = $30,000 - $10,000 = $20,000

3. Use Case

Think of gross profit as your pricing reality check. It shows whether your products are priced to leave enough margin after covering the cost of goods sold (COGS) and shipping. If it’s too low, it may be time to adjust your prices, talk to your suppliers, or look at your shipping costs.

Use operating profit when planning for growth. It shows whether your store can stay profitable as it scales, after covering all operating expenses. A strong gross profit but a weak operating profit can happen if you sell well but spend too much to keep the business running.

Which Metric Matters More for Store Profitability?

Both are important performance metrics, but operating profit is a clearer indicator of a business’s profitability.

Gross profit measures profitability after accounting for direct production or purchase costs, while operating profit measures profitability after accounting for both direct production costs and the ongoing expenses required to operate the business.

This distinction makes operating profit a more comprehensive metric in your business profitability analysis.

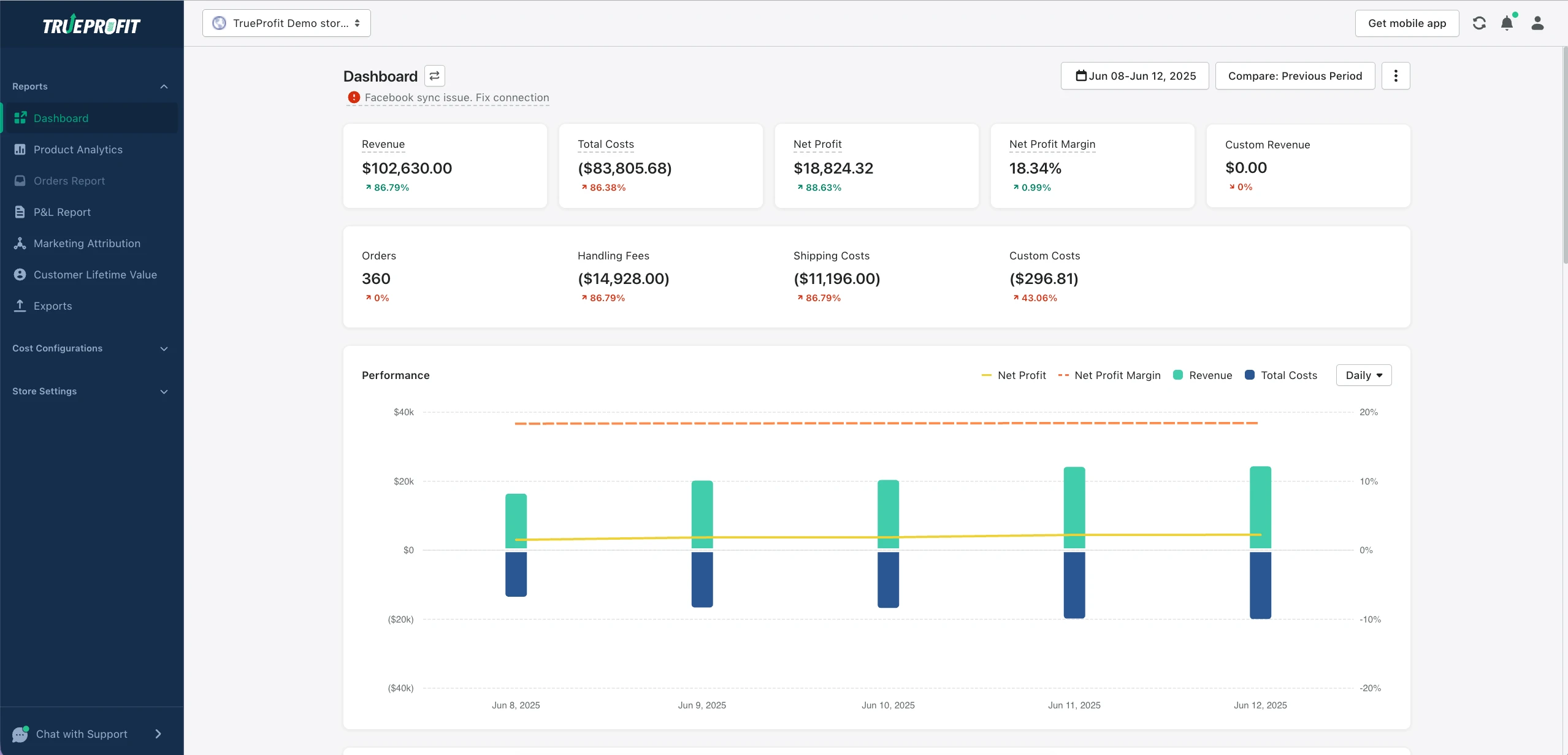

Stay On Top Of Your Margin Tracking

Understanding the difference between gross profit and operating profit is key to truly knowing how your business performs—from product profitability to operational efficiency.

While gross profit highlights how much you make from sales, operating profit shows how well you run your store.

To track both metrics accurately and effortlessly, use TrueProfit, the profit analytics tool built for Shopify sellers. Don’t leave your bottom line to guesswork, let TrueProfit give you full visibility into your business health.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits