Defining Cost of Goods Purchased Formula (+Examples)

Cost of goods purchased formula is:

Cost of Goods Purchased = Purchases + Freight-In + Other Costs – Purchase Returns and Allowances

It is the total amount spent on buying inventory during a specific period. It’s the direct cost a business pays to acquire inventory, including purchases, shipping, and other related expenses.

COGP matters because it’s the foundation for calculating your true profitability. COGP shows you the actual amount you’re spending to acquire inventory, including shipping, duties, and other direct costs, this gives a more accurate view of your real expenses.

In this guide, you’ll learn more about COGP: its definition, calculation, examples, and how it is used for your business.

In this blog:

What is the Cost of Goods Purchased?

Cost of Goods Purchased (COGP) is the total amount spent on buying inventory during a specific period. It’s the direct cost a business pays to acquire inventory, including purchases, shipping, and other related expenses.

While they sound similar, COGP vs. COGS isn’t the same thing. COGP tells you how much you spent on buying inventory, regardless of whether you’ve sold them yet. Meanwhile, Cost of Goods Sold (COGS) is the total direct cost of producing or purchasing the goods that a business has actually sold.

How to Calculate the Cost of Goods Purchased

In accounting terms, COGP formula is:

Let’s break it down:

- Purchases: Total dollar amount spent on buying inventory

- Freight-In: Shipping or transportation costs to bring the goods to your facility

- Other Costs: Any added costs directly tied to acquiring the goods (like import taxes)

- Returns and Allowances: Goods you sent back or got discounts on after purchase

Cost of Goods Purchased is a key part of calculating Cost of Goods Sold (COGS):

Example of the Cost of Goods Purchased

Using the above formula, here's an example of calculating COGP step-by-step.

Let’s say your business bought inventory this quarter with the following details:

- Total purchases: $60,000

- Freight-in charges: $2,000

- Import duty: $1,500

- Purchase returns: $3,500

Here’s how it plays out:

COGP = $60,000 + $2,000 + $1,500 – $3,500 = $60,000

So, your cost of goods purchased this quarter would be $60,000. This means you paid $60,000 to stock up on items you plan to sell (or use in production).

Applications of the Cost of Goods Purchased

Cost of Goods Purchased (COGP) is a key part of profitability analysis.

Even though you don’t usually see “COGP” as a separate line on the PnL Statement, it still helps calculate important numbers that do appear there, especially COGS.

Once they calculate COGS, that number appears directly on the PnL statement, and helps determine your Gross Profit.

Even though COGP isn't shown, it's a critical input behind the scenes of other business performance metrics.

Why Cost of Goods Purchased Matters for a Business?

COGP matters because it’s the foundation for calculating your true profit and profitability.

COGP shows you the actual amount you’re spending to acquire inventory, including shipping, duties, and other direct costs—this gives a more accurate view of your real expenses.

If you don’t accurately track how much you spent to acquire your goods (COGP), then every number that comes after like Cost of Goods Sold (COGS), profit margin, gross profit, and net profit becomes unreliable.

In short, Cost of Goods Purchased (COGP) might not get as much attention as revenue or profit, but it plays a critical role in understanding a business’s financial health.

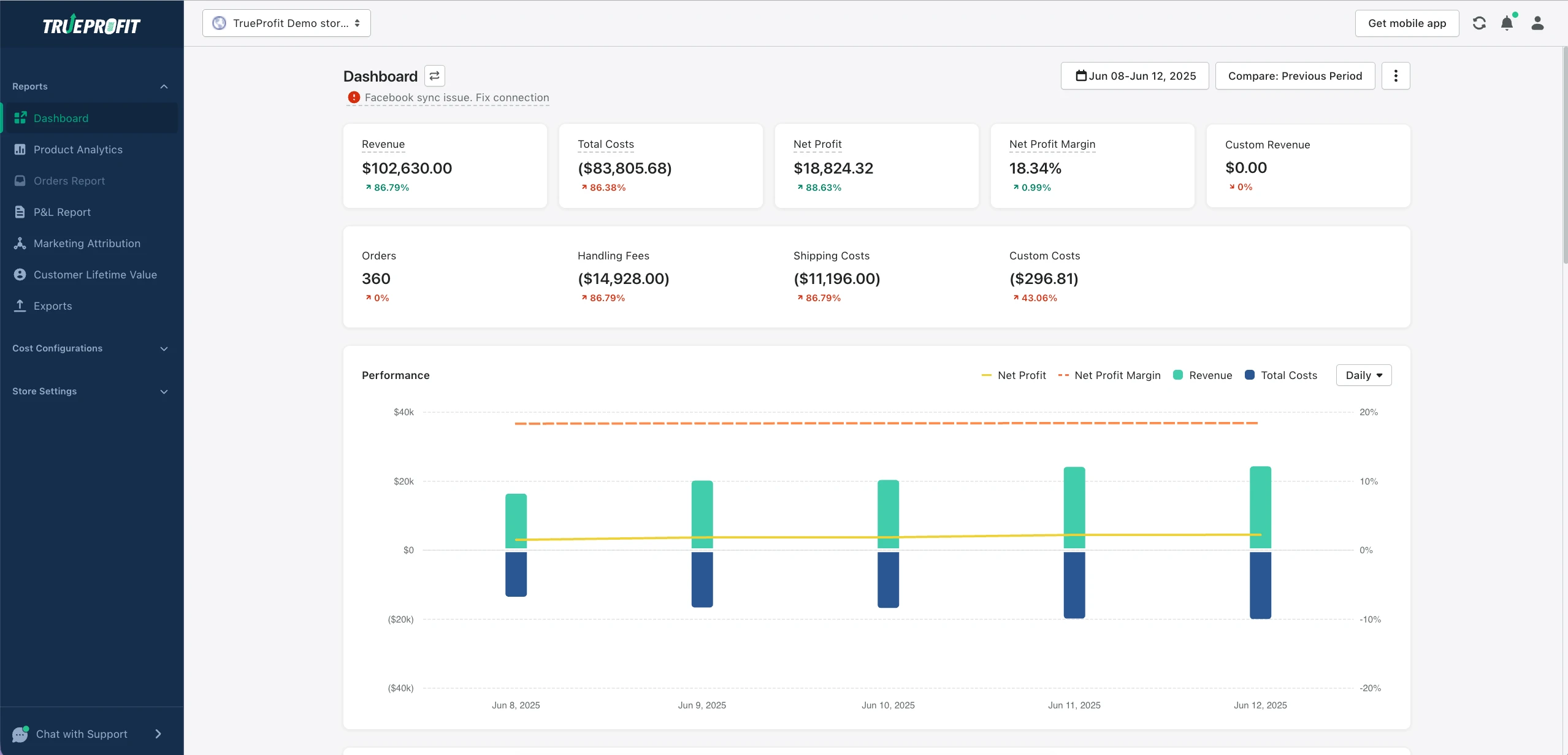

COGP is the start of true profit. It gives you a more accurate view of your real expenses, and with TrueProfit, you can track that effortlessly to get a clearer picture of your true profitability.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits