What is Net Profit & How to Calculate It (+Examples)

Net profit is the amount of profit after subtracting all expenses from revenue. These expenses include the cost of goods sold (COGS), operating expenses (such as marketing, salaries, and rent), interest on debt, and taxes.

It is the final profit a business keeps which helps reveal the true financial performance and profitability of the business within a specific period.

Calculate net profit using this formula: Net Profit =Total Revenue - Total Expenses

This guide will walk you through what net profit is, how to calculate it, why it matters, and practical steps to improve it in your business.

In this blog:

What is Net Profit?

Net profit (also called net income, net earnings, or the bottom line) is the amount of money a business has left after subtracting all expenses from its total revenue.

These costs include the cost of goods sold (COGS), operating expenses, interest payments, and taxes. It reflects the actual profitability of the business over a specific period and indicates how much remains from revenue after all expenses are fully accounted for.

Harry Chu, the founder of TrueProfit, once shared his thoughts on this north-star metric: "Think of net profit as the final score—it reveals how efficiently your business turns revenue into actual earnings."

What is the Net Profit Formula?

Net profit is calculated by subtracting all expenses from a business’s total revenue.

To evaluate profitability relative to revenue, you can calculate the net profit margin. Net profit margin represents the ratio of net profit to total revenue, expressed as a percentage. It is calculated by dividing net profit by total revenue and multiplying by 100 to get a percentage.

How to Calculate Net Profit?

Calculating net profit involves these steps:

Step 1: Calculate Total Revenue

Total revenue includes all income generated from sales of products or services, along with any additional income such as interest or proceeds from asset sales.

Using this formula:

Step 2: Calculate Total Expenses

Like we said above, total expenses include all costs incurred to operate the business, typically including:

- Cost of Goods Sold (COGS)

- Operating expenses (salaries, rent, utilities)

- Taxes

- Interest on loans

- Depreciation and amortization

- Other administrative or selling expenses

Step 3: Apply the Net Profit Formula

Subtract total expenses from total revenue to calculate net profit.

The result will show your net profit if positive or a net loss if negative, providing a clear measure of your business’s true earnings for the period.

For example, your business records $60,000 in total revenue for the month. This includes income from product sales and a supplier rebate.

The business’s total expenses for the month are:

- Cost of Goods Sold (COGS): $30,000

- Operating expenses (advertising, salaries, software): $15,000

- Taxes: $3,000

- Interest on loans: $500

- Depreciation and amortization: $1,000

Total expenses are calculated as:

Total Expenses = $30,000 + $15,000 + $3,000 + $500 + $1,000 = $49,500

The net profit can then be calculated using the formula:

Net Profit = $60,000 – $49,500 = $10,500

In this example, the business achieves a net profit of $10,500 for the month. This metric shows the actual earnings retained after all product costs and operating expenses have been paid, providing a clear view of the business’s true profitability.

Why Is Net Profit Important?

Net profit is a key indicator of a business’s financial health. It is important because it helps you:

- Measures true profitability. It indicates how efficiently a business converts revenue into actual profit.

- Identifies areas for improvement. A low net profit can highlight high expenses or pricing issues, helping you adjust strategies to increase profitability.

- Make decisions based on your bottom line: It indicates which activities contribute to your bottom line and which do not.

- Tracks financial health over time: Monitoring net profit regularly helps you see if your business is becoming more or less profitable, ensuring you take action before problems grow.

Net profit works alongside other essential ecommerce metrics like gross profit, operating profit, and customer acquisition costs to give you a complete view of your business’s financial health.

How to Optimize Your Net Profit?

If your net profit isn’t where you want it to be, consider these practical steps. Small tweaks to your pricing, costs, and operations can greatly impact your profit optimization.

1. Fix your attribution model before optimizing campaigns.

Connect ad spend to actual profit outcomes, not just conversions or revenue.

2. Cut unprofitable products even if they generate revenue.

20% of products often lose money when all costs are included.

3. Negotiate everything every 6-12 months.

Payment fees, shipping rates, and supplier terms improve as your leverage grows.

4. Reduce overhead costs

Audit expenses like rent, subscriptions, and software fees to cut unnecessary spending.

Want to Track Net Profit Easily?

In short, net profit is like a window into your business’s financial health and long-term sustainability. By understanding how to calculate and improve your net profit, you’ll make smarter decisions that help your business grow.

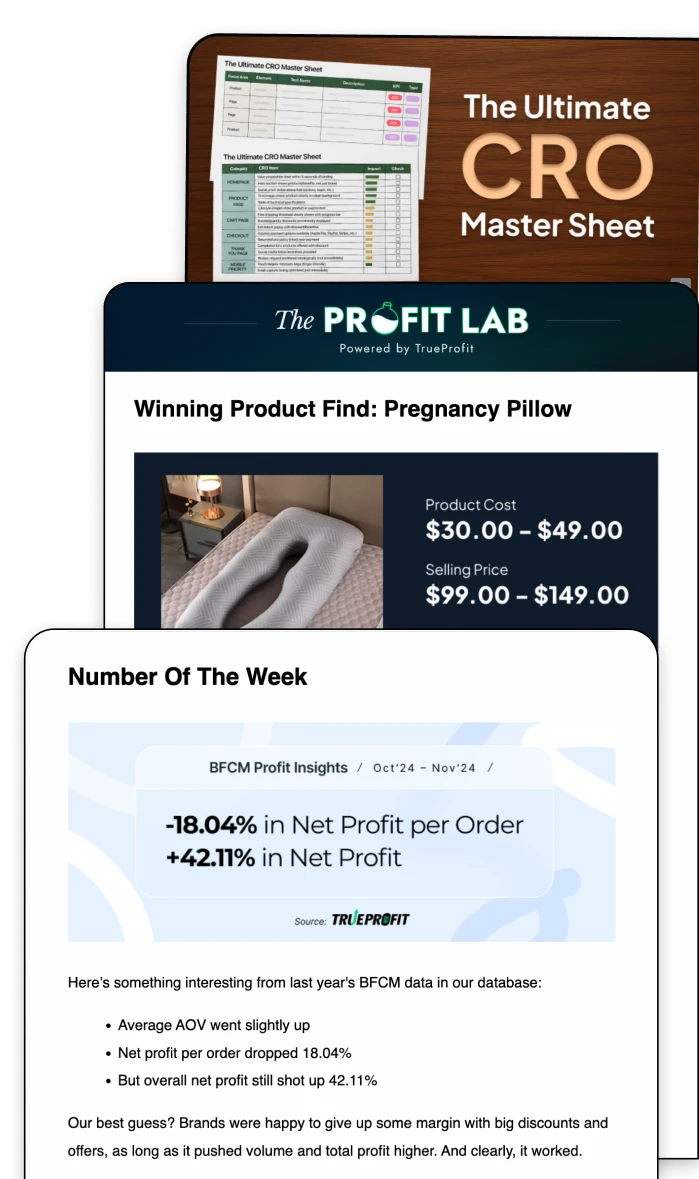

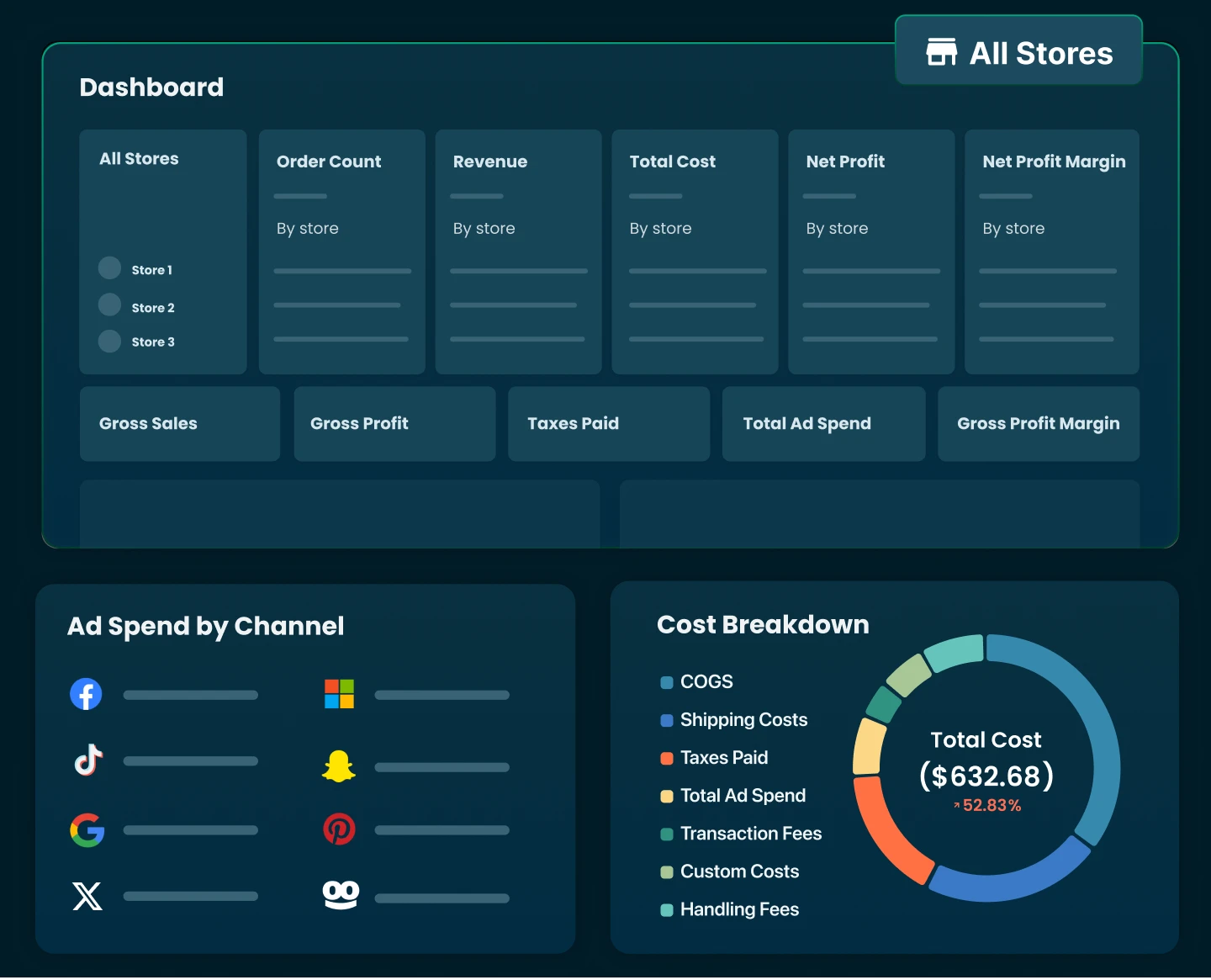

However, calculating net profit manually can be time-consuming and prone to errors. That’s why we created TrueProfit—a net profit analytics platform designed for Shopify sellers. With TrueProfit, you can instantly see your true profit without dealing with complex formulas or manual tracking.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits