What is Gross Revenue Retention (GRR)? Formula + Examples

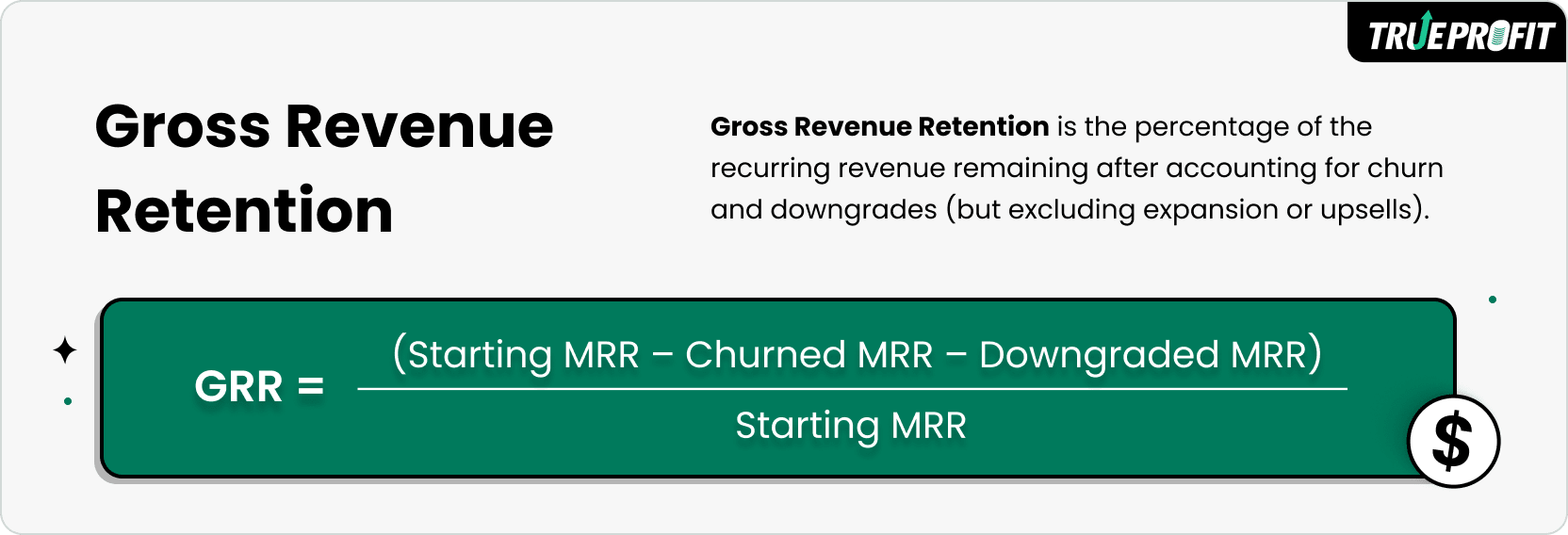

Gross revenue retention is the percentage of the recurring revenue remaining after accounting for churn and downgrades (but excluding expansion or upsells).

It’s a core SaaS performance metric that is used for measuring retention performance.

Here’re some accepted benchmarks across SaaS and subscription-based industry:

- SMB SaaS: 80% – 90%

- Mid-market: 85% – 95%

- Enterprise: 90% – 95%+

The higher customer lifetime value and product complexity, the higher the GRR tends to be.

In this guide, we’ll break down exactly what GRR is, how to calculate it, what a good GRR looks like, and how it differs from similar metrics like Net Revenue Retention (NRR) and Gross Dollar Retention (GDR).

Let’s dive in.

In this blog:

What is Gross Revenue Retention?

GRR tells the percentage of the recurring revenue remaining after accounting for churn and downgrades (but excluding expansion or upsells).

It’s a core SaaS KPI metric that is used for measuring retention performance. It reflects a clean view of retention by filtering out any extra money customers might spend.

How to Calculate It?

Here’s the formula:

Where each term means:

- Starting MRR (aka RR₀): Monthly Recurring Revenue from existing customers at the beginning of the period.

- Churned MRR: Revenue lost when customers fully cancel their subscriptions.

- Downgraded MRR: Revenue lost when customers reduce their subscription value (e.g., move to a cheaper plan).

Gross Revenue Retention Example

Let’s say your SaaS company starts the quarter with $100,000 in MRR from existing customers.

Over the quarter:

- You lose $10,000 due to cancellations.

- You lose another $5,000 from downgrades.

- You gain $15,000 from upsells (but we ignore this for GRR).

Apply the formula:

GRR = ($50,000 - $3,000 - $2,000) ÷ $50,000

GRR = $45,000 ÷ $50,000 = 0.9 → 90%

So, your gross revenue retention is 90%, meaning you retained 90% of your starting revenue from existing customers, excluding upsells.

What’s Difference Between Gross Revenue Retention (GRR) vs. Net Revenue Retention (NRR)

Net revenue retention (NRR) includes everything in GDR plus expansion revenue. It reflects how much revenue your existing customers generate after accounting for churn, downgrades, and upgrades. NRR can exceed 100%, which is a strong signal of product-market fit and growth efficiency.

While Net Revenue Retention includes both customer losses and gains, gross revenue retention isolates just the losses, giving you a clearer picture of customer satisfaction and product stickiness.

Remember, Net Revenue Retention (NRR) can stay high even when you’re losing customers—if your upsell game is strong. But GRR cuts that noise and gives you the unboosted view of how well your product retains revenue.

Why Gross Revenue Retention Matters?

Gross revenue retention is a vital health check for any recurring revenue business.

By tracking GRR, you get:

- A clearer picture of customer satisfaction.

- Early warning signs of churn or downgrades.

- A metric you can improve with better onboarding, support, and product value.

What is a Good Gross Revenue Retention?

A good gross revenue retention rate typically falls between 80% to 95%. The closer to 100%, the better.

Here’re some accepted benchmarks across SaaS and subscription-based industry:

- SMB SaaS: 80% – 90%

- Mid-market: 85% – 95%

- Enterprise: 90% – 95%+

The higher customer lifetime value and product complexity, the higher the GRR tends to be. That’s why GRR in the above group is typically lower in SMBs and higher in enterprise.

Yet, knowing that GRR is always ≤ 100%. Because it does not count expansion revenue like upsells, add-ons, upgrades. To go over 100%, you'd have to gain more than you had — but GRR purposely ignores gains.

In short, gross revenue attention is a key metric for SaaS and subscription-based businesses to assess product value. It’s the foundation of recurring revenue. If your GRR is weak, growth won’t be sustainable—no matter how fast you upsell.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits