Margin vs Profit: Key Differences and How to Use Each One in 2026

Margin refers to the percentage of revenue that remains as profit after specific costs have been deducted from sales. Profit is the amount of money your online store keeps after subtracting all costs from total sales revenue.

Margin vs profit are core metrics for understanding your store’s true profitability. While they’re related, they reveal different insights into your company's performance and profitability.

Let's dive deep into what margin and profit really mean and how to leverage them effectively.

In this blog:

Margin vs Profit: Definition and Formula

Profit is the actual amount of money your business earns after all expenses are subtracted from revenue.

Margin, on the other hand, is the percentage of revenue that turns into profit, it's a way to measure profitability relative to sales.

What is Profit?

Profit is the amount of money your online store keeps after subtracting all costs from total sales revenue. These costs include the cost of goods sold (COGS), shipping cost, payment processing fees, marketing expenses, operating costs, and taxes.

Profit comes in 3 different types, each telling you something specific about your store’s health:

1. Gross Profit

Gross profit is the amount remaining after subtracting the cost of goods sold (COGS) from total revenue. It is calculated by

2. Operating Profit

Operating profit is the profit a business makes after paying for operating expenses, but before interest and taxes are deducted. Calculate it using:

3. Net Profit

Net profit is the final amount of profit a business earns after all expenses have been deducted from total revenue.

It is calculated as:

What is Margin?

Margin refers to the percentage of revenue that remains as profit after specific costs have been deducted from sales. It is used to measure how efficiently an online store converts sales into profit.

There are 3 main types of margin.

1. Gross Profit Margin

Gross profit margin is the percentage of revenue that remains after subtracting the cost of goods sold (COGS) from total sales.

2. Operating Profit Margin

Operating profit margin is the percentage of revenue remaining after subtracting the cost of goods sold (COGS) and all operating expenses from total sales.

3. Net Profit Margin

Net profit margin is the percentage of revenue remaining after all expenses, including COGS, operating expenses, interest, and taxes, have been deducted from total sales.

Critical Differences Between Margin and Profit

Margin and profit are closely linked business performance metrics, but they tell you different things about your store’s performance.

1. Definition

Profit refers to the absolute dollar amount remaining after all expenses are deducted from revenue. Margin refers to the percentage of revenue retained as profit after costs.

2. Unit of Measurement

Profit is expressed in monetary terms (e.g., $10,000), providing a clear figure for earnings. Meanwhile, margin is expressed in percentage terms (e.g., 20%), showing the proportion of profit relative to revenue.

3. Use Case

Margin vs profit serve different purposes in profitability analysis and operational decision-making.

Gross margin helps you spot products that drain cash before you sink ad dollars into them. If your margins are thin, you will hustle for sales without building profit.

Profit can work best as an honest indicator of your business health. If your net profit is low even with strong revenue, it is a sign something is off. Maybe your ad strategy needs work. Maybe your products need better margins. Maybe your overhead is bloated.

Both profit and margin are critical for understanding financial performance. Relying solely on profit may overlook pricing and cost inefficiencies, while focusing only on margin may ignore cash flow constraints.

Aspect | Margin | Profit |

|---|---|---|

Definition | Margin shows the percentage of revenue kept as profit after costs are deducted. | Profit is the absolute dollar amount left after all expenses are subtracted from revenue. |

Unit of Measurement | Percentage (e.g., 20% margin) | Monetary value (e.g., $10,000 profit) |

What It Tells You | How efficiently your business, product, or pricing model converts revenue into profit. | How much money your business actually makes. |

Best Use Case | Used to evaluate pricing, product viability, and cost efficiency before scaling. | Used as a true indicator of business health and sustainability. |

Why It Matters | Thin margins mean you can sell more but still struggle to build real profit. | Low profit despite strong revenue signals issues like high ad costs or bloated overhead. |

Common Mistake | Focusing only on margin and ignoring whether enough cash is being generated. | Focusing only on profit and missing pricing or cost inefficiencies. |

Best Practice | Analyze margin to decide what to sell and scale. | Track profit to understand overall financial performance. |

At the end of the day, margin helps you decide what’s worth selling, while profit tells you whether your business is actually working. The strongest businesses track both together to avoid scaling revenue without profitability.

Margin vs Profit: Real-World Examples Explained

Margin and profit may sound similar, but these examples show how they measure different aspects of business performance.

Example 1: High sales, low margin

A business earns $100,000 in revenue and spends $95,000 on expenses, leaving $5,000 in profit. While the company is profitable, its profit margin is only 5%, meaning a small increase in costs could quickly erase earnings.

Example 2: Lower sales, higher margin

Another business generates $50,000 in revenue with $35,000 in expenses, resulting in $15,000 in profit. Even with lower revenue, the 30% margin shows stronger efficiency and better cost control.

Example 3: Same profit, different margins

Two businesses both make $10,000 in profit. One reaches this with $200,000 in revenue (5% margin), while the other does so with $50,000 in revenue (20% margin). Although profit is identical, the second business is far more efficient and resilient.

These examples highlight why profit shows how much money a business makes, while margin reveals how efficiently it operates. Understanding both metrics together gives a clearer picture of overall financial health.

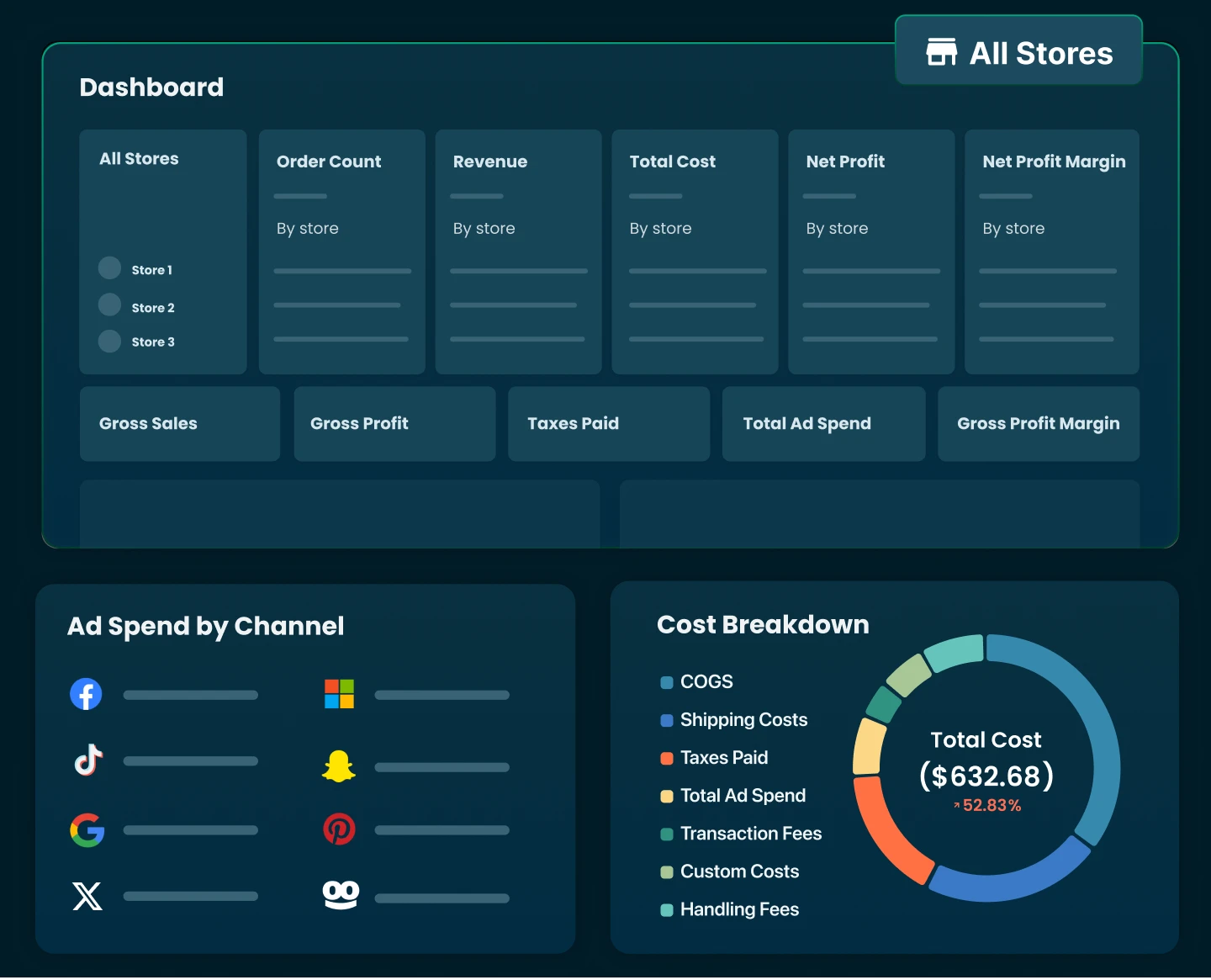

Stay on Top of Profit & Margins with Ease

At the end of the day, knowing the difference between margin and profit helps you see the full picture of how your business is really doing. Margin tells you how efficient your pricing is, while profit shows what’s actually ending up in your pocket. You need both to make smart decisions — especially when costs, fees, and ads start stacking up.

If keeping track of all that sounds like a headache, you’re not alone. That’s exactly why TrueProfit exists. It gives you real-time clarity on your profit and margins — after every fee, cost, and campaign — so you’re never left guessing.

👉 Check out TrueProfit and start making data-backed decisions with confidence.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits