What is Net Revenue Retention? Formula + Example

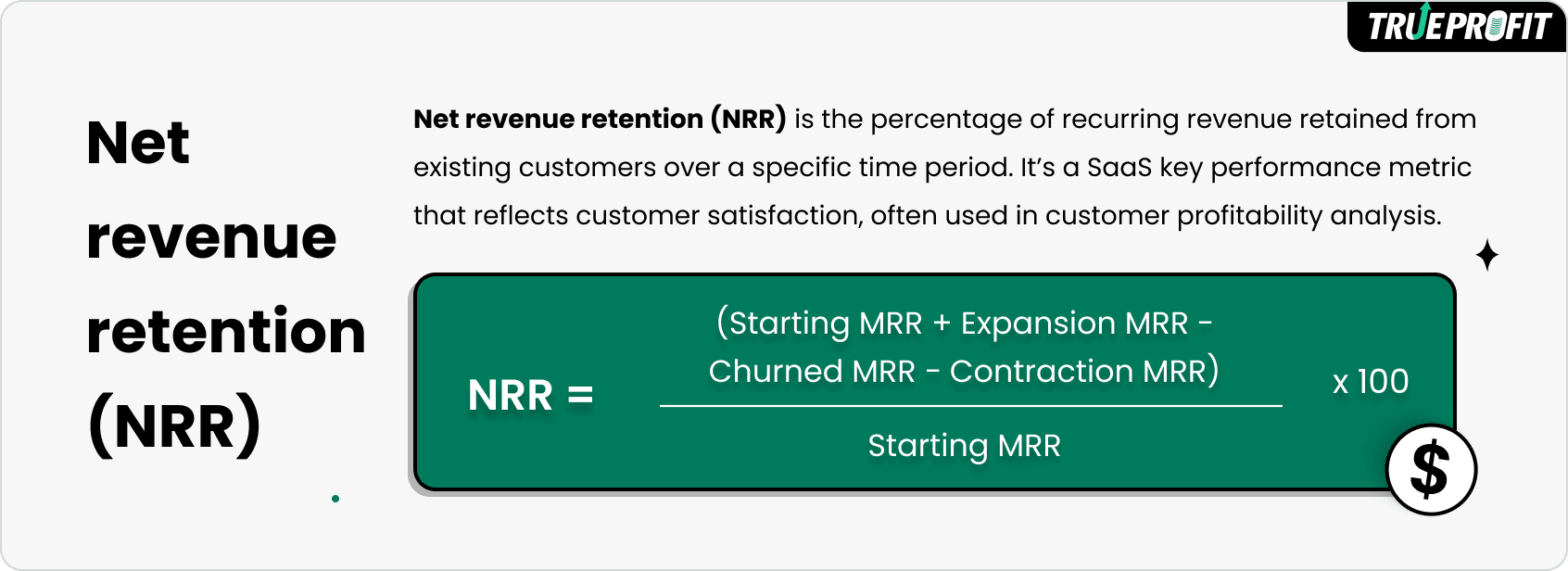

Net revenue retention (NRR) is the percentage of recurring revenue retained from existing customers over a specific time period. It’s a SaaS key performance metric that reflects customer satisfaction, often used in customer profitability analysis.

The formula is:

In this guide, we’ll break down what NRR is, how to calculate it, and how to increase this metric in your business.

In this blog:

What is Net Revenue Retention?

Net revenue retention is the percentage of recurring revenue retained from existing customers in a given period, reflecting both account expansion and contraction.

Unlike Gross revenue retention (GRR), which only tracks how much revenue you kept without counting expansions, NRR includes all the changes in existing customer revenue, including upsells/cross sells, churn rates, and downgrades.

What is the Net Revenue Retention Formula?

The formula is:

Let’s break this down:

- Starting MRR: Monthly recurring revenue from existing customers at the beginning of the period.

- Expansion MRR: Revenue gained from upsells, cross-sells, or upgrades.

- Churned MRR: Revenue lost due to customer cancellations.

- Contraction MRR: Revenue lost from downgrades.

How to Calculate Net Revenue Retention?

Here’s step-by-step guide to calculate NRR:

Step 1: Choose your time frame. Most SaaS businesses calculate NRR monthly (using MRR) or annually (using ARR).

Step 2: Find your starting MRR. Do not include new customers acquired during the period.

Step 3: Add expansion MRR. This includes any upsells, cross-sells, add-ons, or seat expansions from those same customers during the period.

Step 4: Subtract churned MRR. Start by the revenue lost from customers who fully canceled during the period.

Step 5: Subtract contraction MRR. Calculate the revenue lost due to downgrades or reduced usage from existing customers.

Step 6: Plug into the above formula: Net revenue retention = (Starting MRR + Expansion MRR − Churned MRR − Contraction MRR) ÷ Starting MRR × 100

Net Revenue Retention Example

Imagine you’re running a SaaS platform and want to calculate your NRR for July.

Here’s what your numbers look like:

- Starting MRR (from existing customers on July 1st): $100,000

- Expansion MRR (upsells and cross-sells): $15,000

- Churned MRR (lost from customers who canceled): $6,000

- Contraction MRR (lost from downgrades): $4,000

Net revenue retention = (Starting MRR + Expansion MRR − Churned MRR − Contraction MRR) ÷ Starting MRR × 100

Net revenue retention = (100,000 + 15,000 − 6,000 − 4,000) ÷ 100,000 × 100

NRR = (105,000 ÷ 100,000) × 100 = 105%

So, your net revenue retention is 105%. That means your existing customers brought in 5% more revenue this month compared to last month.

What is a Good Net Revenue Retention?

The benchmark for a good Net Revenue Retention varies by business size. For enterprise companies, an NRR above 100% signals strong growth, while small and medium businesses typically consider an NRR between 90% and 100% to be excellent.

How to Increase Net Revenue Retention?

A rule of thumb: NRR goes up when your current customers spend more. There’s a few proven ways to do that:

1. Maximize Expansion Revenue

NRR is all about revenue generated from your current customers. So the more money you earn from your existing customers, the higher your NRR.

Here’s 3 most widely used methods:

- Encourage customers to upsell to higher-tier plans.

- Cross-sell add-ons or modules that work alongside the main product.

- Charge based on number of users, transactions, API calls

2. Minimize Churn

Churn eats directly into NRR. When customers leave, that revenue is gone.

To reduce churn, we suggest:

- Show quickly how customers get value from your product.

- Track engagement metrics to spot high-churn customers early.

- Stay connected and supportive after the sale

3. Prevent Contraction (Downgrades)

Contraction happens when a customer stays but pays less. Maybe they started on a premium plan but moved to a cheaper tier.

In this case, you keep them aware of the ROI they’re getting — and here’s how you do it:

- Highlight milestones (e.g., “You’ve hit 1,000 orders!”)

- Share success stories or case studies from other customers like them

- Remind them of features they’re not using that could benefit them

- Offer proactive support (e.g., “We noticed you haven’t used X yet — want help setting it up?”)

For any SaaS business aiming for sustainable growth, Net revenue retention is a north star metric. It doesn’t just show how well you retain—it shows how well you expand. If you're serious about growth, tracking and improving NRR should be part of your core strategy.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits