Customer Acquisition Cost (CAC): Definition, Formula, How to Reduce

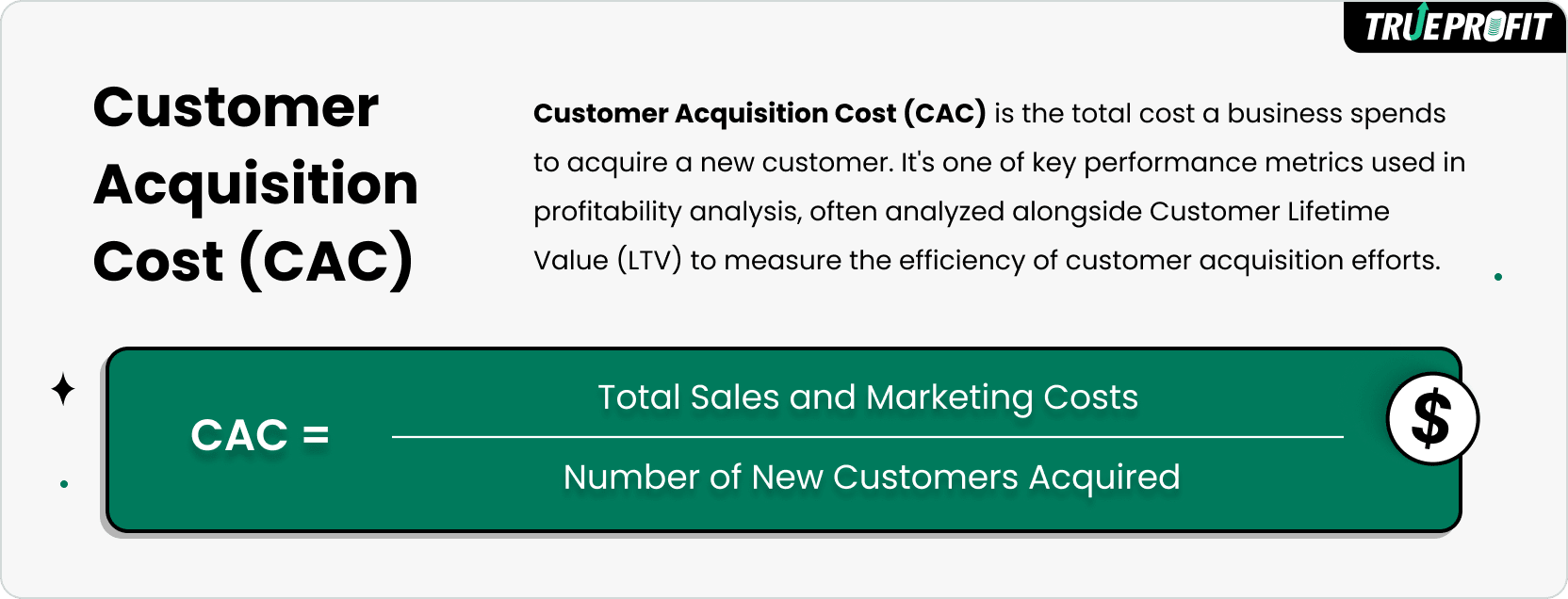

Customer acquisition cost (CAC) is the total cost a business spends to acquire a new customer. It's one of key performance metrics used in profitability analysis, often analyzed alongside customer lifetime value (LTV) to measure the efficiency of customer acquisition efforts.

The formula for Customer Acquisition Cost (CAC) is:

Many businesses aim for a CAC-to-CLV ratio of 1:3, meaning your customer lifetime value should be at least three times your acquisition cost.

In this guide, we’ll walk through CAC’s definition, its formula, how to calculate it step-by-step, and expert tactics from Harry Chu, founder of TrueProfit, on reducing CAC.

In this blog:

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the total cost a business spends to acquire a new customer. It includes all sales and marketing expenses used to attract and convert a lead into a paying customer—such as ad spend, salaries, tools, and creative assets.

It's one of key performance metrics used in profitability analysis, often analyzed alongside customer lifetime value (LTV) to measure the efficiency of customer acquisition efforts.

What is the Formula of Customer Acquisition Cost?

The formula for customer acquisition cost is:

What each part means:

- Sales & marketing costs include all spending related to acquiring customers—such as paid ads, team salaries, creative production, marketing software, commissions, and overheads.

- New customers acquired is the total number of new paying customers in the same time period.

This formula helps you calculate how much it costs your business to acquire each new customer over a specific period of time.

How to Calculate CAC?

To calculate customer acquisition cost, you need to total all your sales and marketing expenses, then divide that by the number of new customers acquired during the same period.

Let’s break it down step-by-step:

Step 1: Choose a time period such as monthly, quarterly, or annually. Make sure your costs and customer data match the same timeframe.

Step 2: Add up your total sales and marketing costs which includes:

- Paid advertising (Google, Meta, TikTok, etc.)

- Salaries and commissions of sales and marketing teams

- Marketing software and tools

- Content creation and design

- Agency or freelancer fees

- Events, sponsorships, or promotions

Step 3: Count the number of new paying customers. Again, only include actual customers (not leads or free trial sign-ups) acquired in the same period.

Step 4: Apply the above formula: Customer Acquisition Cost = Total Sales & Marketing Costs / Number of New Customers

Example of Customer Acquisition Cost

Let’s say you’re running a DTC skincare brand.

Monthly marketing spend:

- Meta ads: $15,000

- Google Ads: $5,000

- Email marketing software: $500

- Influencer collabs: $3,000

- Marketing salaries: $6,500

Total: $30,000

New customers in the month: 600

CAC = $30,000 / 600 = $50

This means you’re spending $50 to acquire each new customer. To understand if this is good, compare it to your average order value (AOV) and customer lifetime value (CLV).

When you compare CAC to LTV, you get a clearer view of profitability and long-term growth potential. For example, if it costs you $50 to acquire a customer (CAC), but they bring in $200 over their lifetime (LTV), your CAC-to-LTV ratio is healthy and scalable.

Best Practices for Reducing Customer Acquisition Cost

Harry Chu, founder of TrueProfit, noted that “the ideal tactic is lower CAC while you keep CLV crazy high”. That means you’re acquiring customers at a lower cost, and revenue you make from each customer is enough to cover costs and leave room for net profit.

Here’s 4 best practices Harry Chu picked up:

1. Optimize for High-LTV Customers

High-LTV customers bring in much higher revenue compared to others. They buy more often, stay longer, and are less sensitive to price. So even if the initial CAC is a bit high, their long-term value outweighs the cost = you're getting more profit per person.

Your goal is to check customer lifetime value data, then figure out:

- Best customer by product

- Best customer by channel

- Best customer by behavior.

Once you know these patterns, you can optimize your entire marketing funnel to attract more of those high-value customers.

2. Double Down on Your Best Channels

The best channel is the one that brings your highest-value customers at a sustainable cost. By investing more where you get the best return, your CAC just goes down over time.

- Identify your top-performing channels using Net profit on ad spend by channel.

- Shift budget gradually. Maintain at least 20-30% of your total budget on them initially.

- Monitor performance metrics. Aim for 3:1 ROAS ratio as a good benchmark. Anything lower than that is a flag that you better slow down.

3. Improve Conversion Rate First

Conversion rate is the percentage of visitors who make a purchase. Here are the main parts to optimize:

- Landing pages: Make sure your pages are clear, fast, and easy to navigate.

- Product pages: Use detailed descriptions, high-quality images, and videos.

- Calls-to-action: Buttons and prompts should be obvious and compelling.

- Checkout Process: Simplify it, reduce steps, and offer guest checkout.

- Trust signals: Add reviews, testimonials, guarantees, and security badges.

- Loading speed: Fast loading keeps visitors engaged.

Since your CAC = Total Marketing Spend ÷ Number of Customers Acquired, if you get more customers from the same traffic (higher conversion rate), your CAC goes down automatically.

4. Stay on Top of Profit Margin

Profit margin is the profit as percentage after subtracting all the costs from total revenue. Tracking profit margin alongside CAC over time reveals your true cost efficiency. According to Harry Chu, here’s the pitfall to avoid no matter what.

High CAC with low profit margin. That means you’re spending a lot to acquire each customer, but after covering all costs, you have no profit at all.

So, what’s healthy?

What is a Healthy Customer Acquisition Cost?

A healthy CAC benchmark is when it’s less than a third of your customer’s lifetime value (CLV), often reflected in a 1:3 CAC-to-CLV ratio. It’s a buffer. Enough breathing room to cover all operating costs, handle unexpected expenses, and still turn a profit.

A healthy CAC should also be significantly lower than your profit margin. There’s no one-size-fits-all ratio—it just needs to leave you with a good profit margin after all expenses.

Customer acquisition cost is a critical marketing KPI—it’s a business-critical metric. By understanding your CAC, you can make better decisions around pricing, scaling your ads, and improving your overall sales efficiency.

To take your CAC tracking to the next level, consider using tools like TrueProfit. It’s a Shopify net profit analytics platform, which automatically calculates CAC alongside CLV, ad spend, and real-time profit—giving you a full picture of your marketing performance without messy spreadsheets.

Lila Le is the Marketing Manager at TrueProfit, with a deep understanding of the Shopify ecosystem and a proven track record in dropshipping. She combines hands-on selling experience with marketing expertise to help Shopify merchants scale smarter—through clear positioning, profit-first strategies, and high-converting campaigns.

Shopify profits

Shopify profits