Gross Margin vs Operating Margin: Key Difference (+Examples)

Gross margin and operating margin are two key business performance metrics. Though they’re closely related, gross margin vs. operating margin aren’t the same.

Gross margin shows how much profit you keep after covering the cost of goods sold (COGS). Basically, it tells you how profitable your products are before other expenses.

Operating margin goes further, showing how much profit you keep after paying for operating expenses like rent, salaries, and marketing, giving you a clearer view of your business’s overall efficiency.

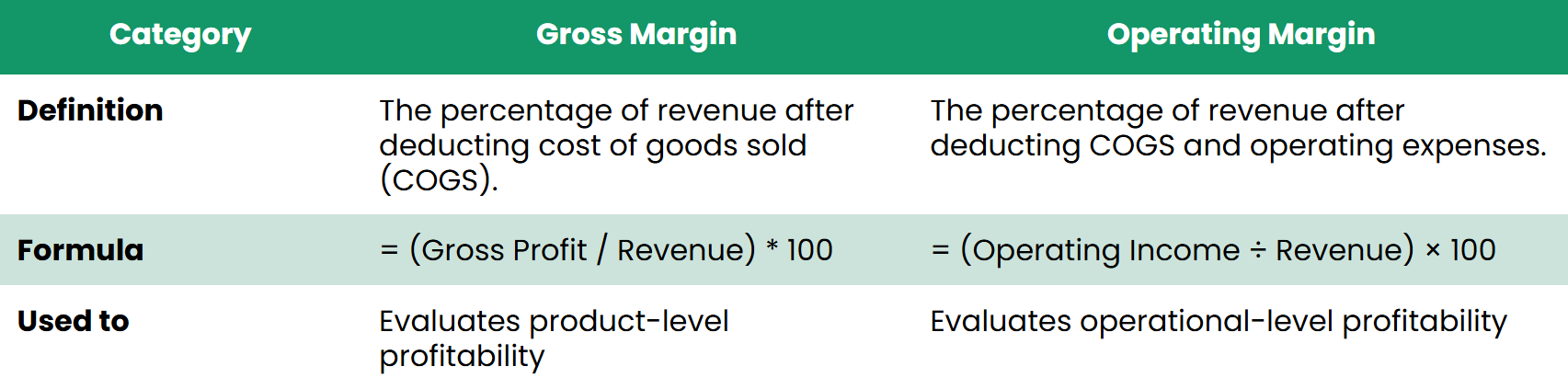

Here’s a quick look at the table comparing the two metrics:

This guide will dig deeper into what the two metrics are, how to calculate them, how they're used and some industry benchmarks.

In this blog:

Gross Margin vs Operating Margin: Key Differences Breakdown

1. Defintion

Gross margin is the percentage of revenue remaining after deducting the cost of goods sold (COGS). This percentage is often referred to as the gross profit margin and is a key indicator of product-level profitability.

On the other hand, operating margin indicates the percentage of revenue left after deducting both COGS and operating expenses. This metric helps you understand how well your company controls operational costs while staying profitable.

2. Calculation

Gross Margin is calculated by dividing gross profit (revenue minus COGS) by revenue.

For operating margin, take your gross profit and subtract your operating expenses—like rent, salaries, and utilities.

For example, if your business brings in $100,000 in revenue and your cost of goods sold is $60,000, your gross margin would be 40%. If you also have $25,000 in operating expenses, your operating profit would be $15,000, resulting in an operating margin of 15%.

3. Application

Gross margin is used to analyze profitability at the product level, helping you decide whether you need to adjust prices or find more cost-effective suppliers.

Meanwhile, operating margin gives you a broader view of your business’s financial health, showing if your operations are running efficiently enough to support sustainable profit.

Aspects | Gross Margin | Operating Margin |

|---|---|---|

When It Increase | Indicates higher profit per sale after product costs are covered | Indicates the business is retaining more profit after paying for operating expenses |

When It Decrease | Suggests rising production costs or prices set too low | Suggest operating expenses are rising faster than sales growth |

Profit Impact | Directly impact gross profit | Directly impact operating profit |

Action Suggested | Consider adjusting prices, lowering production costs, or negotiating better supplier rates | Review and reduce operating expenses |

A higher gross margin means you’re making more profit from each sale after paying for your products. If this metric drops, it flags your costs might be rising or your prices are too low. When that happens, you may need to trim production costs, find better supplier rates, or raise prices to keep your business profitable.

Your operating margin goes higher when your business keeps more profit after paying for day-to-day expenses. Now, if your operating margin starts to drop, it’s a heads-up that your expenses are eating into your profit. Maybe you’ve hired more people, spent more on ads, but your sales don’t grow enough to cover those extra costs.

What is a Good Gross Profit Margin?

A “good” gross profit margin depends on your industry, but generally, the higher, the better—as long as it’s sustainable. Many high profit margin businesses aim for a gross margin between 30% to 50%, while some niches, like luxury products, may see margins above 60%.

What is a Good Operating Profit Margin?

A 10% operating profit margin is average, and 20% is excellent. It shows how much profit you keep after paying for daily business costs. Just remember, high debt can reduce these profits, as interest payments come out of your operating income.

Is Higher Gross Profit Margin Better?

In general, yes—a higher gross profit margin is better because it means you’re keeping more profit from each sale after covering your product costs.

But, a very high margin could mean your prices are too high, which might hurt sales if customers can find similar products for less elsewhere.

Streamline Margins Tracking With Automation

Understanding the difference between gross margin vs operating margin is essential for getting a clear picture of your business's profitability.

While gross margin tells you how efficiently you're producing or sourcing products, operating margin reveals how well you're managing overall operational costs. Both metrics are powerful on their own but even more valuable when used together to guide pricing, spending, and growth decisions.

If you're looking to track both margins accurately and effortlessly, tools like TrueProfit can automate the process and give you real-time visibility into your profit metrics so you can focus on scaling with confidence.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits