Churn Rate: What It Is & How to Calculate It?

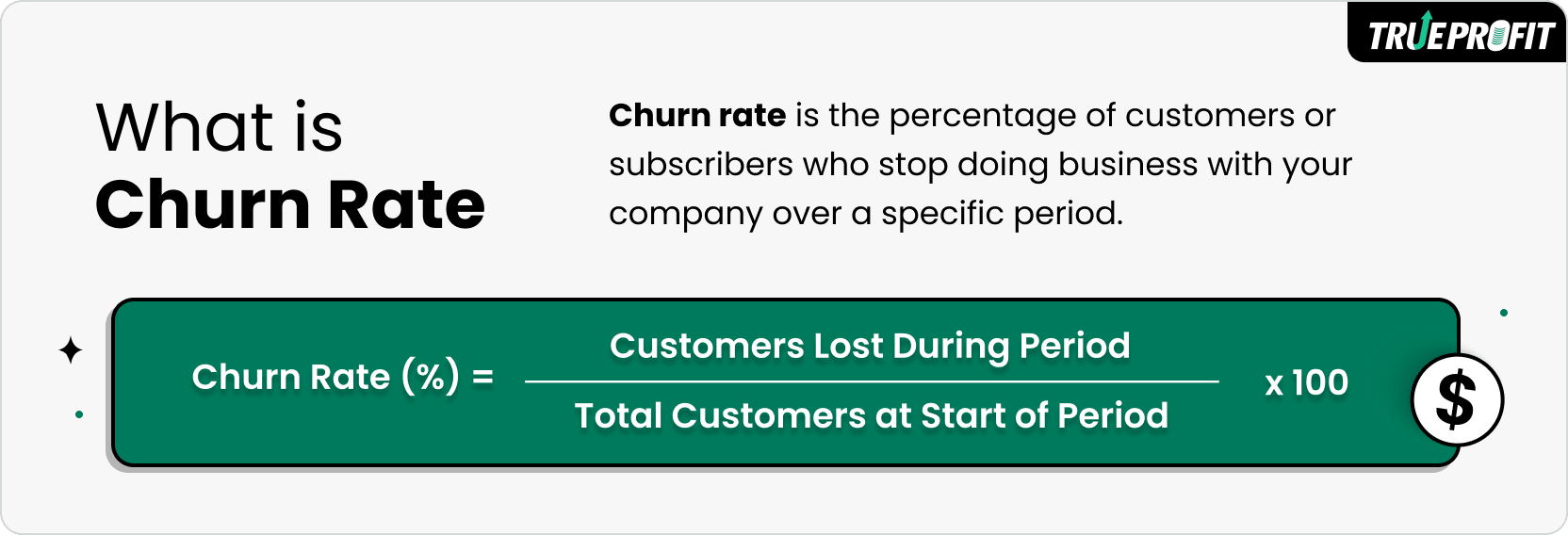

Churn rate is the percentage of customers or subscribers who stop doing business with your company over a specific period.

Calculating it is simple:

Churn Rate (%) = (Customers Lost During Period ÷ Total Customers at Start of Period) × 100

Monitoring churn helps you understand retention health, spot revenue leaks, and evaluate the effectiveness of your strategies.

In this guide, we’ll cover what churn rate means, how to calculate it, real examples, benchmarks, and ways to control it so you can keep your customer base healthier.

In this blog:

What is the Churn Rate?

Churn rate is the percentage of customers (or subscribers) who stop doing business over a given period. It’s also called attrition rate or customer turnover.

It's the inverse of retention rate—the percentage of returning customers over a specific period. To simply put, retention rate measures the percentage of customers you keep; churn rate measures the percentage you lose.

How to Calulcate Churn Rate?

The basic formula is:

Here’s 4 simple steps on calculating it:

Step 1 — Define the time period. Decide whether you’re measuring churn monthly, quarterly, or annually.

Step 2 — Count starting customers. Record the number of active customers at the very start of the period.

Step 3 — Count customers lost. Determine how many customers canceled, stopped using your service, or didn’t renew within that period.

Step 4 — Plug numbers into the above formula. Churn Rate (%) = (Customers Lost During Period ÷ Total Customers at Start of Period) × 100

Example of Churn Rate

Let’s imagine you run a streaming service:

- Start of month: 1,000 subscribers

- End of month: 950 subscribers

- Subscribers lost: 50

Churn Rate = (50 ÷ 1,000) × 100 = 5%. This means 5% of your subscribers canceled that month. If your goal is to grow, your acquisition rate must exceed your churn rate.

What is It Used For?

Churn rate is a business KPI metric mostly used to evaluate retention strategy effectiveness. It helps track the rate of customer loss, giving a clear view of where losses are happening and whether your retention efforts are protecting the most profitable customers.

By doing so, churn rate can help business owners:

- Spot leaks in the customer base

- Prioritize high-value customers (when paired with Customer lifetime value)

- Benchmark performance (against industry averages or MoM, YoY)

What is the Average Churn Rate?

5% and 7% per month is the the average churn rate across industries, varying widely depending on the market:

- SaaS companies: 5–7% annually for enterprise products, up to 10–15% for SMB-focused tools.

- Telecom & cable: Around 1–2% monthly.

- Subscription boxes: Often 10%+ monthly due to impulse sign-ups.

- Streaming services: Typically 2–6% monthly.

In general, the lower, the better. Yet, a healthy churn rate still depends on industry niche and profit margin benchmarks. This is why store owners track it alongside Customer lifetime value (LTV) and Customer acquisition cost (CAC) to see if their customer retention efforts are sustainable.

7 Ways to Control Churn Rate in Business

Not all churn is equally harmful. The key is to spot high-impact churn — the type of customer loss that hits your net profit and growth the hardest. Fixing those churns will significantly affect your bottom line.

Here are 7 proven strategies to tackle high-impact churn:

1. Focus on Key Customer Segments

Losing a low-value, low-margin customer isn’t the same as losing a high-CLV, repeat buyer. Instead of just looking at your total churn rate, break it down by segments — for example, first-time buyers vs. repeat customers, high-value vs. low-value buyers, or subscription tier.

If churn is high in low-profit segments, it might not be worth focusing your retention efforts there. Focus resources where LTV (lifetime value) minus CAC is highest, preserving your profit margin.

2. Prioritize High CLV Customers

A “healthy” churn rate is only healthy if the CLV remains above your acquisition and retention costs. Calculate CLV regularly (total revenue per customer × average lifespan × gross margin) and compare it against churn trends. If churn spikes in your most profitable group, it’s an urgent red flag.

3. Address Trigger Points Early

Look for patterns in when customers drop off after purchase. Use cohort analysis in your analytics platform to see at which month/week retention drops sharply. If churn spikes after month 2, that’s where to insert win-back offers or personalized engagement, rather than blanket retention spending.

4. Managing Product Returns Effectively

High return rates often predict future churn — and they’re measurable. Track return rates alongside customer status. If customers who return 2+ products have a 70% churn probability, target them with product education, quality fixes, or personalized support instead of costly discounts.

5. Speed Up Customer Support Response

Slow support can drive churn, and it’s easy to track. Compare churn rates for customers whose tickets were resolved in <24 hours vs. >48 hours. If faster resolution correlates with higher retention, you can justify investing in efficiency over blanket loyalty discounts.

6. Keep High-Risk Customers Engaged

Inactive customers are the highest churn risk. Track login frequency, email open rates, or repeat purchase intervals. For example, if customers who haven’t purchased in 45 days churn at 60%, set automated win-back campaigns for that exact time frame, avoiding over-targeting engaged customers.

7. Strategically Use Discounts

Sometimes discounts win the sale but accelerate churn if they attract price-sensitive buyers. Tag orders placed with heavy discounts and measure their churn rate vs. full-price buyers. If discount buyers churn faster, reduce deep discounting and invest in value-based retention strategies instead.

Understanding churn rate and retention metrics is essential for keeping your customers and growing your business sustainably. To make tracking these numbers even easier, tools like TrueProfit can help Shopify store owners see their net profit clearly, monitor customer behavior, and make data-driven decisions to improve retention without sacrificing margins.

Lila Le is the Marketing Manager at TrueProfit, with a deep understanding of the Shopify ecosystem and a proven track record in dropshipping. She combines hands-on selling experience with marketing expertise to help Shopify merchants scale smarter—through clear positioning, profit-first strategies, and high-converting campaigns.

Shopify profits

Shopify profits