How To Use Profit Margin Formula in Google Sheets?

Most businesses use profit margin formula in google sheets because it’s flexible, easy to update, and lets you organize all your revenue and cost data in one place. But let’s be honest—it’s also easy to get lost in complex spreadsheets, especially if formulas aren’t your thing.

In this guide, I will show you exactly how to use the profit margin formula in Google Sheets—step by step, with clear formulas and real examples you can use right away.

Before we start...

If you're just looking to quickly check your net profit margin — no setup, no formulas —

👉 Use TrueProfit’s free net profit calculator

This net profit margin calculator is already set up to account for all your key costs like COGS, ad spend, shipping, and more. It’s faster, more accurate, and gives you the number right away.

But if you’re someone who wants to track your profit margin trends over time or prefer working in Google Sheets, this step-by-step guide is for you.

Let’s dive in.

In this blog:

How to Use the Profit Margin Formula in Google Sheets

The standard net profit margin formula is:

To get your profit, subtract your cost (usually cost of goods sold, or COGS) from your total revenue. Then divide that profit by revenue and multiply by 100 to express it as a percentage.

Example: If you made $10,000 in sales and your costs were $7,000, your profit is $3,000.

So your profit margin is:

(3,000 ÷ 10,000) x 100 = 30%

In Google Sheets, this becomes a simple cell-based formula like:

=((A2 - B2) / B2) * 100

Let’s break it down:

- Revenue is the total amount you earn from sales. In this example, it’s in cell B2.

- Cost (usually Cost of Goods Sold) is in cell C2.

- Profit is calculated by subtracting cost from revenue: A2 - B2

Then, divide that profit by revenue and multiply by 100 to get the percentage.

Using this profit margin formula in Google Sheets, you can quickly calculate profit margins for multiple products, sales channels, or time periods—all in one place.

Step-by-Step Guide to Calculating Profit Margin in Google Sheets (with Example)

Let’s walk through a real-life example of calculating profit margin in Google Sheets. Imagine you run a small t-shirt business. You sell each t-shirt for $25, but the cost to make and ship each shirt is $15. Let’s calculate the profit margin for each t-shirt sale.

Step 1: Set Up Your Google Sheets

First, organize your data in Google Sheets like this:

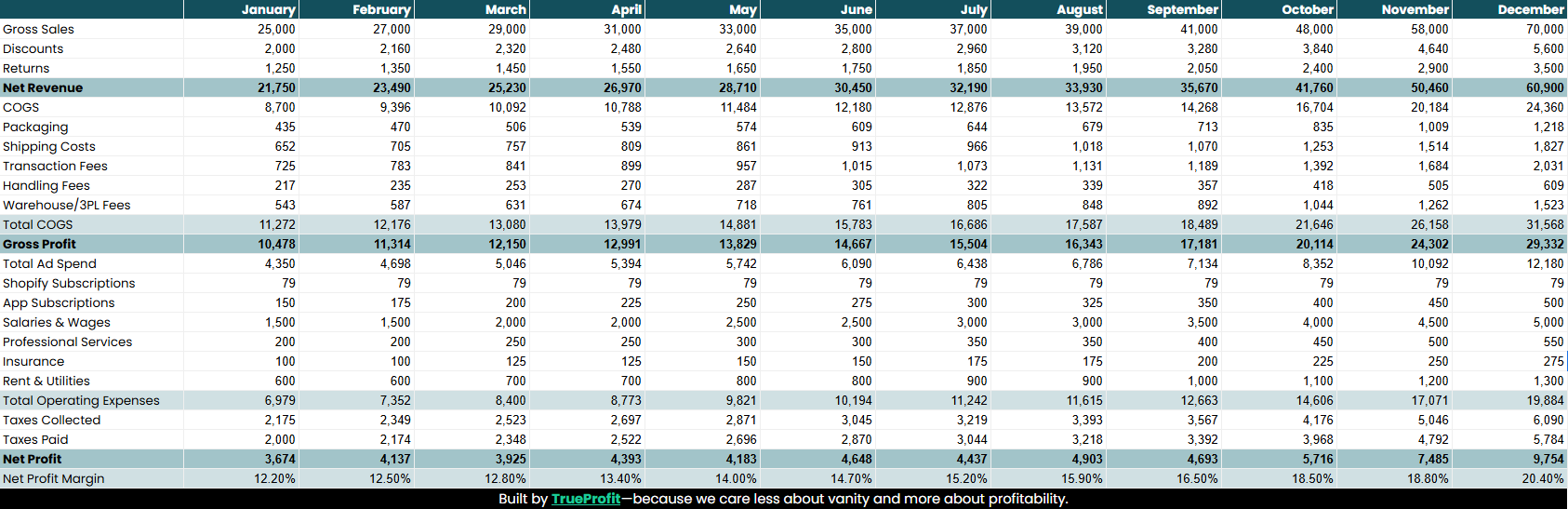

👉 Use this plug-and-play P&L template built for eCommerce stores.

Step 2: Apply the Profit Margin Formula

First, check how your Profit Margin column is formatted:

If the cell is set to Percentage format (Format > Number > Percent), use this formula:

=(A2 - B2) / A2

Google Sheets will automatically show the result as a percentage (e.g., 40%).

If the cell is set to Number format, use this formula instead:

=((A2 - B2) / B2) * 100

This formula will subtract the cost from the revenue to find the profit ($25 - $15 = $10), then divide that by the revenue ($10 ÷ $25), and multiply by 100 to get the percentage.

Step 3: The Result

Once you apply the formula, you’ll see the result in the Profit Margin column. For this example:

=((25 - 15) / 25) * 100 = 40%

This means your profit margin for each t-shirt sold is 40%.

Step 4: Track More Data

Let’s say you sell multiple t-shirts each month. You can now extend this formula to track multiple sales and calculate the profit margin for each. By following these steps, you can easily calculate profit margin for your t-shirt business or any other product using Google Sheets.

Common Mistakes to Avoid in Profit Margin Calculation

When calculating profit margins in Google Sheets, even small mistakes can significantly affect your results. Here are some common errors you should watch out for and how to avoid them:

1. Incorrect Data Input

Mistake: Entering incorrect revenue or cost data, such as mixing up the numbers or using outdated values, can lead to inaccurate calculations.

How to Avoid It: Double-check your data entries to ensure that the revenue (sales price) and cost (production or shipping) figures are accurate. Accurate data is key when using the profit margin formula in Google Sheets.

2. Using the Wrong Formula

Mistake: Using the wrong formula or failing to subtract cost from revenue before dividing can give incorrect results.

How to Avoid It: Always use the correct profit margin formula: =((Revenue - Cost) / Revenue) * 100. In Google Sheets, make sure that the formula references the correct cells for revenue and cost.

3. Forgetting to Format the Result as a Percentage

Mistake: After applying the profit margin formula, the result may show as a decimal (e.g., 0.4) instead of a percentage (e.g., 40%).

How to Avoid It: After entering the formula in Google Sheets, format the profit margin result as a percentage. Go to Format > Number > Percent to display the result correctly.

4. Not Using Absolute References for Fixed Data

Mistake: If you're using the same revenue or cost figure across multiple rows but forget to use absolute references (e.g., $B$2), your formula may pull incorrect data when copied to other rows.

How to Avoid It: Use absolute references for fixed values in your Google Sheets profit margin formula. For example, =((B2 - C$2) / B2) * 100 ensures the formula remains accurate across multiple rows.

5. Mixing Up Profit and Revenue Calculations

Mistake: Confusing profit and revenue calculations. Profit should always be calculated as revenue minus cost, not revenue divided by cost.

How to Avoid It: Ensure that you're subtracting cost from revenue to calculate profit before applying the formula in Google Sheets.

The Limits of Using Google Sheets to Track eCommerce Profits

That said, while Google Sheets is a helpful tool to get started, it’s important to be honest—it’s not a long-term solution.

1. Heavy Reliance on Manual Input

Manually entering data like revenue, COGS, ad spend, shipping, and transaction fees takes time—and the more you scale, the more room for error. One missed decimal or copy-paste mistake can throw off your entire margin calculation. Plus, if multiple team members are editing the sheet, version control becomes a mess.

Real risk: You’re basing business decisions on numbers that might not even be accurate.

2. Static Formulas Can’t Handle Real-Time Changes

Google Sheets runs on formulas you create—but those don’t update dynamically when new orders come in, COGS fluctuate, or ad spend spikes. You have to update those manually, which leads to lagging data and outdated margins.

Real risk: You're reacting to last week’s numbers, not today’s reality.

3. Missing Hidden or Fluctuating Costs

Most sellers forget to include variable costs like:

- Transaction fees from Shopify, Stripe, or PayPal

- Shipping or fulfillment fees (especially if they vary by order or location)

- Product costs that change due to supplier price updates or currency rates.

Google Sheets doesn’t flag these for you—it only reflects what you manually input. So these missing costs silently eat into your real profits.

Real risk: You think you’re profitable, but you're not.

4. It Doesn’t Scale With Your Business

What works for 10 orders a week won't work when you're handling hundreds or thousands. Google Sheets becomes a bottleneck, not a solution. You’ll spend more time managing the tool than managing your business.

Real risk: You slow down your growth just trying to keep your numbers straight.

Use Google Sheets if: | Time to switch to a real-time analytics tool when: |

|---|---|

|

|

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.

Shopify profits

Shopify profits