7 Best Profit and Loss Apps to Track E-commerce Profits in 2026

Tracking profit and loss is no longer optional. It’s essential for merchants who want to scale smarter, not harder. With rising ad costs, complex fees, and shifting margins, knowing exactly what you’re earning (or losing) per day can be the difference between growth and burnout. Profit and loss tracker apps can help businesses gain immediate insight into their financial status at any moment.

In this guide, we’ve rounded up the 7 best profit and loss apps that help e-commerce brands get clarity on their numbers automatically in 2026. Whether you're a solopreneur or scaling into multiple six-figures, these tools make profit tracking actionable and stress-free. If you're looking for a more detailed way to calculate, a profit and loss calculator app could be the perfect choice.

In this blog:

1. TrueProfit – Best Overall for Real-Time Profit Tracking

Best for: Shopify merchants who want to see true profit in real time.

TrueProfit stands out as the go-to profit and loss app for e-commerce, designed specifically for Shopify sellers. It automatically tracks every cost that affects your bottom line like COGS, ad spend, shipping, transaction fees, and any custom expenses in order to update your true net profit in real time, with zero manual input.

Key benefits:

- Real-time net profit on 4 levels: store, ad, product and order.

- Ad spend integration (Meta, Google, TikTok, X, Pinterest,...).

- Auto-sync with shipping, dropshipping and POD platforms.

- Advanced analytics like LTV, CAC, marketing attribution.

- Mobile app for on-the-go profit tracking.

Why it’s #1 in Shopify Profit Tracker App: Rather than flooding you with surface-level metrics, TrueProfit centers everything around real net profit, giving Shopify merchants clarity on what’s actually working so they can make smarter, faster business decisions.

2. QuickBooks Online – Best for Full-Service Accounting

Best for: Brands that need an all-in-one accounting suite beyond just e-commerce insights.

QuickBooks is a trusted name in accounting—and for good reason. It automates everything from invoicing to payroll, while giving you access to professional-grade profit and loss statements. However, it’s more tailored for general small businesses than DTC brands. If you want a quick check on your financial health, try this free profit margin calculator instead.

Key benefits:

- Comprehensive accounting features

- Automated P&L and cash flow reports

- Syncs with banks, Shopify, PayPal, and more

Limitations: It doesn’t break down product-level profitability without third-party add-ons.

Pricing: Starts at $38/month for the Simple Start plan, with more features in higher tiers.

3. Xero – Best for Bookkeeping + Third-Party App Support

Best for: Brands working with accountants or managing finances across multiple tools.

Xero offers smart financial reporting with clean UI and top-notch integrations. It’s not purpose-built for e-commerce, but its custom P&L reports can serve ecomm sellers well—especially when combined with inventory or analytics extensions.

Key benefits:

- Customizable financial reports

- Shopify, Stripe, PayPal integrations

- Scalable for multi-user businesses

Pricing: Starts at $25/month, with higher plans unlocking advanced features and multi-currency support.

4. Bench – Best for Hands-Off Bookkeeping Services

Best for: Founders who want white-glove bookkeeping without lifting a finger.

Bench is more than an app—it’s a service that assigns you a dedicated bookkeeper. Each month, they deliver a tidy profit and loss report, ready for decision-making or tax filing. It’s ideal if you want stress-free, done-for-you accounting.

Key benefits:

- Dedicated human bookkeeper

- Monthly P&L summaries emailed directly

- Year-end tax-ready financials

Pricing: Starts at $299/month, which includes bookkeeping and P&L delivery. Premium plan with tax filing available.

5. Hurdlr – Best for Solo Entrepreneurs

Best for: Dropshippers or freelancers needing lightweight, mobile-first tracking.

Hurdlr automatically tracks income, expenses, and tax estimates in real time. It’s perfect for one-person shops looking to stay profitable without diving into spreadsheets. However, it lacks SKU-level profitability insights.

Key benefits:

- Real-time profit calculation

- Automatic mileage and expense tracking

- Mobile app with easy setup

Pricing: Free basic plan available; Premium plan starts at $8.34/month unlocks real-time tax estimates and more.

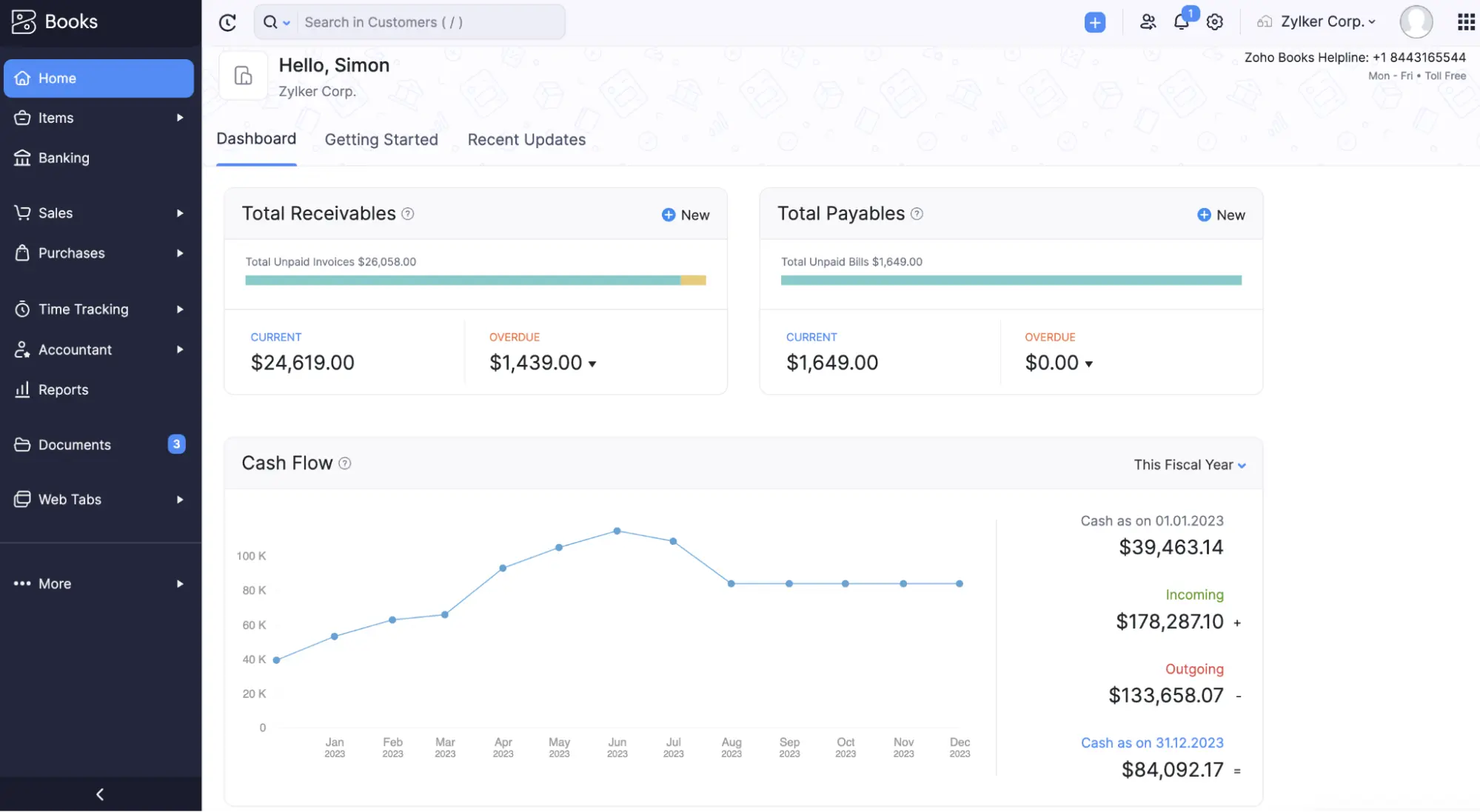

6. Zoho Books – Best for Growing Multi-channel Sellers

Best for: Ecomm brands selling across Amazon, eBay, Etsy, and Shopify.

Zoho Books offers robust accounting tools with automation, inventory syncing, profit and loss statement app integration and P&L reporting. While not built solely for DTC brands, it’s highly adaptable and great for scaling across sales channels.

Key benefits:

- Strong multi-channel support

- Automation for invoicing and payments

- P&L reporting with custom tags and filters

Pricing: Starts at $15/month, with tiered plans offering advanced analytics and inventory features.

7. Wave Accounting – Best Free Bookkeeping App

Best for: Bootstrapped merchants and early-stage brands.

Wave delivers core accounting features for free—including clean profit and loss statements, basic invoicing, and payment tracking. It’s ideal if you're just starting out and want to keep tabs on income without a paid plan.

Key benefits:

- Free P&L tracking and reports

- Easy-to-use dashboard

- Ideal for freelancers and microbrands

Pricing: Free Starter plan for basic needs, Pro plan starts at $19/month for more features. Optional payment processing and payroll services incur small fees.

Which Profit & Loss App Should You Choose?

If you’re a growing e-commerce merchant, TrueProfit is hands down the best app to track your real-time profitability. It removes the guesswork, shows you exactly where your money is going, and helps you stay lean while scaling fast.

Need full accounting? Consider QuickBooks or Xero. Want bookkeeping done for you? Bench is a great pick. Just starting? Wave can help you get organized.

Understanding your P&L isn’t just about finance, it’s about making smart, confident business decisions every day. Whether you're testing new products, scaling ads, or prepping for tax season, these tools help you stay on top of your numbers so you can focus on what matters: growth.

Ready to stop guessing and start growing? Try TrueProfit free and see your real profit today.

Tracy is a senior content executive at TrueProfit – specializing in helping eCommerce businesses scale profitably through content. She has over 4 years of experience in eCommerce and digital marketing editorial writing. She develops high-impact content that helps thousands of Shopify merchants make data-driven, profit-focused decisions.

Shopify profits

Shopify profits