Profit & Loss (PnL): An Easy Guide for E-comm Businesses

Profit and loss (PnL) statements are vital in the world of finance. They provide a comprehensive overview of a business's financial performance, including its revenue, expenses, and profits over a specific period.

By looking at PnL statements, businesses can evaluate their financial health, make informed business decisions, and identify areas for improvement.

Some commonly asked questions about PnL statements include: “What is PnL?”, "What is the difference between revenue and net income?" and "How can I use a PnL statement to make informed business decisions?".

All those questions will be clarified in today’s article. Let's dive in!

In this blog:

What Is Profit & Loss (PnL)?

PnL statements, also known as income statements, are financial documents that show a business's revenue, cost of goods sold, gross profit, operating expenses, operating profit, and net profit.

- What is PnL: An abbreviation for "Profit and Loss", also known as “P&L”.

- What it tracks: Earned money vs spent money.

- What it informs: if you run at a profit or a loss throughout that time.

Source: CFI’s Financial Analysis Fundamentals.

In different contexts, the meaning of PnL can change slightly.

For example, PnL meaning in trading usually refers to realized and unrealized gains from positions, while in eCommerce, PnL reflects operational profitability across products, ads, and fulfillment. Some merchants also look at today's PnL meaning to understand daily performance fluctuations.

A profit and loss statement summarizes all the activity recorded in your income and expenses accounts over the specified time. Income typically includes sales while expenses might cover things like payroll, advertising, rent, and insurance.

The statement will include all sales, including credit sales that your customers might not have paid yet. It will also include bills for expenses that you have incurred but not paid.

Your total profit or loss is what you’ve earned minus what you’ve spent:

- If this amount is positive, it’s called net income.

- If it’s negative, it’s called a net loss.

These statements are prepared at the end of a business's financial period, be it monthly, quarterly, or annually. They are used to evaluate a business's financial performance, make informed business decisions, and identify areas for improvement.

A PnL statement can also help you calculate profit margin and displays how well the business is converting revenue into profits.

How Can A Profit & Loss (PnL) Report Drive Business Growth?

PnL statements are an essential tool for businesses looking to evaluate their financial performance, make informed business decisions, and identify areas for improvement.

Profit and loss statements are important for businesses because they:

- Evaluate financial performance: Offer insights into a business's financial health, including revenue, expenses, and profits.

- Make informed business decisions: Helps businesses make strategic decisions, such as increasing revenue or cutting expenses.

- Identify areas for improvement: Businesses can identify areas for improvement.

- Assess financial health and potential for growth: Assess a business's financial health and potential for growth.

- Identify risks and opportunities for growth: Highlight potential risks and opportunities for growth.

- Track financial progress over time: Comparing PnL statements from different periods helps businesses track their financial progress over time.

- Provide insights into financial performance: Offer valuable insights into a business's financial performance.

- Help businesses make informed decisions: Provide essential information for businesses to make informed decisions about future goals and strategies.

Overall, these statements are a crucial part of a business' financial management, offering insightful information about performance and assisting you in making profit-driven choices regarding long-term objectives or strategies.

How To Read a Profit & Loss (PnL) Report?

Now that you understand the basics of PnL, let's break down how to read a PnL report effectively. A profit and loss statement consists of six key components, grouped into two categories:

- Revenue & Profitability Metrics – Show how much your business earns and retains.

- Expenses & Cost Metrics – Detail the costs involved in running your business.

To accurately assess financial performance, you need to understand these six essential components:

1. Revenue

The total income generated from sales before deducting any expenses. It’s a key metric that reflects business growth.

For example, suppose your store attracted:

- April: $5.500

- May: $6.800

- June: $9.700

Then your total revenue in Q2 is $22.000.

2. Cost of Goods Sold (COGS)

This indicates the costs a business expended in creating the products or services it sold. Raw material expenses, direct labor charges, and other direct costs are included. A crucial part of a PnL statement is COGS since it sheds light on a business's manufacturing expenses.

3. Gross Profit

The profit after subtracting COGS from revenue. This indicates how efficiently your business produces and sells goods.

4. Operating Expenses

The costs of running daily business operations, such as salaries, rent, utilities, and marketing. Monitoring these expenses helps optimize spending.

5. Operating Profit

The profit left after deducting operating expenses from gross profit. This metric highlights how efficiently your business is managed.

6. Net Profit

This is the total amount of money left over after deducting all expenses from revenue. Net profit is a critical component of a PnL statement because it provides insights into a business's overall financial health.

Understanding these components helps businesses analyze revenue streams, production costs, and operating expenses to make informed financial decisions.

What Risk Factors Affect Your Profit & Loss (PnL) Report?

1. Changes in Market Demand

If demand decreases, the business may experience a decline in revenue, which can negatively impact the PnL report. On the other hand, if demand increases, the business may experience an increase in revenue, leading to a positive impact on the statements.

2. Increases in Production Costs

PnL can be affected if production costs increase, such as materials or labor. This can lead to a decrease in profits, which can negatively impact the overall profit and loss. Companies need to be cautious when making decisions that can lead to increased production costs, as it can impact their bottom line.

3. Changes in the Regulatory Environment

Companies need to stay up to date with changes in the regulatory environment to ensure they are operating in compliance with regulations.

For example, new taxes or regulations can result in increased costs for the business, which can negatively impact the PnL.

4. Fluctuations in Currency Exchange Rates

This affects especially if the business has operations in multiple countries. If the currency exchange rate changes, it can impact the business's revenue and expenses, leading to a positive or negative impact, depending on the direction of the change.

5. Natural Disasters/Unforeseen Events

In rare cases, some events can disrupt business operations, impacting the business's financial performance. These circumstances are uncontrollable and unpredictable, most of the time.

For example, if a business's production facility is damaged by a natural disaster, it can lead to a delay in production, and a decrease in revenue, which can negatively impact the PnL.

How to Analyze a Profit & Loss (PnL) Report?

Maximize your PnL report with these 6 steps:

- Set Clear Goals – Define targets like increasing revenue or cutting expenses to track progress.

- Monitor Performance – Review statements regularly to spot areas for improvement.

- Identify Trends – Compare past reports to recognize patterns and make data-driven decisions.

- Benchmark Against Competitors – Measure performance against industry standards to stay competitive.

- Consult Experts – Work with accountants or finance professionals for accurate insights.

- Combine with Other Reports – Use alongside balance sheets and cash flow statements for a complete financial picture.

By following these steps, you can turn your PnL report into a powerful tool for business growth.

What Is The Best Way To Create A Profit & Loss (PnL) Report?

1. The Manual Approach: Traditional Accounting Methods

Many businesses rely on spreadsheets or accounting software to compile their P&L statements using either:

- Cash accounting method: Records transactions when cash is received or paid. Simple but can be misleading.

- Accrual accounting method: Records transactions when they occur, regardless of cash flow. More accurate but complex.

While these methods work, they require time-consuming calculations, constant updates, and financial expertise to ensure accuracy. Additionally, manual tracking increases the risk of errors, making it harder to get a clear, real-time picture of profitability.

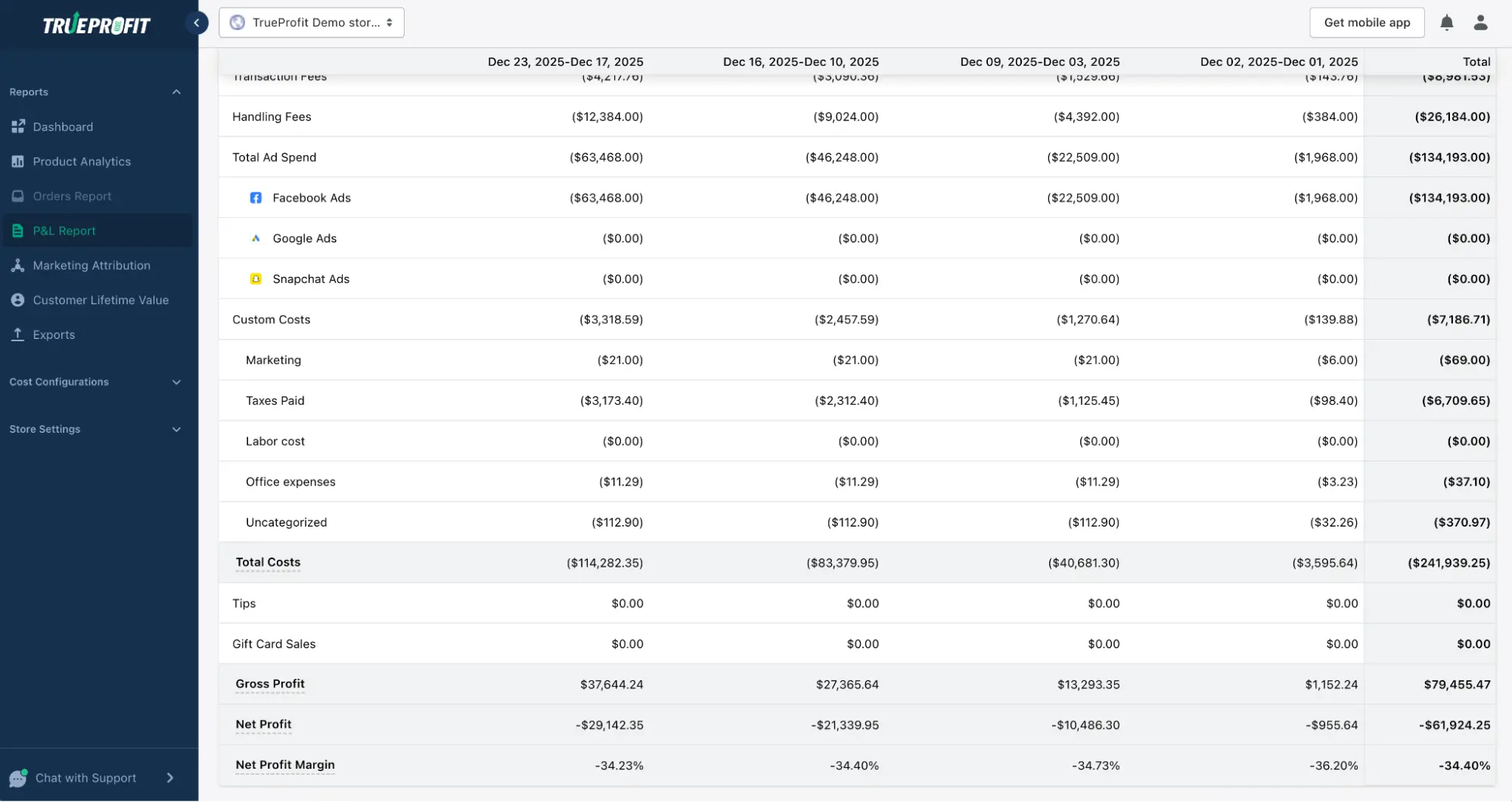

2. The Automatic Approach: TrueProfit – Real-Time PnL Reporting

For Shopify merchants, TrueProfit provides a real-time PnL report, not just a static report. Instead of relying on spreadsheets or month-end accounting, merchants get a live view of profitability across products, orders, and marketing channels.

With TrueProfit, you get:

- Real-time net profit dashboard: Instantly see how much you're truly earning after all costs.

- Complete P&L reporting: Track weekly and monthly performance with clear, P&L tables.

- Automatic cost tracking: COGS, ad spend, shipping fees, transaction fees,... all synced and calculated automatically.

- Profit-based product analytics & attribution: Identify your most profitable products and channels to scale the right areas.

- Customer lifetime value: Understand exactly how much each customer is worth to optimize CAC.

- Custom metrics: Build and monitor any KPI your business relies on, all updated in real time.

This real-time visibility helps merchants quickly identify profit leaks — whether they come from rising ad costs, shrinking margins, or operational inefficiencies.

For example, when revenue increases but net profit drops, TrueProfit makes it clear whether the issue is:

- Low gross margins

- Increasing customer acquisition costs

- High operating expenses

Instead of guessing or waiting for delayed reports, merchants can act immediately.

By eliminating manual calculations and delayed data, TrueProfit turns PnL from a historical report into a decision-making system, helping businesses optimize pricing, control costs, and scale with confidence.

Let's take a look at a P&L report made by TrueProfit. You can see all the ins and outs of your biz in one single dashboard.

Understanding how a Profit & Loss (PnL) statement works is essential for evaluating whether a business is truly healthy. Revenue alone doesn’t tell the full story — only a clear PnL reveals whether growth is sustainable or quietly eroding profit.

When used correctly, a PnL statement helps businesses identify inefficiencies, optimize pricing and marketing decisions, and scale with confidence. But relying on manual spreadsheets or delayed accounting reports often leads to incomplete or outdated insights.

That’s why having accurate, real-time profit visibility matters. With the right PnL setup, businesses can move faster, make smarter decisions, and focus on what actually drives long-term profitability.

Start tracking what truly matters: net profit, not just revenue.

Irene Le is the Content Manager at TrueProfit, specializing in crafting insightful, data-driven content to help eCommerce merchants scale profitably. With over 5 years of experience in content creation and growth strategy for the eCommerce industry, she is dedicated to producing high-value, actionable content that empowers merchants to make informed financial decisions.

Shopify profits

Shopify profits