Apparel Profit Margin Benchmarks for 2026 (Gross, Operating & Net)

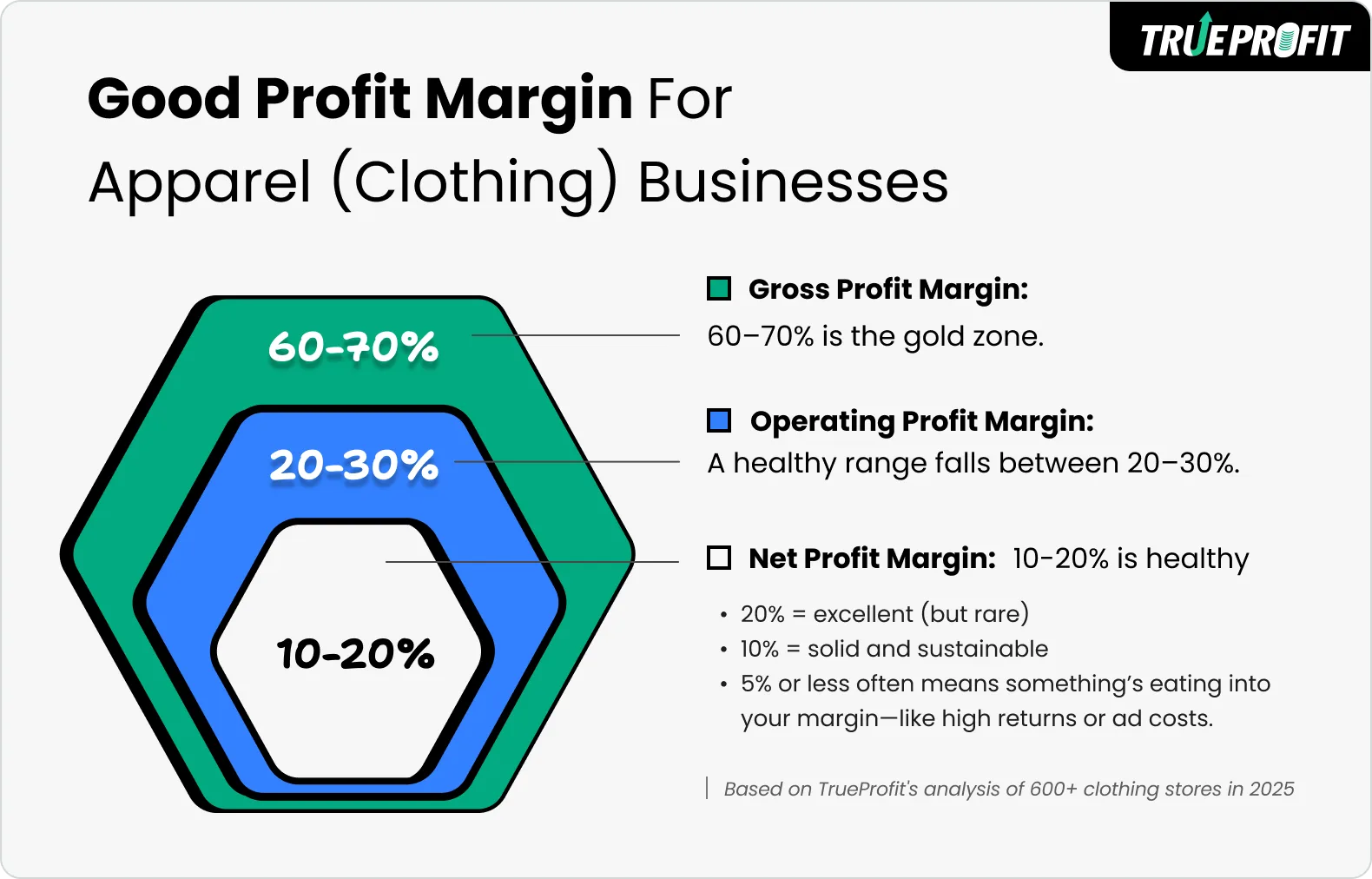

According to TrueProfit’s analysis of 600+ clothing stores, in 2026 good margins for clothing businesses look like this:

- Gross profit margin: 60–70%

- Operating profit margin: 20–30%

- Net profit margin: 10–20%

But wait, before you take these numbers at face value…

These are benchmarks, not rules. They’re a helpful starting point, but not the full story. What truly matters is whether your margins are improving, and whether they make sense for your business model.

So what’s next?

In this guide, you’ll get a deeper look into each margin type. Then, we’ll break down five more metrics that give real context to those numbers, so you can stop guessing and start understanding how healthy your clothing store really is.

In this blog:

What is a Good Profit Margin for Apparel in 2026?

In 2026, clothing stores should aim for 60–70% gross margin, 20–30% operating, and 10-20% net profit margin.

Here’s the bottom line:

- Gross profit margin measures the percentage of revenue left after covering the cost of goods sold. For apparel, 60–70% is the gold zone for gross margin.

- Operating profit margin shows the percentage left after subtracting both COGS and day-to-day operating expenses. A healthy range for operating margin falls between 20–30%.

- Net profit margin tells you what percentage of revenue remains after all expenses like COGS, operating costs, taxes, interest, and one-time charges. A healthy net profit margin looks like this:

- 20%+ = excellent (but rare)

- 10% = solid and sustainable

- 5% or less often means something’s eating into your margin like high returns or ad costs.

In short, apparel margins aren’t one-size-fits-all. What works for a print-on-demand shop won’t work for a premium slow-fashion brand. And that’s because...

Different business models = different cost structures.

- DTC brands usually enjoy better margins since they sell directly to the customer and avoid retailer cuts.

- Wholesale or marketplace sellers (like Amazon or TikTok Shop)? They trade margin for volume and exposure.

- Subscription-based models have recurring revenue but higher churn and retention costs.

And profit margin benchmarks also differ from one category to another. Here’s a quick glance of average profit margin by apparel category.

Apparel Categories | Average Gross Profit Margin | Average Net Profit Margin |

|---|---|---|

Casual Apparel | ~55–65% | ~5–20% |

Formal Apparel | ~45–65% | ~10–20% |

Fast Fashion Apparel | ~50–65% | ~15–20% |

Sustainable Apparel | ~40–50% | ~5–15% |

Luxury Apparel | ~65–80% | ~15–25% |

Seasonal Apparel | ~45–65% | ~5–15% |

👉Use benchmarks as signals, not standards. They help you spot red flags and uncover improvement areas, but always run them through the lens of your specific model.

What Actually Affects Profit Margins in the Clothing Business?

Now that we’ve covered the benchmarks.

Let’s zoom in on what actually drives your margin up (or down).

1. Product Cost (COGS)

Cost of goods sold is a fixed cost controlling almost every decision in clothing brands, from pricing to promotion strategy. In healthy businesses, COGS typically sits around 25–35% of total costs. When it climbs beyond that range, profitability becomes extremely difficult because there are still many other expenses to cover.

Cost of goods sold directly sets your gross profit margin, even strong sales volume with a thin gross margin can still result in negative profit. Meanwhile, brands with better COGS can run sales, bundles, and free-shipping offers without destroying profitability.

2. Pricing Strategy

As we said above, how you price your products will set your margin from day one. Premium pricing can increase margins but may lower conversion if not backed by strong value. Meanwhile, if your pricing is set too close to your COGS, even small expenses such as ads, returns, payment fees, or discounts can easily eat into the profit margin in clothing stores.

Many clothing brands price based on competitors or “what feels reasonable,” then realize later that their margins can’t support marketing or scale. That's why a healthy pricing strategy always starts with margin, not your competitor site.

3. Return & Refund Rate

Let’s face it: High rates of returns and refunds hit clothing retail harder than most categories. Sizing issues, fit expectations, and style preferences mean higher return rates. Pricing absorbs this risk. If your margin is thin, one return can erase the profit from multiple successful orders. Fit issues, sizing confusion, and fabric expectations all lead to costly returns. Every return chips away at your margin with lost revenue, reverse shipping, and restocking labor.

4. Marketing & Ad Spend

In the clothing business, paid ads often account for most customer acquisition especially for newer DTC brands. Because ad spend comes straight out of profit, even a small increase in CAC can erase margins if AOV and net profit per order don’t rise alongside it. That’s how a store with “good performance” on paper can become unprofitable overnight.

5. Fulfillment & Shipping

Fulfillment speed and accuracy directly affect returns and refunds, which silently destroy margins in clothing. Slow shipping leads to impatient customers, chargebacks, and “item not received” claims.

Incorrect fulfillment increases return rates, and the fashion category already has higher-than-average returns due to sizing and fit issues. Every return means you lose shipping fees twice (even more), plus handling fees, while often being unable to resell the item at full price.

6. Overhead Costs

Overhead costs are the ongoing, fixed expenses required to run your clothing business, even when you’re not actively selling more units. It could be brand shoots, staff salaries, returns handling, sampling cost, etc. None of which are tied directly to ad ROAS or product performance, but all of which can totally reduce the overall net profit margin.

If overhead isn’t tracked closely, brands likely think ads or pricing are the problem, when the real issue is this operational cost.

7. Product Type

Clothing items could be: basics (tees, underwear), fashion items (dresses, trend pieces), outerwear (jackets, coats), activewear (leggings, sports bras), denim, footwear, and accessories. Each item has very different production costs, selling pricing, even demands different promotion strategies that result in different ad budgets. They're all costs that directly eat into profit margin.

How to Increase Profit Margins for Clothing Business?

Improving profit margins in a clothing business isn’t about raising prices blindly or cutting costs everywhere. It’s about understanding what is your healthy margin and making intentional decisions from product pricing to fulfillment.

1. Find a Good Supplier

Like we said above, cost of goods is one of the biggest cost types in operating a clothing business. And choosing manufacturers directly influences your cost of goods sold.

Here's how a good supplier can increase your profit margin:

In fashion, many reliable suppliers are based in China and Vietnam, where mature supply chains and efficient production enable competitive pricing and scalable inventory.

In contrast, bad suppliers cause refunds, reshipments, and dead stock, none of which always show up clearly in COGS but all of which erode net profit.

2. Reduce Shipping and Fulfillment Costs Strategically

Shipping can quietly eat away your profit if it’s not actively managed. Review your fulfillment setup regularly and look for opportunities to negotiate rates, switch to lighter packaging, or consolidate shipments.

Offering fewer shipping options or setting minimum order thresholds can also help offset costs. Even small reductions per order add up quickly at scale, making fulfillment optimization one of the highest-impact margin levers in clothing.

3. Control Overhead Before It Eats Your Margin

Overhead costs rarely feel dangerous at first, but they compound fast. Subscriptions, software tools, storage fees, contractors, and operational expenses can slowly erode margins if left unchecked.

Audit your overhead monthly and cut anything that doesn’t directly support revenue or efficiency. In fashion, lean operations often outperform bloated ones, especially during slow seasons when fixed costs hit harder.

4. Increase Average Order Value to Absorb Fixed Costs

Raising prices isn’t the only way to improve margins. Increasing average order value (AOV) allows you to spread fixed costs like shipping, ads, and payment fees across more revenue.

Use bundles, upsells, and cross-sells to encourage customers to add one more item at checkout. Even a modest AOV increase can dramatically improve profitability without increasing traffic or ad spend.

According to TrueProfit’s analysis of 600+ clothing stores, the average order value for clothing businesses typically falls between $60 and $70. If your AOV consistently exceeds this range, it’s a strong sign that your business is performing well.

5. Build Brand Value

Strong brands don’t compete solely on price, and that’s where margin protection happens. When customers trust your brand, they’re less price-sensitive and more likely to buy again.

Invest in consistent branding, clear positioning, and customer experience, from product pages to post-purchase communication. Over time, brand value allows you to maintain healthier margins while competitors race to the bottom.

More Metrics You Should Track in a Clothing Store

Tracking profit margin alone doesn’t give you the full picture of how your store is performing. Here are a few other important ecommerce metrics that work hand-in-hand with it:

1. Net Profit on Ad Spend

Here’s the first one to track:

Net profit on ad spend shows how much actual profit you make for every $1 you spend on ads. Unlike ROAS, NPOS includes all your costs, giving you a clearer view of advertising efficiency.

Use this formula:

Let’s do the math:

You made $15,000 in revenue. You spent $3,000 on ads.

Your COGS + expenses? $10,500. That leaves $1,500 in net profit.

So: NPOAS = $1,500 / $3,000 = $0.50

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost is the average amount you spend to acquire a single customer.

CAC is calculated using this formula:

Say you spent $8,000 on TikTok + Meta ads, influencers, and email platforms.

You brought in 200 new customers.

Your CAC = $8,000 / 200 = $40 per customer

Now you’ve got a benchmark to compare against AOV and LTV.

3. Average Order Value (AOV)

Let’s talk about cart size. Average order value tells you how much the average customer spends per order.

The AOV formula is:

Example: You did $5,000 in sales from 125 orders.

AOV = $5,000 / 125 = $40

That’s your baseline for revenue per order and a key number to grow through upsells, bundles, or cross-sells.

4. Lifetime Value (LTV)

Here’s the big-picture view. Also known as Customer Lifetime Value, LTV measures how much total revenue a customer brings in across their entire relationship with your brand.

Let’s say someone shops 4× a year, spends $40 per order, and sticks around for 2 years.

LTV = 4 × $40 × 2 = $320

AOV tells you about one order. LTV tells you about customer loyalty.

5. LTV/CAC Ratio

The LTV/CAC ratio compares what a customer is worth to what it costs to acquire them.

Example: You spend $100 to acquire a customer (CAC), and their LTV is $400.

LTV/CAC = 4

That’s $4 earned for every $1 spent — a healthy, scalable spot to be.

If the ratio is:

1 = you're just breaking even

< 1 = you're losing money

> 3 = you're in a healthy, scalable place

Metrics like these can measure your clothing store performance and define your success benchmarks in 2026.

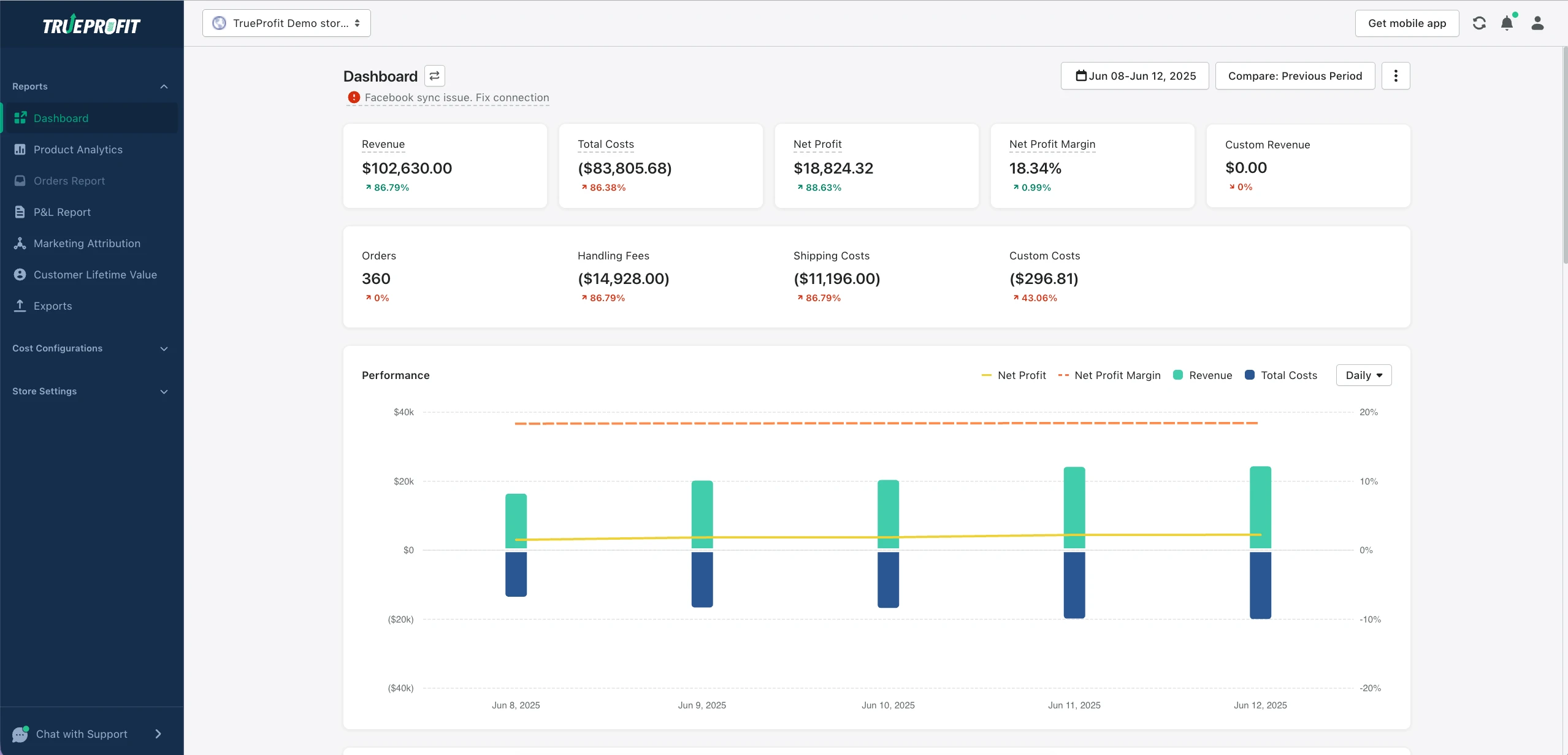

The Smartest Way to See Real-Time Profit Margins for Apparel Businesses

The clumsiest, most painful way to calculate profit is doing it manually in spreadsheets. It's slow, error-prone, and almost always outdated by the time you finish.

The smarter option, already used by thousands of Shopify merchants, is switching to TrueProfit, the #1 net profit analytics platform for Shopify.

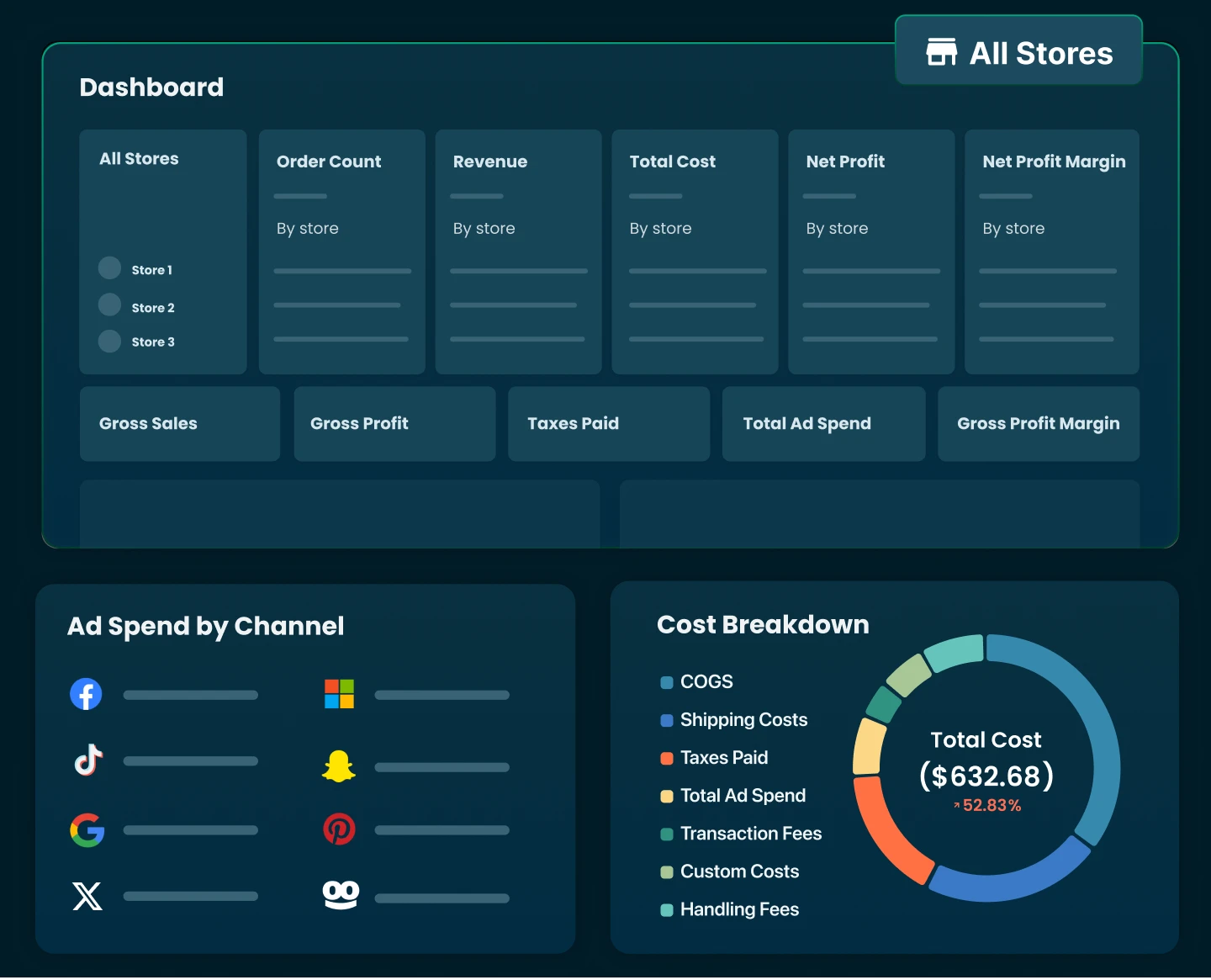

For clothing brands managing dozens (or hundreds) of SKUs, multiple sizes, different suppliers, and varied shipping zones, TrueProfit becomes a genuine pain reliever. It brings all your store data such as revenue, costs, products, and marketing performance into one unified dashboard, so you can clearly see real net profit at every level: storewide, per product, and by ad channel.

Here’s how TrueProfit truly changes the way Shopify stores track performance:

- Real-time net profit dashboard: Instantly see how much you're truly earning after all costs.

- Automatic cost tracking: COGS, ad spend, shipping fees, transaction fees, and more, all synced and calculated automatically.

- Profit-based product analytics & attribution: Identify your most profitable products and channels to scale the right areas.

- Complete P&L reporting: Track weekly and monthly performance with clear, automated profit statements.

- Customer lifetime value: Understand exactly how much each customer is worth to optimize CAC.

- Custom metrics: Build and monitor any KPI your business relies on — in real time.

And with the mobile app, you can keep an eye on profit performance anytime, anywhere, without being tied to your desktop.

With TrueProfit, clothing brands stop guessing and start managing profit with clarity, so every decision is grounded in one reliable source of truth for net profit, not assumptions.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits