What’s Average Customer Acquisition Cost (CAC)?

Many businesses grow quickly but hit a wall when their Customer Acquisition Cost (CAC) starts climbing higher than expected.

The question is: what’s a reasonable or “average” CAC, and how do you keep it under control?

In this article, we’ll explore benchmarks, factors that drive CAC, and practical ways to optimize it without sacrificing growth.

In this blog:

What's Customer Acquisition Cost?

The cost of customer acquisition—sometimes called customer acquisition cost—refers to the total expense a business incurs to acquire a new customer.

This could include advertising spend, promotional campaigns, sales team salaries, travel costs, commissions, and the tools or software used to run these efforts. The more efficient your campaigns and funnel become, the lower your CAC will be.

Understanding the true cost of acquisition matters because it helps marketers make smarter, less risky decisions. This metric reveals how much you must spend to grow your customer base and even how long it takes to recover your acquisition spend.

This is the standard formula of CAC:

What's Average Customer Acquisition Cost (CAC)?

A consumer subscription startup might see an average customer acquisition cost (CAC) ranging from $30 to $70. In contrast, a B2B SaaS company can spend thousands of dollars to win a single enterprise customer. These differences highlight how acquisition costs vary widely depending on the type of business and the sales cycle involved.

For ecommerce brands, a common rule of thumb is that CAC should account for roughly one-third of the customer lifetime value (LTV). For example, if a shoe brand expects a customer to spend $600 over their lifetime, a $200 CAC is considered acceptable. This ratio ensures that each customer generates enough long-term value to cover acquisition costs and still leave room for profit.

At the end of the day, there is no single “perfect” CAC that applies to every business. Your average cost depends on factors such as your industry, the channels you rely on, the competitiveness of your audience, and most importantly—the value each customer delivers over time.

What's Considered a Good Benchmark?

Like we said above, there is no universal benchmark for what makes a “good” Customer Acquisition Cost (CAC). The right number depends on your industry, your profit margins, and how much revenue an average customer is expected to generate over their lifetime. For this reason, CAC is almost always evaluated in relation to Customer Lifetime Value (LTV).

A common guideline many businesses follow is the 3:1 LTV-to-CAC ratio. In simple terms, if a customer is worth $300 over their lifetime, spending up to $100 to acquire them is considered sustainable.

If the ratio drops to 1:1, you are essentially breaking even, which means you will need to rely heavily on upsells, repeat purchases, or customer retention to survive. On the other hand, if your ratio climbs to 5:1 or higher, you may actually be under-investing in acquisition and missing out on opportunities to scale.

In short, a good benchmark is one that supports profitable growth today while leaving enough margin to reinvest in future acquisition.

5 Critical Factors That Impact CAC

There’re several things that can drive your CAC up or down. Here’re 5 common factors:

1. Marketing Channel

Paid search, social ads, influencers, SEO, PR and community each behave differently. Paid channels usually scale fastest but cost more per acquisition; organic channels cost less per acquisition but take time to build.

No single channel is guaranteed to deliver the best CAC. The key is testing, measuring, and doubling down on what works

2. Audience Fit

When your message resonates with the right people, acquisition becomes cheaper. The customer already has the intent or problem you solve, so they need less convincing. But when you cast the net too wide, you end up paying for clicks from people who were never going to buy in the first place. That wasted spend pushes CAC higher.

3. Conversion Rate & Funnel Efficiency

At its simplest, conversion rate is the percentage of visitors who take the action you want—most often, making a purchase. If you spend $1,000 to bring 1,000 visitors to your site and only 10 of them buy, that’s a 1% conversion rate. Your CAC is $100 per customer. But if 30 people buy instead, your conversion rate jumps to 3%, and your CAC drops to about $33 per customer.

Your customer acquisition cost (CAC) is only as efficient as your sales funnel. You can pour thousands into ads, but if your conversion rate is weak, every dollar stretches thinner. On the flip side, a well-optimized funnel can slash CAC dramatically—even with the same ad spend.

4. Customer Lifetime Value (LTV)

Customer lifetime value (LTV) is the total revenue a business expects to earn from a single customer over the entire relationship. LTV defines how much CAC you can afford. The widely accepted benchmark is LTV:CAC ≈ 3:1 — spend $1 to earn $3 in lifetime value. A business with a $500 LTV can comfortably spend $150 on CAC, while a business with a $50 LTV has far less room to play with.

5. Brand Awareness

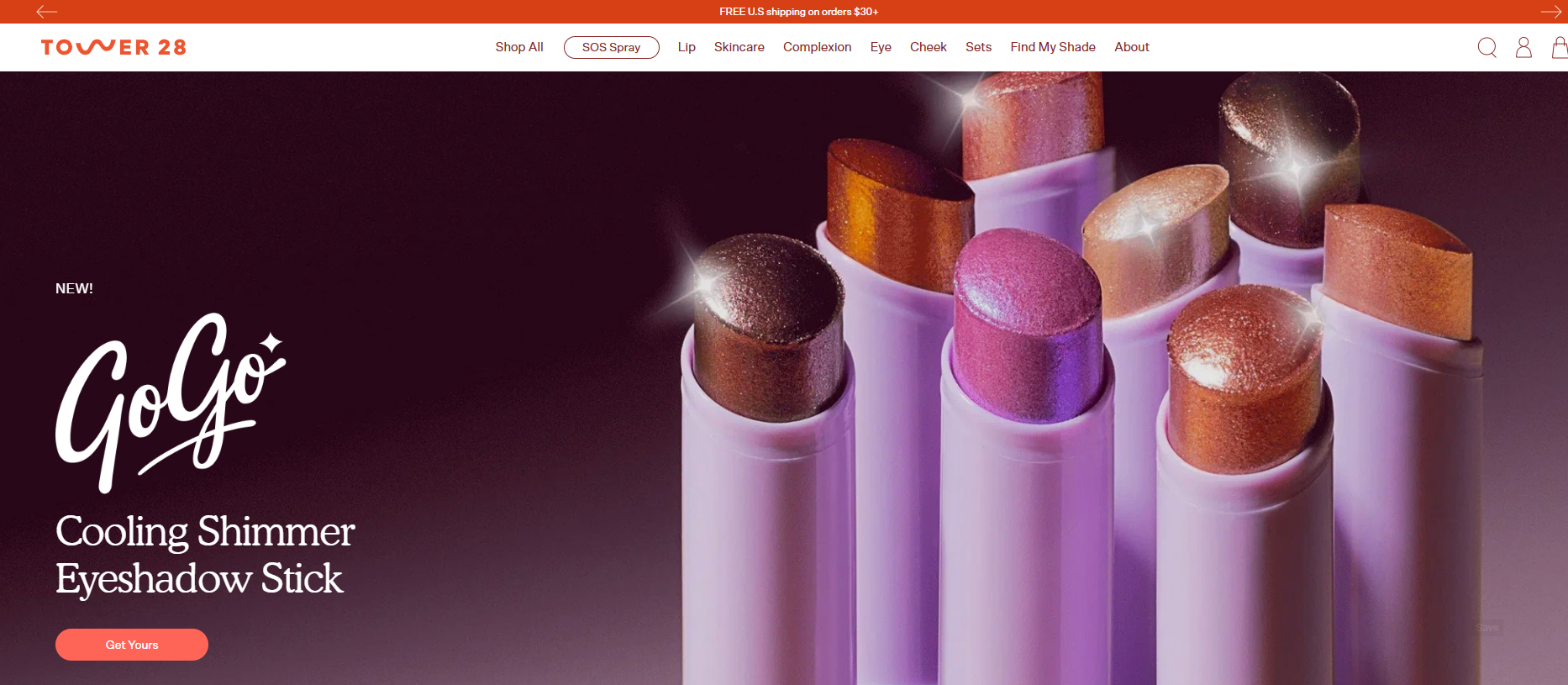

One of the most overlooked drivers of Customer acquisition cost (CAC) is brand awareness and trust. Simply put: people are more willing to buy from a brand they recognize and trust, which makes it cheaper to convert them into paying customers.

When your brand is unknown, every click or ad impression has to work harder. Shoppers hesitate, compare you to competitors, or bounce altogether—forcing you to spend more to win them over. On the other hand, strong brand awareness shortens the decision-making process. If customers already know who you are, your ads don’t need to do the heavy lifting of building trust from scratch

How to Reduce CAC in a Business?

Reducing CAC isn’t about cutting costs blindly—it’s about improving efficiency at every stage of the acquisition journey.

1. Measure CAC the Right Way

One of the biggest mistakes is measuring CAC against the wrong KPI. For example, tracking app installs or free trials without considering how many convert to paid customers can make CAC look artificially low (or high). Instead, always tie CAC back to real profit-generating actions—purchases, subscriptions, or high-intent leads.

Store owners often stress that if a CAC of $2.50 looks “too high” for a $0.99 product, the problem isn’t CAC—it’s that the lifetime value (LTV) or repeat purchase rate isn’t being factored in. With healthy LTV, even a higher CAC can be profitable.

2. Balance Your Channel Mix

If you’re relying too heavily on a single channel, CAC will rise as competition increases. You’re essentially putting your entire acquisition strategy at the mercy of one algorithm, one set of costs, and one type of customer journey.

So, the idea is simple: building a balanced channel mix—some channels are intent-driven (Google Search, Shopping) while others are discovery-driven (Facebook, TikTok, Display). Each plays a different role in the funnel. Google captures people already searching for a solution; Facebook interrupts people with an offer they didn’t know they wanted yet.

This gives you a baseline of “warm” traffic and sets a more predictable CAC.

3. Improve Funnel & Offer Conversion

Before chasing cheaper traffic, let’s make sure the traffic you already have is converting at its highest potential.

Here’re small tweaks you can make in your funnel:

Many businesses assume that lowering Customer acquisition cost (CAC) is only about finding cheaper clicks. In reality, reducing CAC often depends more on how well your funnel and offer convert rather than the price of traffic.

Optimize your landing page: Your landing page serves as the bridge between ad interest and buying intent. You should test different layouts, messages, and calls-to-action (CTAs) to identify and remove friction. Heatmap tools such as Hotjar and analytics platforms such as GA4 can reveal where visitors hesitate or exit.

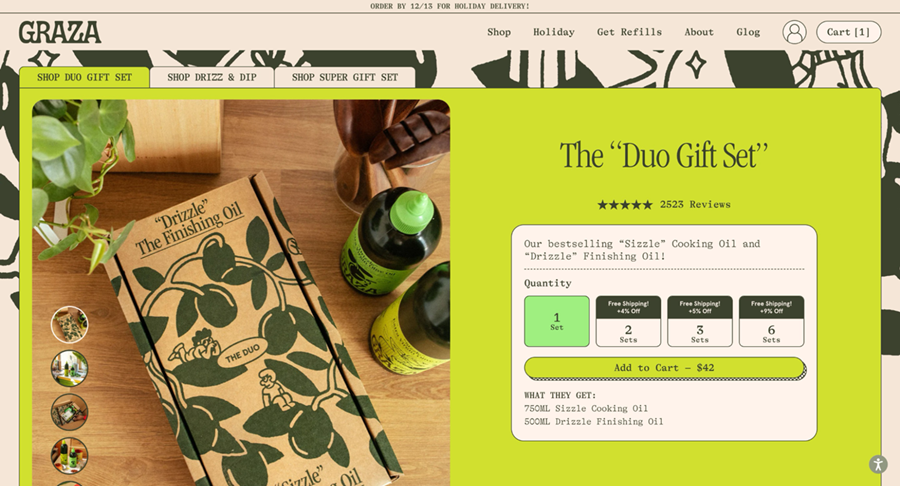

Make the offer irresistible: A compelling offer consistently outperforms cheaper clicks. You can bundle products, add limited-time promotions, or create a value ladder that guides customers from entry-level purchases to mid-ticket and high-ticket offers.

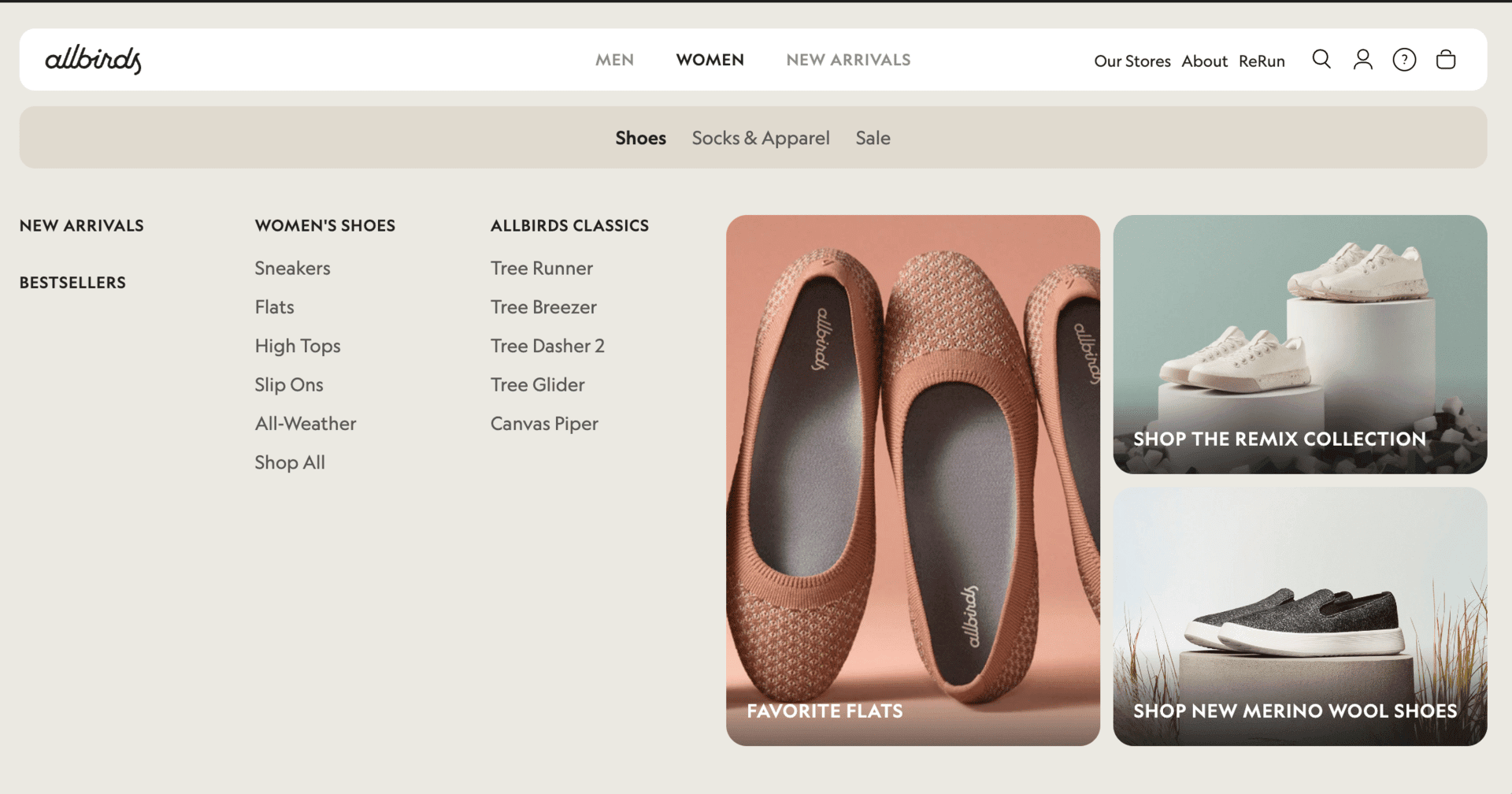

Shorten the path to purchase: Every additional click in the journey increases the risk of losing a customer. You can reduce this risk by streamlining the checkout process, minimizing unnecessary form fields, and ensuring a smooth transaction. At the same time, you should strengthen trust by displaying reviews, guarantees, clear shipping timelines, and secure payment options, which all help customers feel confident in completing their purchase.

4. Increase Average Order Value (AOV) and LTV

Average order value (AOV) matters because it maximizes every purchase. If a customer spends $50 instead of $25 in a single transaction, your CAC effectively gets cut in half. Businesses can raise AOV through strategies such as product bundles, order bumps at checkout, limited-time upsell offers, or free shipping thresholds that encourage larger carts.

Lifetime value (LTV) is just as important as AOV because it shifts the focus beyond the first sale. In many industries, the second or third purchase is where true profitability begins. Retention strategies such as loyalty programs, email and SMS campaigns, and personalized recommendations encourage repeat purchases, extending the revenue you earn from each customer.

The real secret? Work backward from your 90-day or lifetime value per customer. If you know that your average buyer spends $150 in their first 3 months, a $50 CAC isn’t bad at all.

5. Scale Smartly

Here are three rules of scaling smartly while keeping CAC in a healthy range.

The first rule of smart scaling is to avoid putting all your weight on a single winning campaign. Instead of doubling the budget on one ad set, diversify into more variations of creatives, audiences, and offers. This horizontal scaling approach keeps performance steady and lowers the risk of overpaying for the same audience.

The second rule is to watch how different channels interact. Smart scaling means measuring incrementally—testing how raising spend in one channel impacts performance across your funnel.

The third rule is to protect cash flow as you grow. A sudden surge in acquisition spend can drain budgets before revenue catches up. This is where a strong understanding of your customer lifetime value (LTV) becomes essential. If you know your customers come back and buy again, you can afford to spend more upfront without panicking about a temporary CAC increase.

Last but not least, keep this ratio as you go: For every 10% increase in ad spend, expect a 1–5% increase in CAC. It’s the sweet spot to scale smartly.

Smart Businesses Balance CAC and LTV for Real Growth

If there’s one piece of advice that’s been repeated throughout this article, it’s this: don’t look at CAC on its own. The smartest businesses always measure it against customer lifetime value. It’s because sustainable growth is not about chasing the cheapest clicks or leads.

It’s about understanding the long-term value of each customer and making decisions with that bigger picture in mind. When you measure CAC against LTV, you stop worrying about “how cheap” your customers are and start focusing on “how profitable” they can be.

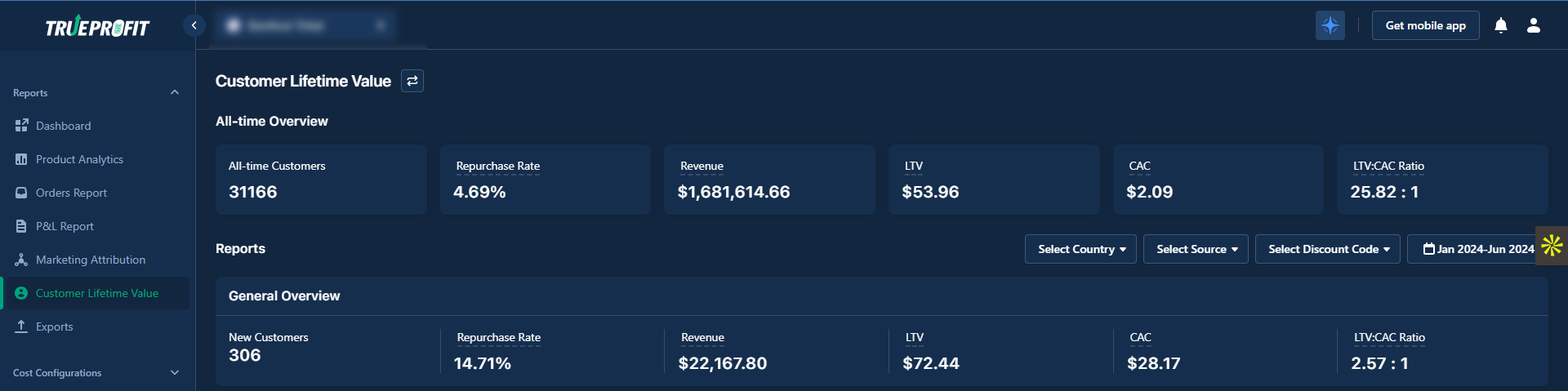

This is the point where tools like TrueProfit provide significant value. As a net profit analytics platform, TrueProfit gives Shopify retailers real-time visibility into all the essential ecommerce metrics including both CAC and LTV. This way, retailers can see a complete view of their store's financial performance, helping spot which campaigns, offers, and segments are most profitable. Ultimately, retailers can make informed decisions that scale their most effective strategies and strengthen long-term growth.

Final Thoughts

The key takeaway is that CAC is not fixed, and it should never be viewed in isolation. Businesses can test, refine, and optimize their acquisition strategies while keeping customer value at the center of their decisions.

Each improvement brings them closer to the ultimate goal: transforming marketing spend into a loyal, profitable customer base that supports sustainable growth.

Irene Le is the Content Manager at TrueProfit, specializing in crafting insightful, data-driven content to help eCommerce merchants scale profitably. With over 5 years of experience in content creation and growth strategy for the eCommerce industry, she is dedicated to producing high-value, actionable content that empowers merchants to make informed financial decisions.

Shopify profits

Shopify profits