Operating Profit vs. Net Income: 4 Key Differences

Both operating profit and net income are profitability metrics, but they measure slightly different aspects of business performance.

In this article, we’ll walk through the definitions, calculations, and purposes of operating profit vs. net income, along with examples to show how they differ.

In this blog:

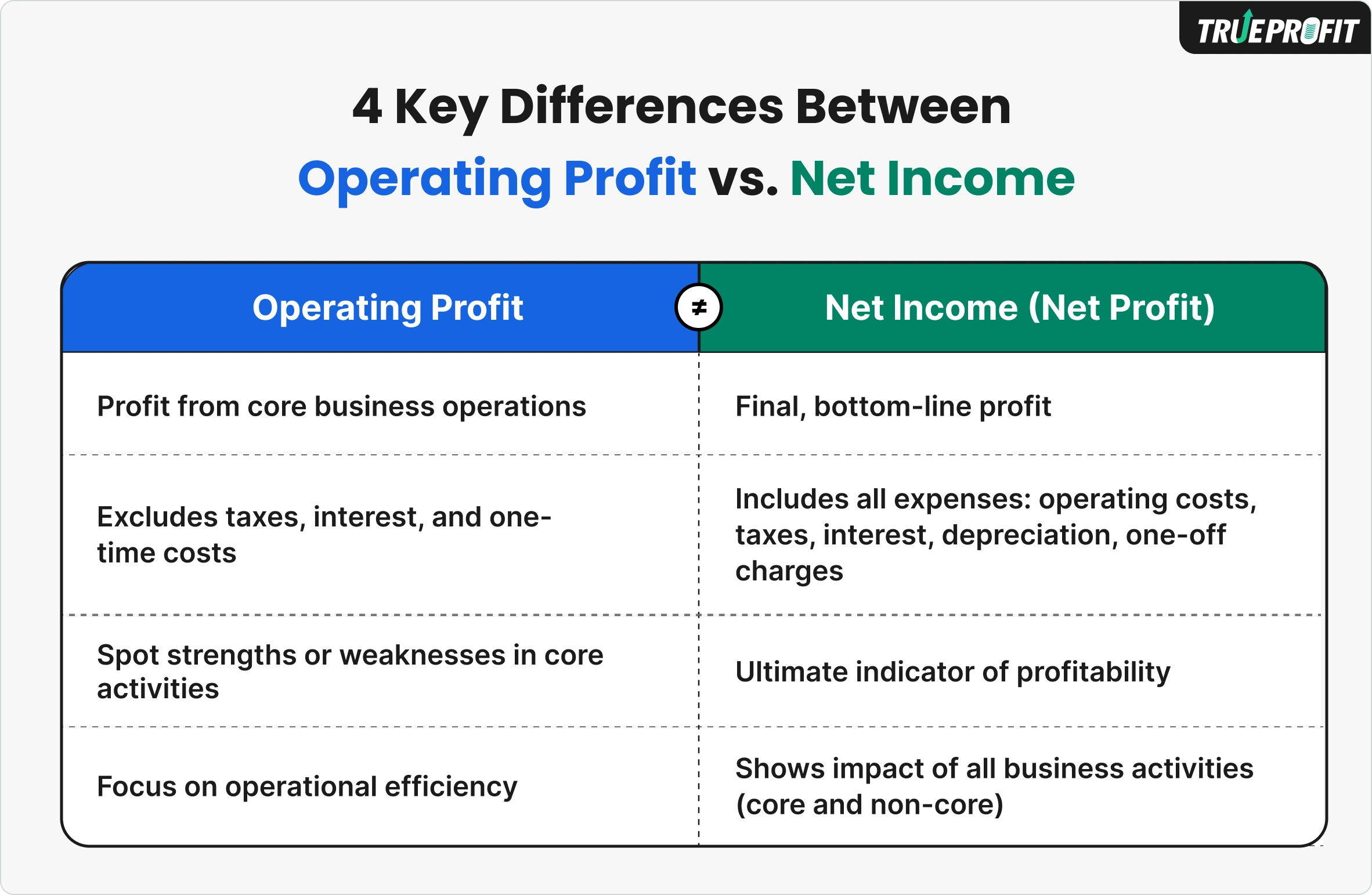

Operating Profit vs. Net Income: What are The Differences?

It’s easy to see why operating profit and net profit are often mentioned together—they both show your business profitability. But these two numbers measure different layers of your financial performance, and understanding the distinction can make a huge difference in running a smarter, more profitable business.

Here’s how they differ:

Definition

Operating profit, sometimes called operating income or operating earnings, focuses on your day-to-day business operations. In other words, operating profit focuses strictly on the profit generated from your core business activities—like selling products or providing services—before taking into account things like taxes, interest, or one-time expenses.

Net income, on the other hand, is what most people call the “bottom line” or “net profit.”It’s the actual profit left over after every single cost is accounted for—operational costs, taxes, interest, and any other expenses. Net income gives the most complete picture of your company’s financial performance, revealing how much money your business truly earned over a period.

Calculation

To calculate operating profit, you start with your revenue and subtract all the direct costs of producing your products (COGS) and the day-to-day operating expenses, like salaries, rent, and utilities. What you leave out are things like taxes, interest on loans, or any one-time, non-operational costs.

Calculating net income, however, is about capturing the “bottom line” of your business—the actual profit you walk away with after every expense is accounted for. That means including not just operational costs, but also taxes, interest, depreciation, and any unusual or one-off charges.

Both calculations start with revenue, but that’s where the similarity ends. Operating profit zooms in on the health of your daily operations, while net income zooms out to show the overall financial outcome.

Examples

Here’s an easy way to picture it. BrightHome Furniture makes $200,000 in revenue this month. After paying for materials and labor—$70,000 in COGS—they have $130,000 gross profit.

Next, they cover $60,000 in operating expenses like rent and salaries. The remaining $70,000 is operating profit, kind of like the money you have left after paying for groceries and bills, but before taxes and loan payments.

Operating Profit = 200,000 − 70,000 − 60,000 = 70,000

Now, BrightHome pays $20,000 in loan interest and $30,000 in taxes. What’s left? The net income of $20,000—this is the real “take-home” profit, the money the business actually keeps.

Net Income = 70,000 − 20,000 − 30,000 = 20,000

In short, operating profit measures your day-to-day performance, while net income shows your final bottom line.

Purpose

Operating profit and net income are both key financial metrics, but they each reveal very different sides of your business performance.

Operating profit offers a more focused lens on operational efficiency, helping you clearly see whether your day-to-day efforts are actually generating sustainable profits. It’s especially useful for quickly spotting areas where the business is performing well—or where it might be leaking money—without getting distracted by taxes, interest, or one-time expenses.

Net income, on the other hand, is the ultimate measure of overall business performance. It reflects the full financial reality of your company, showing the money that truly stays in the business after accounting for every cost and obligation.

By carefully tracking net income, entrepreneurs can effectively evaluate store success, measure the impact of strategies, and understand whether their overall efforts are translating into real, bottom-line profit.

How to Use Operating and Net Profit to Grow Your Business

Understanding the difference between operating profit and net income is crucial for making smarter, data-driven business decisions. Each metric offers a unique perspective and by regularly analyzing both, you can uncover actionable insights to optimize performance and boost profitability.

Here’s a practical step-by-step approach:

- Step 1: Analyze operating profit to pinpoint efficiency. Look closely at which areas of your day-to-day operations are generating the most profit and which may be underperforming.

- Step 2: Identify opportunities to reduce costs or streamline processes. Use the operating profit insights to cut unnecessary spending or implement smarter workflows without compromising product quality or customer experience.

- Step 3: Examine net income to gauge overall financial health. Net profit accounts for every expense—from operating costs to taxes and interest—giving you the complete picture of your store’s bottom line.

- Step 4: Use net income to guide strategic decisions. Whether you’re considering reinvesting in marketing, paying down debt, or expanding your product line, net profit helps you make informed, confident choices.

- Step 5: Track both metrics consistently. Regular monitoring allows you to see exactly how your operational changes, cost-cutting measures, and strategic moves impact profitability over time.

Monitoring these metrics becomes effortless with TrueProfit, a net profit analytics platform built specifically for Shopify sellers. With TrueProfit, you can:

- Monitor your overall business performance on a single, intuitive profit dashboard

- Automatically track costs and profitability in real-time, without manual calculations

- Generate detailed P&L reports for any chosen period, providing a clear financial snapshot

By giving you a transparent, accurate view of your store’s profitability, TrueProfit empowers you to make smarter decisions, optimize operations, and ultimately grow your bottom-line profits more confidently than ever.

Final Thoughts

Understanding the differences between operating profit vs. net income is essential for making smart business decisions. Operating profit tells you how efficiently your business runs day to day, while net income shows you the final profitability after everything is accounted for.

As Harry Chu puts it: “You don’t just want to know if your business engine is strong—you also want to know what’s left in your pocket at the end of the trip.”

That’s why smart entrepreneurs track both. And with tools like TrueProfit, you can connect all the dots on your PnL in real time—making sure you don’t just grow revenue, but protect your actual bottom line.

Irene Le is the Content Manager at TrueProfit, specializing in crafting insightful, data-driven content to help eCommerce merchants scale profitably. With over 5 years of experience in content creation and growth strategy for the eCommerce industry, she is dedicated to producing high-value, actionable content that empowers merchants to make informed financial decisions.

Shopify profits

Shopify profits