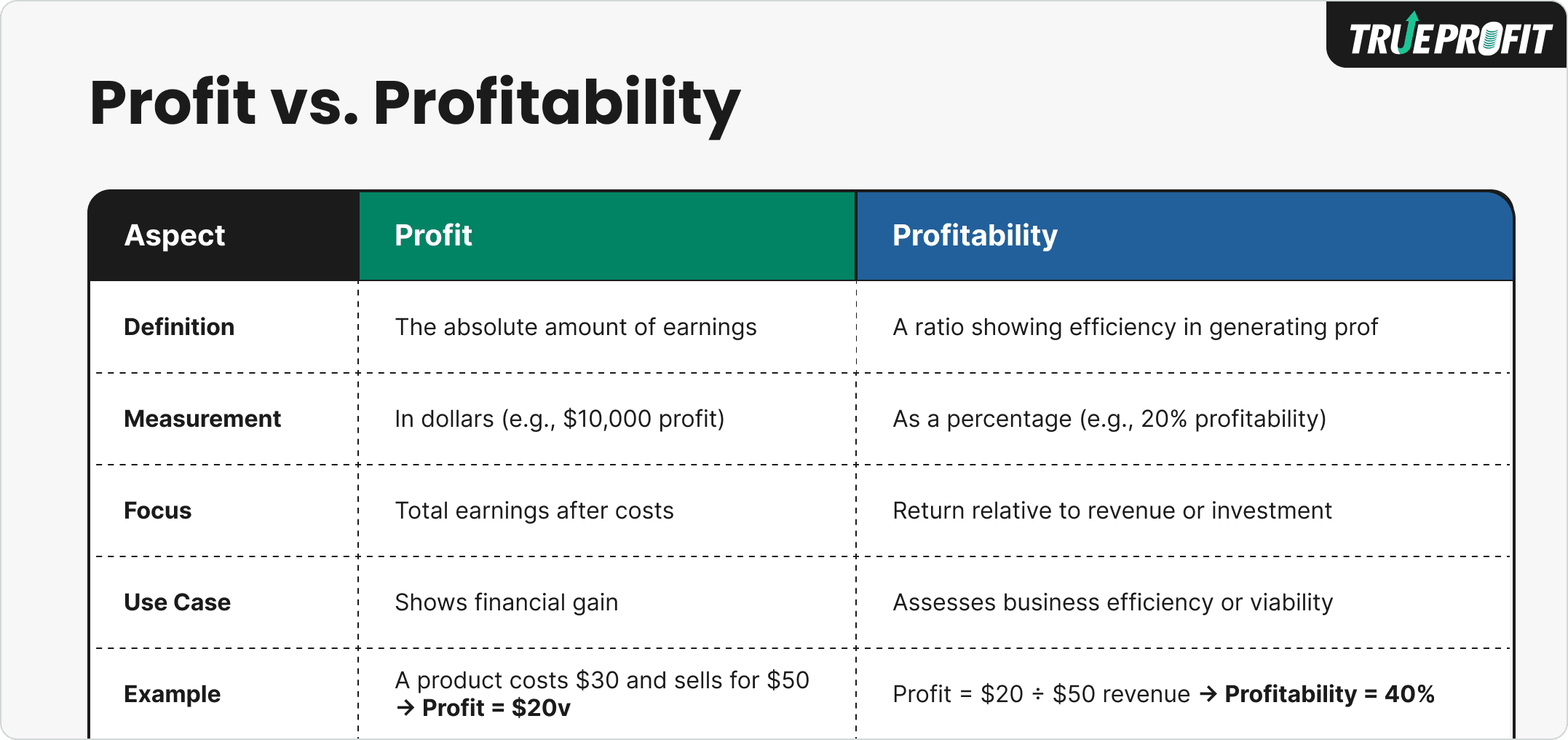

What is the Difference Between Profit and Profitability?

Profit is what remains after all costs are subtracted from revenue.

Profitability is the percentage of revenue that turns into profit after costs are covered— and can be used as a benchmark to compare performance over time or across products, industry, or even companies.

Now, let’s break down 5 key differences between the two.

In this blog:

5 Key Differences Between Profit and Profitability

1. Definition

Profit is what remains after all costs are subtracted from revenue. It's an absolute number, usually expressed in currency (e.g. dollars, euros, etc.), showing how much money your business keeps after covering its costs. It’s the number that determines whether a company is financially sustainable, scalable, or at risk.

Meanwhile, profitability is the percentage of revenue that turns into profit after costs are covered. Unlike profit, profitability is a relative measure — expressed as a percentage or ratio (e.g., 20% net profit margin). It provides context to profit by showing what percentage of sales actually becomes profit.

2. Types

Profit comes in different forms depending on which costs you’ve already subtracted. The three most common types are:

- Gross Profit measures the amount left after subtracting COGS from revenue.

- Operating Profit (also known as operating income) reflects your profit after covering both product costs and day-to-day operating expenses.

- Net Profit is your final profit after all expenses have been deducted — including COGS, operating expenses, taxes, interest, and other costs. It’s often called “the bottom line” because it shows how much money you actually keep.

Profitability follows a similar path. It is usually tied to those same profit types. The most common ones include:

- Gross Profit Margin is the percentage of your revenue left after paying for COGS.

- Operating Profit Margin reflects your business’s ability to generate profit from revenue after covering core operating expenses.

- Net Profit Margin shows how much of your total revenue becomes actual profit after all expenses.

3. Formula

The basic formula for profit is:

Depending on the type of profit, “expenses” can mean different things:

- Gross Profit = Revenue – Cost of Goods Sold (COGS)

- Operating Profit = Gross Profit – Operating Expenses

- Net Profit = Revenue – (COGS + Operating Expenses + Taxes + Interest)

Profitability is calculated by dividing profit by revenue, then multiplying by 100 to get a percentage:

Examples:

- Gross Profit Margin = (Gross Profit / Revenue) × 100%

- Operating Profit Margin = (Operating Profit / Revenue) × 100%

- Net Profit Margin = (Net Profit / Revenue) × 100%

4. Purpose

You use profit to track your bottom line. It helps you decide how much you can re-invest, whether you can afford to scale, and when it’s time to cut back.

Meanwhile, profitability is super useful for benchmark performance. It lets you compare performance across different products or time periods, and identify the most efficient paths to scale.

Both are important, and tracking both gets you a complete view. Profit directly measures your true performance. And profitability helps you interpret profit more accurately by adding some contexts, usually revenue, but also sometimes assets, time or cost that went into generating it.

Examples of Profit and Profitability

A small online T-shirt shop earns $5,000 in revenue this month from selling custom tees. It spends $2,000 on inventory (COGS), $1,000 on ads and packaging (operating expenses), and $300 on taxes.

- Gross Profit = $5,000 – $2,000 = $3,000. So, in this case, the shop earns $3,000 after covering product costs.

- Operating Profit = $3,000 – $1,000 = $2,000. This means the business makes $2,000 after day-to-day operations.

- Net Profit = $2,000 – $300 = $1,700. This is the final take-home profit after all costs.

Now let’s look at profitability based on the same revenue:

- Gross Profit Margin = $3,000 / $5,000 = 60%. For every $1 earned, 60 cents cover product markup.

- Operating Profit Margin = $2,000 / $5,000 = 40%. The store keeps 40 cents in operating income per dollar.

- Net Profit Margin = $1,700 / $5,000 = 34%. After all expenses, the shop earns 34 cents in actual profit per dollar of sales.

How to Increase Profitability

1. Raise Prices (Strategically)

You don’t need to double your prices to see better margins. Even a small increase — say, 5–10% — can create a noticeable lift in profit. Just remember this: If your value is clear, people are willing to pay.

2. Lower Your COGS

Every dollar saved in COGS goes straight to your bottom line, without touching your price tag. If you sell T-shirts and pay $7 per unit, ask your supplier if there’s a price break at higher volume. Or compare other vendors to see if better rates are available.

3. Cut Unnecessary Expenses

Less waste = more profit. It’s that simple. Here’s a pro tip: Create a spreadsheet with all fixed and variable costs, then mark which ones actually drive results. Cancel what doesn’t.

4. Increase AOV (Average Order Value)

You’ve already spent the money to acquire that customer. Getting them to spend more in the same visit boosts profitability without increasing your ad spend.

If you’re selling T-shirts, you can:

- Bundle a 3-pack with a slight discount

- Offer matching tote bags or hats at checkout

- Show “Complete the Look” items on your product page

5. Track Profitability Over Time

A drop in profit isn’t always a red flag. A sudden spike in one day doesn’t mean anything, either. What really matters is whether your business can consistently turn a profit, month after month. And you only catch that pattern when you track performance over time.

The last one is key. You’ll see profitability shifts over time and that’s normal. What matters is that you’re tracking the right signals to understand why it’s rising or dipping, and what to do next.

Understanding your true profitability is essential, but manual tracking often falls short — especially in eCommerce, where costs are always moving. That’s why Shopify sellers use TrueProfit — a real-time net profit analytics tool that helps track your true net profit after all costs, so you always have a clear view of profitability.

Harry Chu is the Founder of TrueProfit, a net profit tracking solution designed to help Shopify merchants gain real-time insights into their actual profits. With 11+ years of experience in eCommerce and technology, his expertise in profit analytics, cost tracking, and data-driven decision-making has made him a trusted voice for thousands of Shopify merchants.

Shopify profits

Shopify profits