What is Total Revenue and How to Calculate It?

Understanding your business’s financial health starts with the basics. One of the first numbers you’ll see on a P&L report is total revenue.

In this guide, you’ll discover how total revenue tracks sales performance and why analyzing it with net profit gives a clearer picture of business success.

In this blog:

What is Total Revenue?

Total revenue, often called “sales” or the “top line”, is the total amount of money a store earns from its business activities like selling products before any expenses are deducted. It represents the full income generated over a specific period.

Total revenue is one of the most widely used performance metrics in annual financial statements. It helps measure the volume of sales and the scale of a store, or in other words, it provides a clear picture of how large the store is and how effectively it generates sales.

Types of Total Revenue

Revenue can be categorized into two main types: operating revenue and non-operating revenue.

Operating revenue comes from a store’s main selling activities, such as product sales and reflects ongoing performance. Non-operating revenue arises from incidental or one-time events, like selling the other stores or earning additional income, and does not indicate the core business’s health. That’s why both contribute to total revenue, but only the operating revenue reflects business sustainable performance.

How to Calculate Total Revenue

Calculating total revenue is straightforward. At its core, total revenue is the sum of all sales. Each product’s revenue is calculated individually and then added together to get the total picture.

The formula for calculating the total revenue:

When quantity sold refers to the total count of items that were delivered to customers. The selling price is the amount charged for each individual product or service. For example, if you sold 100 cups of coffee at $5 each, your total revenue would be 100 x 5 = $500. For general stores with multiple products catalogs, you calculate total revenue for each product and then sum them up.

Understanding how to calculate total revenue is the first step in analyzing a company’s financial performance, as it sets the foundation for calculating net profit, which reveals the true profitability.

Total Revenue vs. Net Profit: What’s the Difference?

Total revenue and net profit are two essential financial metrics that, when analyzed together, provide a complete picture of a company’s financial health.

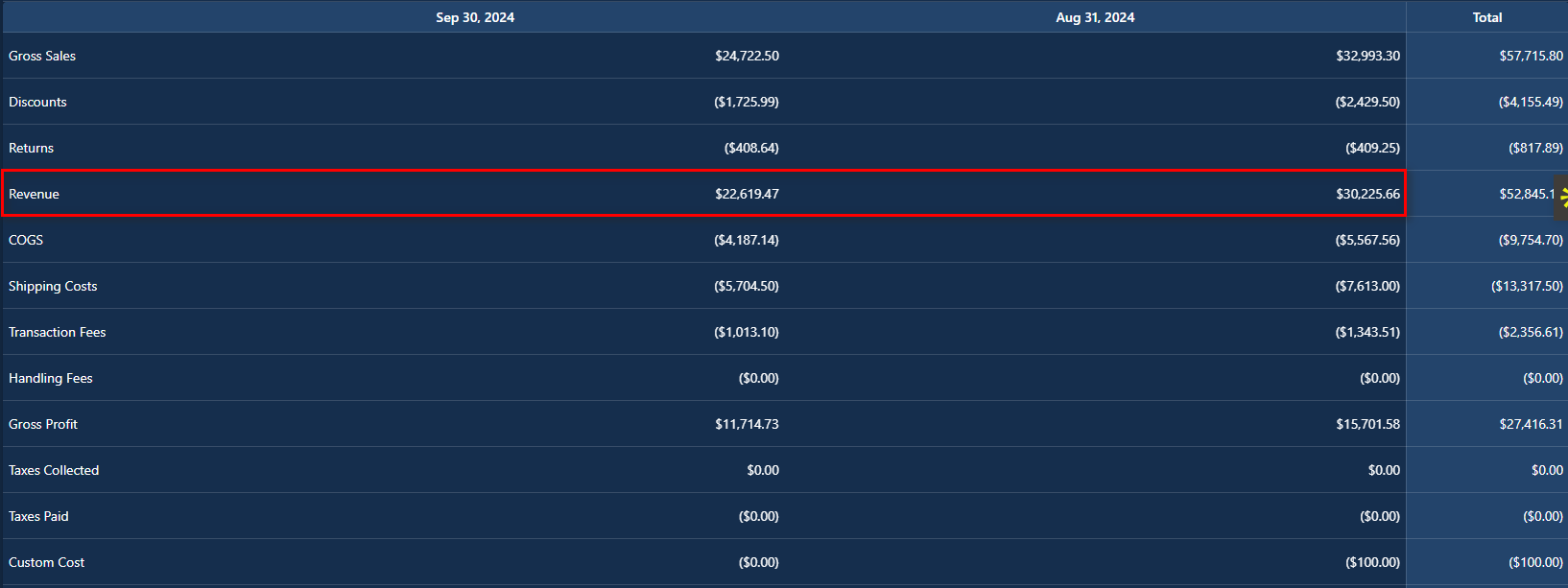

This is the critical difference: Total revenue—the “top line”—represents all sales income before expenses, while net profit—the “bottom line”—is what remains after subtracting all costs from total revenue, including ad spend, shipping fees, product costs (COGS), operating expenses, and more. When evaluating a business performance, revenue shows how much sales comes in, but only net profit reveals the true profitability of those sales.

So, what’s the key takeaway from understanding this core difference?

We’ll highlight this truth: total revenue cannot reveal the ultimate goal of most sellers—profitability—but without it, you lose the accurate view of overall sales performance. The most accurate view comes from analyzing revenue and net profit together: revenue shows the scale of sales volume, while net profit measures the value of those sales. Taken side by side, these metrics give a full picture of financial health that guides smarter decisions.

Monitor the Complete View of Your Store’s Finances

So, what’s the quick financial lesson here? Revenue measures sales performance. Net profit reveals profitability. And costs are the behind-the-scenes drivers that decide your ultimate business performance.

For many sellers, however, tracking all these metrics together can feel overwhelming. That’s where TrueProfit comes in. TrueProfit is a net profit analytics tool that tracks all essential financial metrics—revenue, profit, total costs, and more—in a single performance analytics dashboard, giving Shopify sellers a comprehensive view of their store’s true profit and loss.

With the app, retailers can have an instant and real-time snapshot of their financial health, showing not just how much the store sold, but its ability to generate profit— allowing the smarter, data-driven decisions that prioritize sustainable growth and bottom-line success.

Final Thoughts

Total revenue is the foundation of your financial reports. It’s simple to calculate and gives a clear snapshot of your sales activity. But to understand your business performance fully, you need to compare it with gross profit and net income.

Leah Tran is a Content Specialist at TrueProfit, where she crafts SEO-driven and data-backed content to help eCommerce merchants understand their true profitability. With a strong background in content writing, research, and editorial content, she focuses on making complex financial and business concepts clear, engaging, and actionable for Shopify merchants.

Shopify profits

Shopify profits